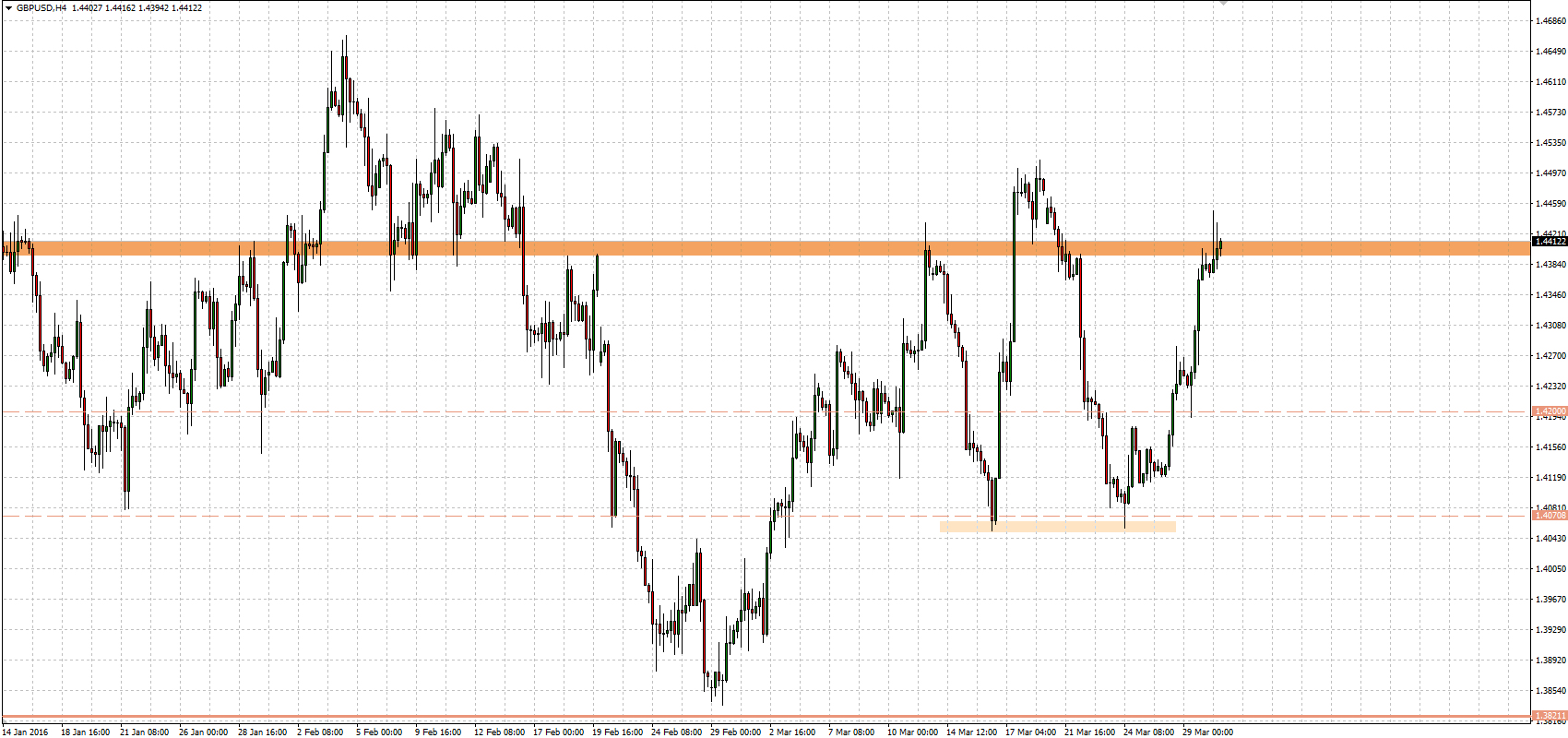

After last week’s selloff at GBPUSD which started after terrorist attacks in Brussels, declines reached support at 1.4070. Declines were finished last Thursday after local double bottom pattern and bullish candle (at time-frame H4) with long lower shadow. Demand took over control during end of last week but current week it was a capitulation of supply.

In the last three days demand broke resistance at 1.4200 and today price reached above 1.4400. In the long term the technical situation on the chart continues to favour supply. Because there aren’t new higher highs and higher lows which should confirm uptrend. Right now important job for demand is to break above march’s high (moves above 1.4514 level). Nearest supports: 1.4400, 1.4290, 1.4200. Nearest resistances: 1.4500, 1.4600.