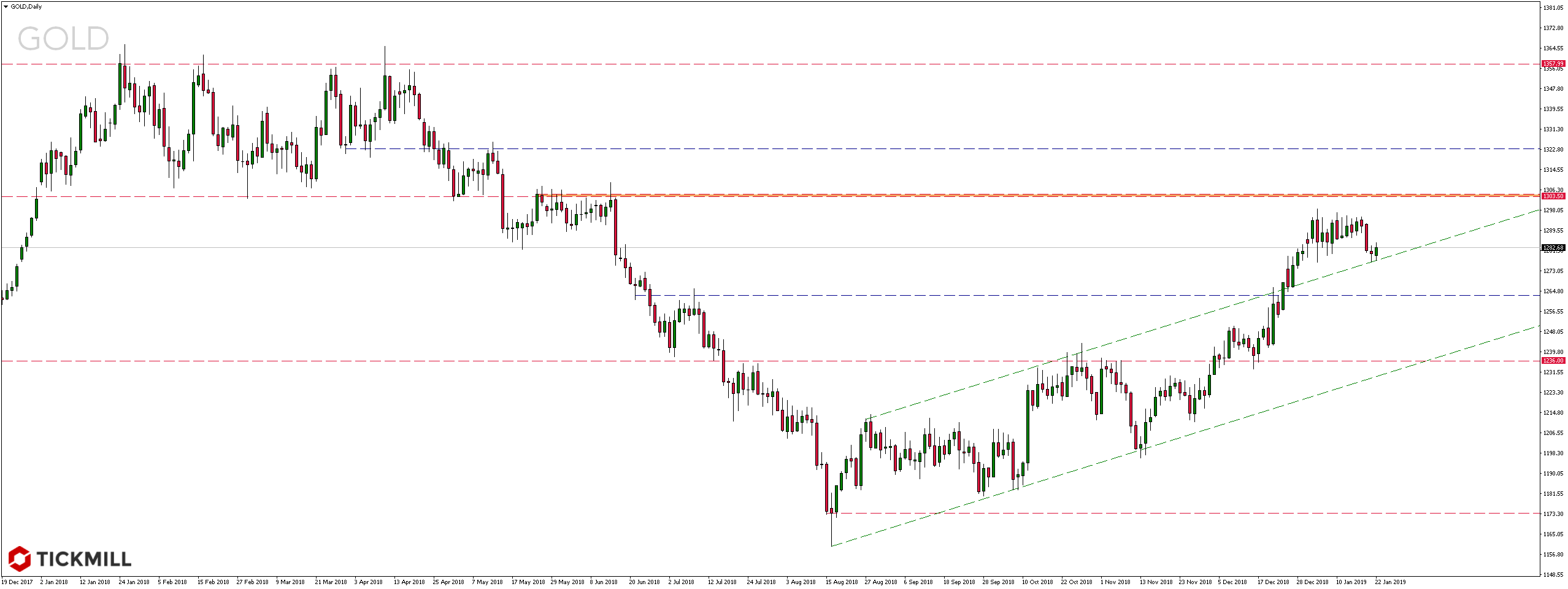

GOLD

Looking at gold prices, as a result of last week’s declines, the price has fallen to the upper limit of the previous growth channel, where the demand response has now emerged. Therefore, if this zone is rejected, we could expect even more growths in the near future. On the other hand, a permanent overcoming of the currently tested level could open the way to further depreciation, for which the real range seems to be around the level of 1263 USD or even 1236 USD.

AUDJPY

Looking at the AUDJPY , we will notice that, according to my last week’s projection, the exchange rate reached the area of the recently defeated support (now resistance), where already last Friday the first supply reaction appeared. Permanent rejection of this zone could pave the way for further declines, for which the level of 73.00 seems to be the realistic range.

