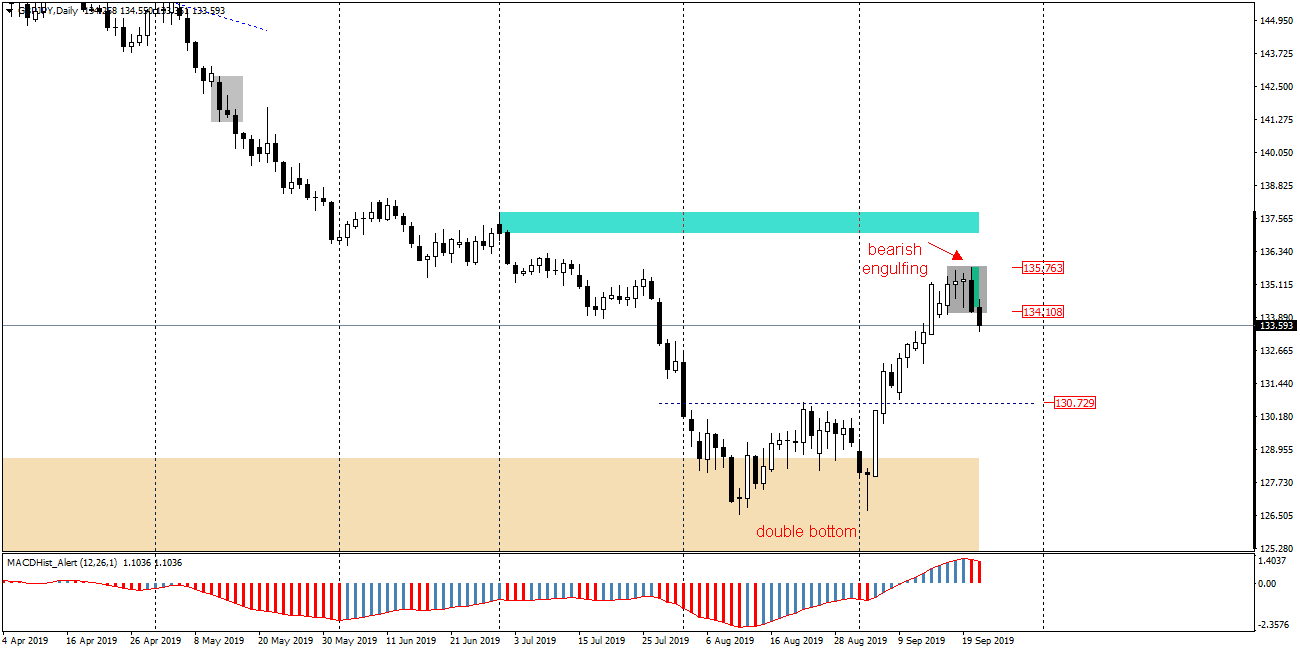

GBPJPY has been in a downward trend for over six months now. After reaching 126.50, the pair rebounded twice in 3 weeks from that level and was not able to go lower, thus establishing an upward double bottom pattern.

The Friday (20.09) daily candle formed the bearish engulfing pattern and today’s quotations indicate that price is leaving the formation and the probability of a return to the declines lasting from March this year.

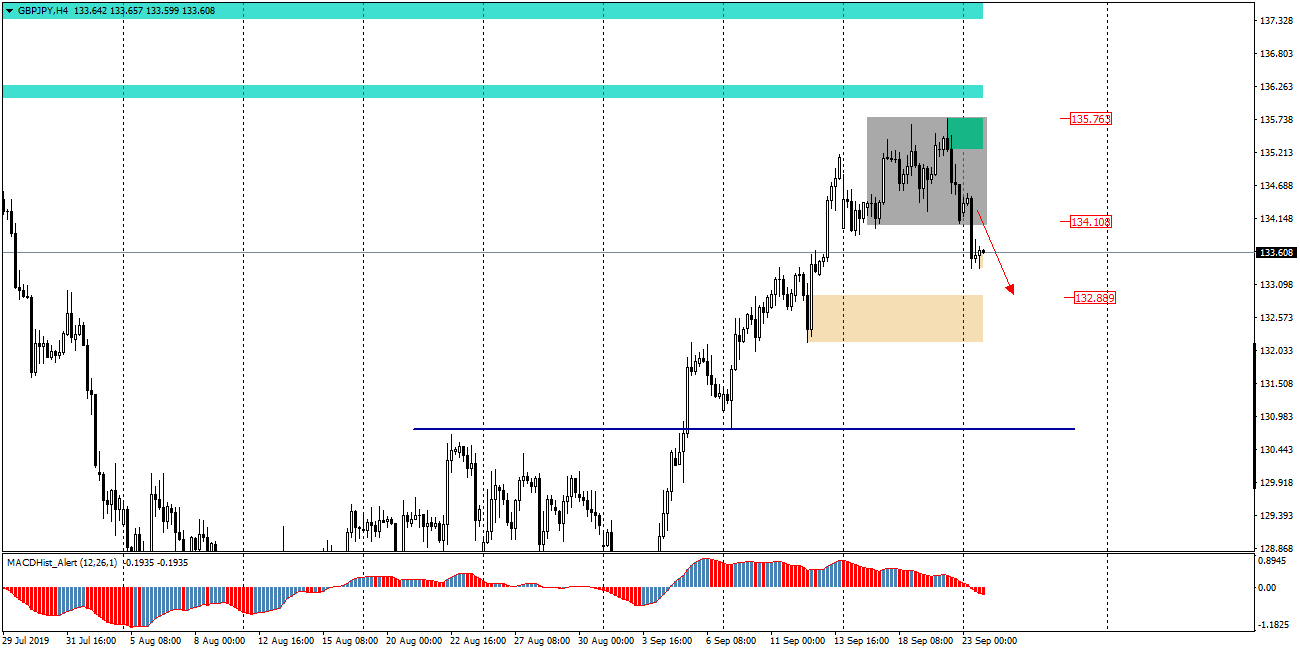

Analysing chart H4 we can try to determine the extent to which the price can move during the next sessions. The range of falls can be limited by the nearest demand zone starting at 132.90 and, if it is overcome, by the resistance of the mentioned double bottom formation 130.70 (blue line), which can now support the falling price.

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities