The lack of agreement between the government of Teresa May and the opposition as to the form of exit from the European Union results in above-average volatility in pairs with the pound, which tempts and I often return to them with hope for a large spoil.

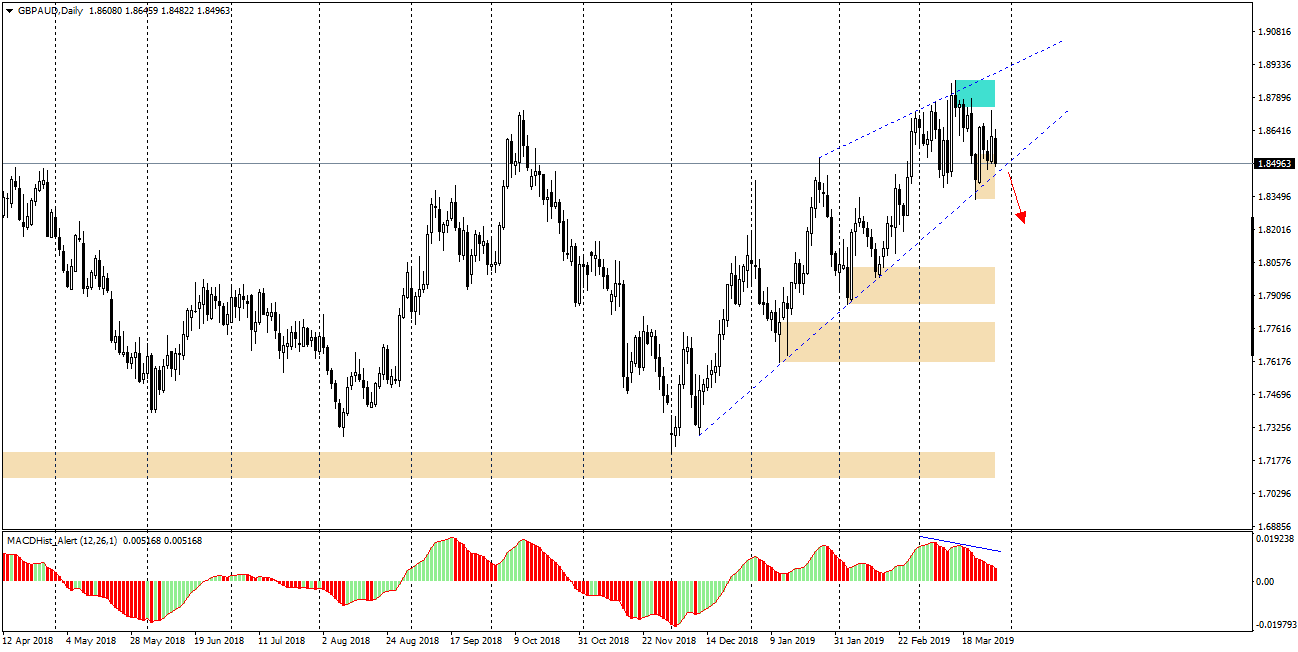

Since the beginning of December 2018 the pair has been moving in an upward trend, and the decreasing amplitude of increases and downward corrections have formed the ascending wedge formation on the Daily chart. The support of this formation and at the same time the bullish trend line have already been tested 6 times. In the coming days another attempt to break the mentioned trend line is expected.

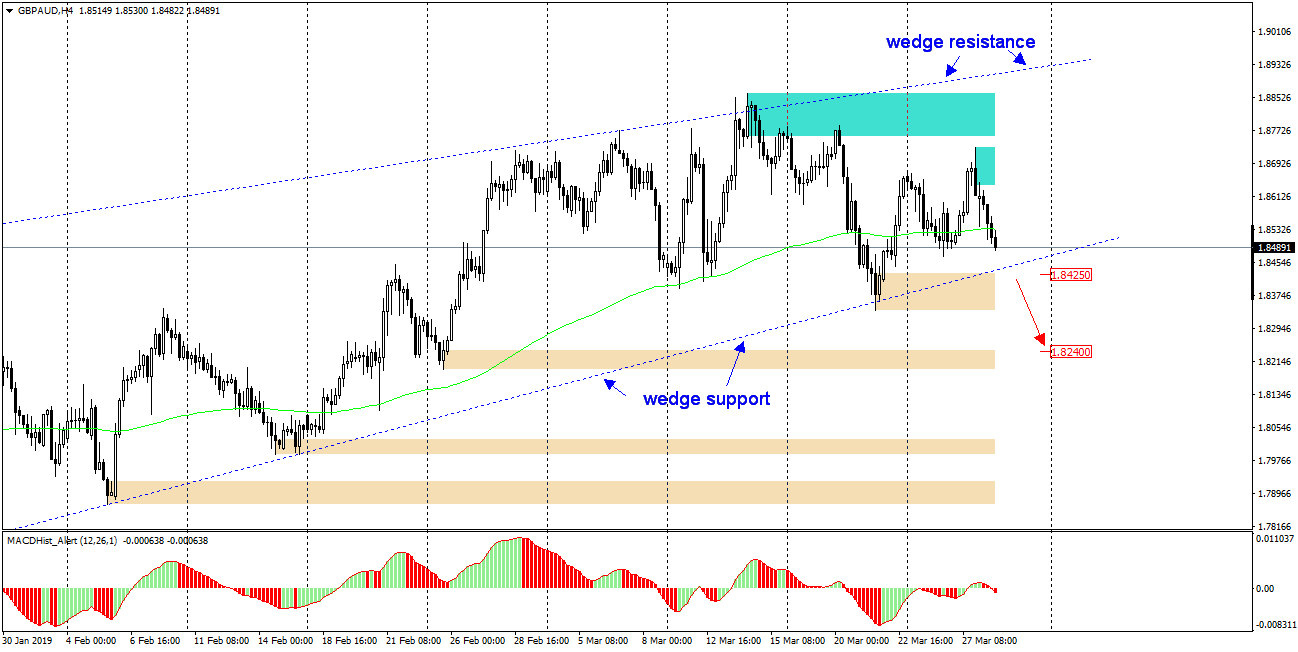

On chart H4 we will notice that the price is moving towards the nearest demand zone, which starts at the level of 1.8425, and also there is currently the support for the aforementioned upward trend of the rising wedge formation. Overcoming this support can be an impulse for further declines, and their range in the first movement can reach 180p.

Much, of course, depends on further reports from the British Parliament. There is a saying – ‘ three times a charm’ – perhaps in the case of a divorce agreement with the EU, this will work and another, third vote in the House of Commons will be effective and the pound will be strengthened. If not, however, falls will be very likely.