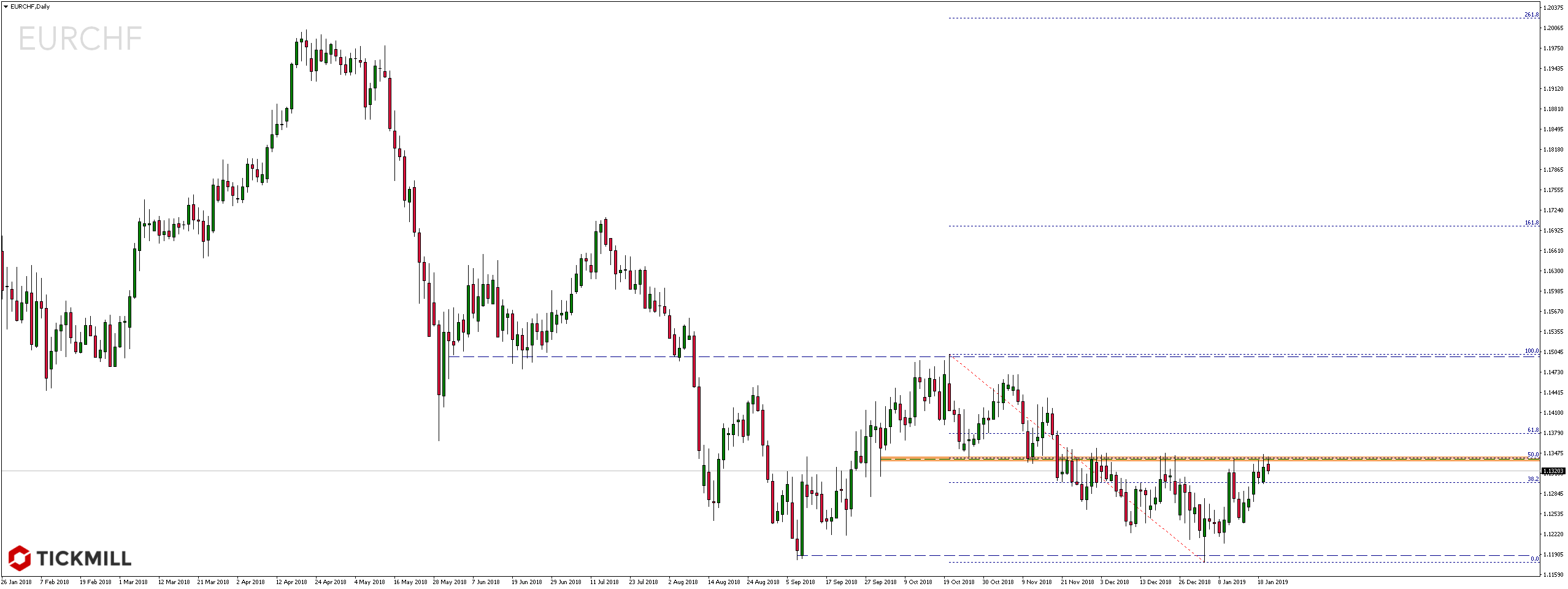

EURCHF

EURCHF exchange rate is also in the area of significant resistance. Given that this level coincides with the measurement of the 50% Fibonacci correction from previous declines and taking into account the current supply response, it seems increasingly likely that this zone could be rejected. If this were to happen, we could even expect a further decline in the near future.

Tickmill is authorised and regulated in the UK by the Financial Conduct Authority (FCA), one of the most respected financial supervisors. Access a wide range of markets, including the Forex market, Stock Exchange Indices, Raw Materials and Bonds. Use some of the lowest spreads on the market. Experience trading at its best with an international broker and gain the advantage of exceptional trading conditions. Open a real account or try a demo account.

Tickmill is authorised and regulated in the UK by the Financial Conduct Authority (FCA), one of the most respected financial supervisors. Access a wide range of markets, including the Forex market, Stock Exchange Indices, Raw Materials and Bonds. Use some of the lowest spreads on the market. Experience trading at its best with an international broker and gain the advantage of exceptional trading conditions. Open a real account or try a demo account.