DAX is one of the most popular indexes in the world. It is listed on the Frankfurt Stock Exchange. Virtually every day there is very high volatility which gives many trading opportunities.

Session Summary 05.07.2017

Yesterday the European stock markets helped with good data from the economies, especially PMI indexes from the service sector for Germany and the whole eurozone, which amounted to 54 vs 53.7 and 55.4 vs 54.7. For the eurozone, good retail sales data also came in at 0.4% vs 0.3% (m/m), and 2.6% vs 2.3% (y/y).

Emotion did not provide the minutes of the June FOMC meeting. Federal Reserve members were divided on the date when the balance-sheet total began to be reduced, as evidenced by the protocol. Some members are afraid of the negative effects of overheating and want to start the procedure within a few months. There is also a group that would be willing to wait for decisions to better assess the health of the economy and inflation. The protocol did not bring much new and so were the reactions of investors.

Today, we will know important data from the US labor market. The ADP report, which always appears before official data, is considered to be the prediction of the official data, although the correlation between these publications is often not large. In addition today there will be data on unemployment claims. The data can tell more about possible FOMC decisions than yesterday’s protocol. We have already seen data on German industrial orders, which turned out to be weaker than expected, which may be impact of the session.

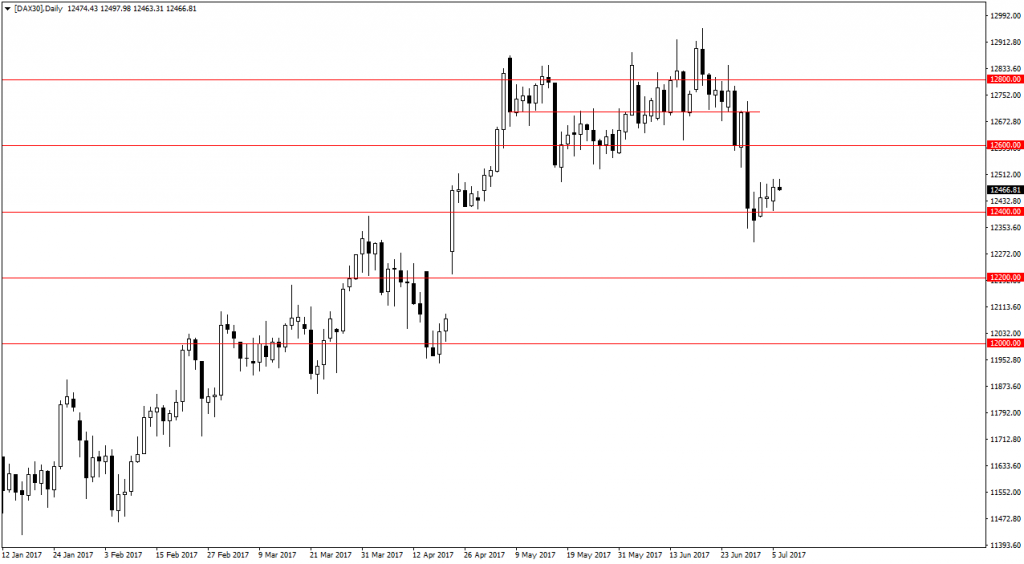

Today, the Nikkei index ended the day with -0.48%. The S&P 500 ended the session in positive 0.15%. Also DAX ended the day above the line, which amounted to 0.13%. The German index set a new record around 12951 points. However, he has not been able to stay on this level for too long. Last Thursday and Friday index fell sharply, stopping just around the support area of 12400 points. A descent below this barrier will open the way to 12200 points. The nearest level of resistance is 12600 points. For the time being, the index is above 12400 points, but for now it is only an upward correction of recent strong falls.

DAX Intraday

DAX Intraday

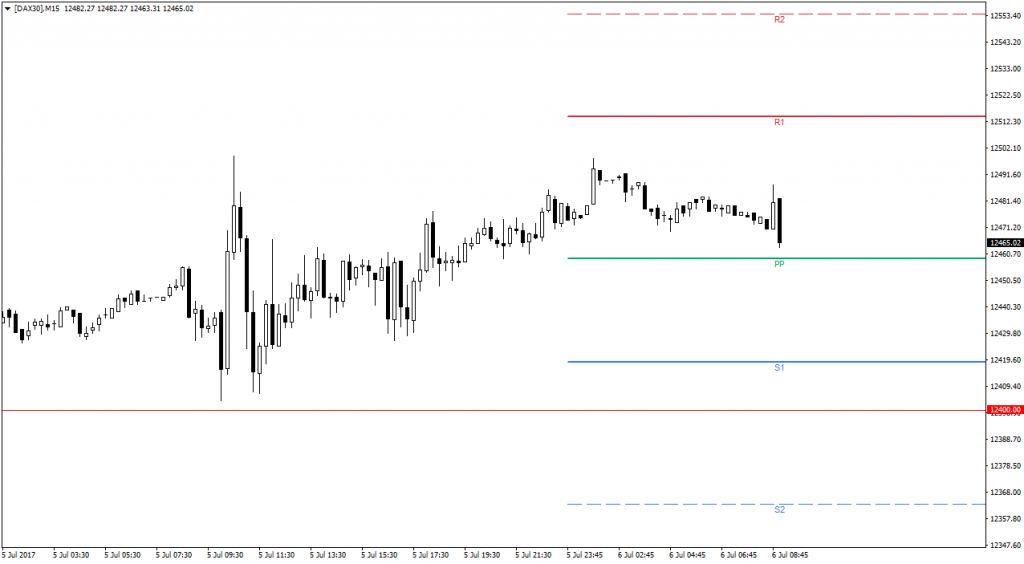

The DAX index after the opening of the futures market is heading towards the pivot point level around 12460 pts. Breaking this level will open the way to S1 near 12420 points. On the other hand, the output above today’s maxima is around 12450 points. will open the way to R1 12515 points.

Key data for the DAX index

Key data for the DAX index

13:30 – ECB Monetary Policy Meeting Accounts

14:15 – ADP Non-Farm Employment Change

14:30 – Unemployment Claims