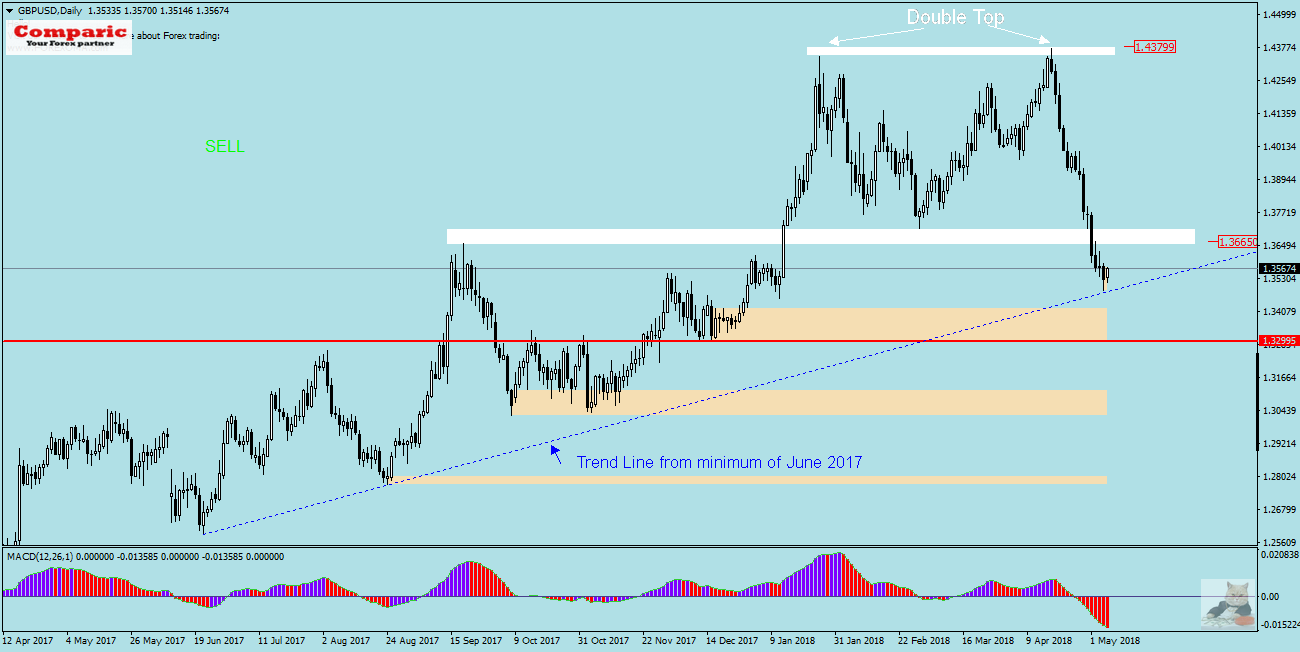

GBPUSD – popular cable for more than 18 months is moving in an upward trend. Maximum from 25.01 and 17.04 formed on the chart at level 1.4380 Price Action formation – Double Top, which initiated recent decreases. As a result of quite intense declines, the pair reached last Friday (04.05) the trend line extended from the low of June 2017, reaching the minimum of the current month at 1.3885. Today we see the first signs of a change in moods and the price is slowly turning back.

It is difficult to predict today whether it will be a correction or something more, maybe more will be revealed when the price reaches the first resistance zone, which is in the range of 1.3705-1.3665 and from which on March 1st (then it was support zone) there was a dynamic rebound which ended with the establishment of the maximum of this year and the aforementioned Double Top formation.

On the H1 chart, we also notice that the price has broken out from the local bearish channel, which may indicate some bear fatigue and the opportunity to take the initiative, at least in short-term, by bulls. The important event that awaits us on Thursday 10/05/2018 – when the Bank of England announces the level of interest rates for the coming months, it may strongly confuse our forecasts, which is why it is necessary to be particularly careful when concluding transactions on this pair. Earlier market expectations for interest rate hikes were the driving force behind increases, but recent macro data from the UK caused the probability of rate hikes to be reduced to a minimum, which led to the latest declines.