DAX is one of the most popular indexes in the world. It is listed on the Frankfurt Stock Exchange. Virtually daily there is a very large volatility that gives many trading opportunities.

Summary of session 06/12/2017

The Santa Claus session on the German trading floor ended with a slight decrease of 0.38%, although the beginning of the listings ran under the dictation of bears, who started the day with a 40-point gap. The level of 12,900 points has been strongly tested, but the bulls have won and the session’s tone should be considered positive.

We also got acquainted with orders data in factories, which were better than the low forecasts of 0.5% vs. -0.2%, but not as good as in the previous month, when the increase reached 1.2% after a revision up from 1%.

Naga Markets is an investment company licensed by CySEC, offering access to SwipeStox, a social app for traders, where they can share their trading ideas about Forex, stock indices and CFD’s thanks to simple professional investors’ transaction mirroring.

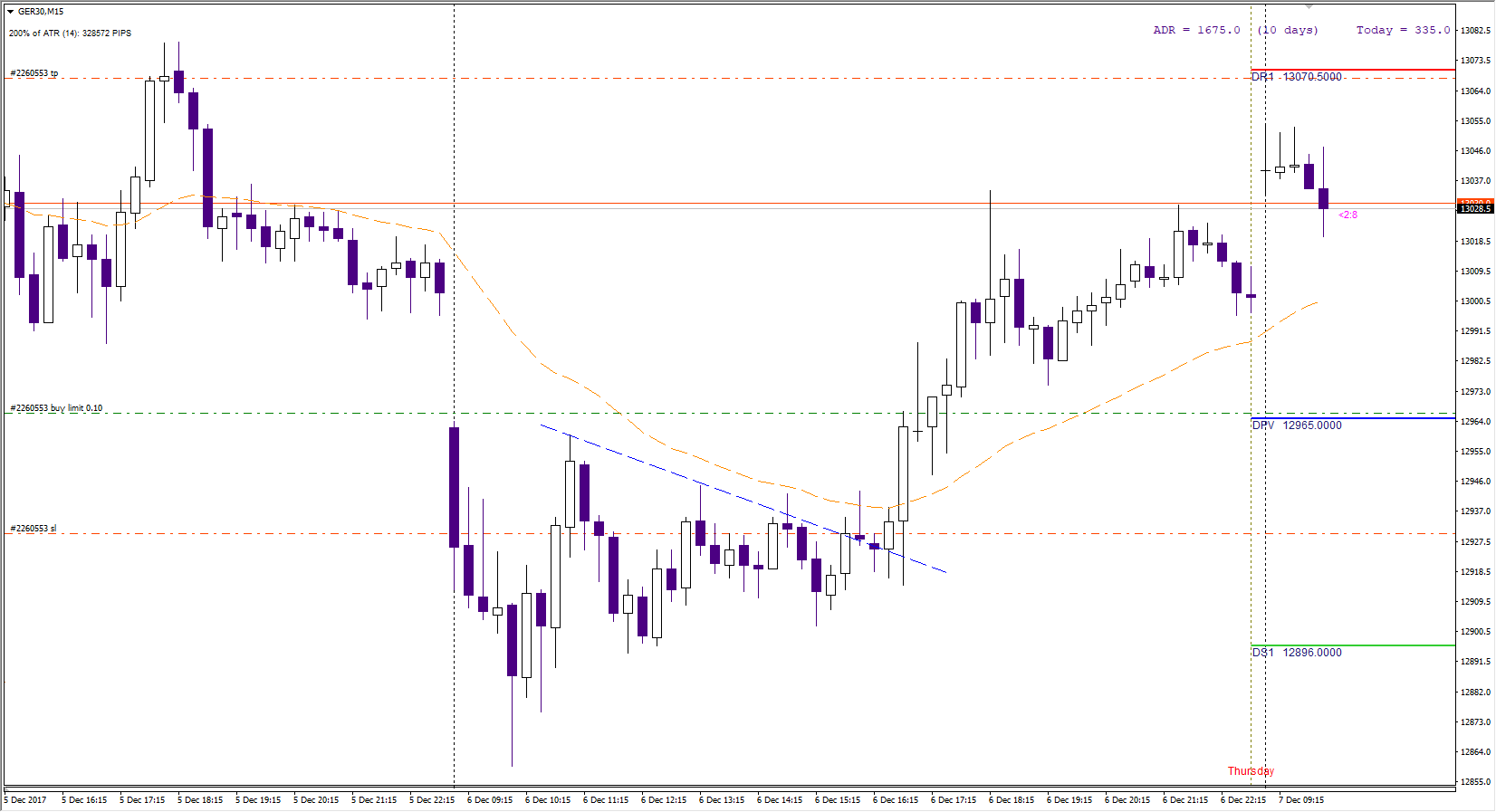

DAX Intraday

Yesterday’s afternoon counter-attack met with resistance level around 13k points, slightly above the daily balance point. Today at the opening the buyers coped with this obstacle, that’s why every correction should be bought, local support level is at 12 965. Few minutes after 9:00 we had attempt to close the gap. From the top will probably be defended Friday’s high and also the 200-hour average- 13 050.

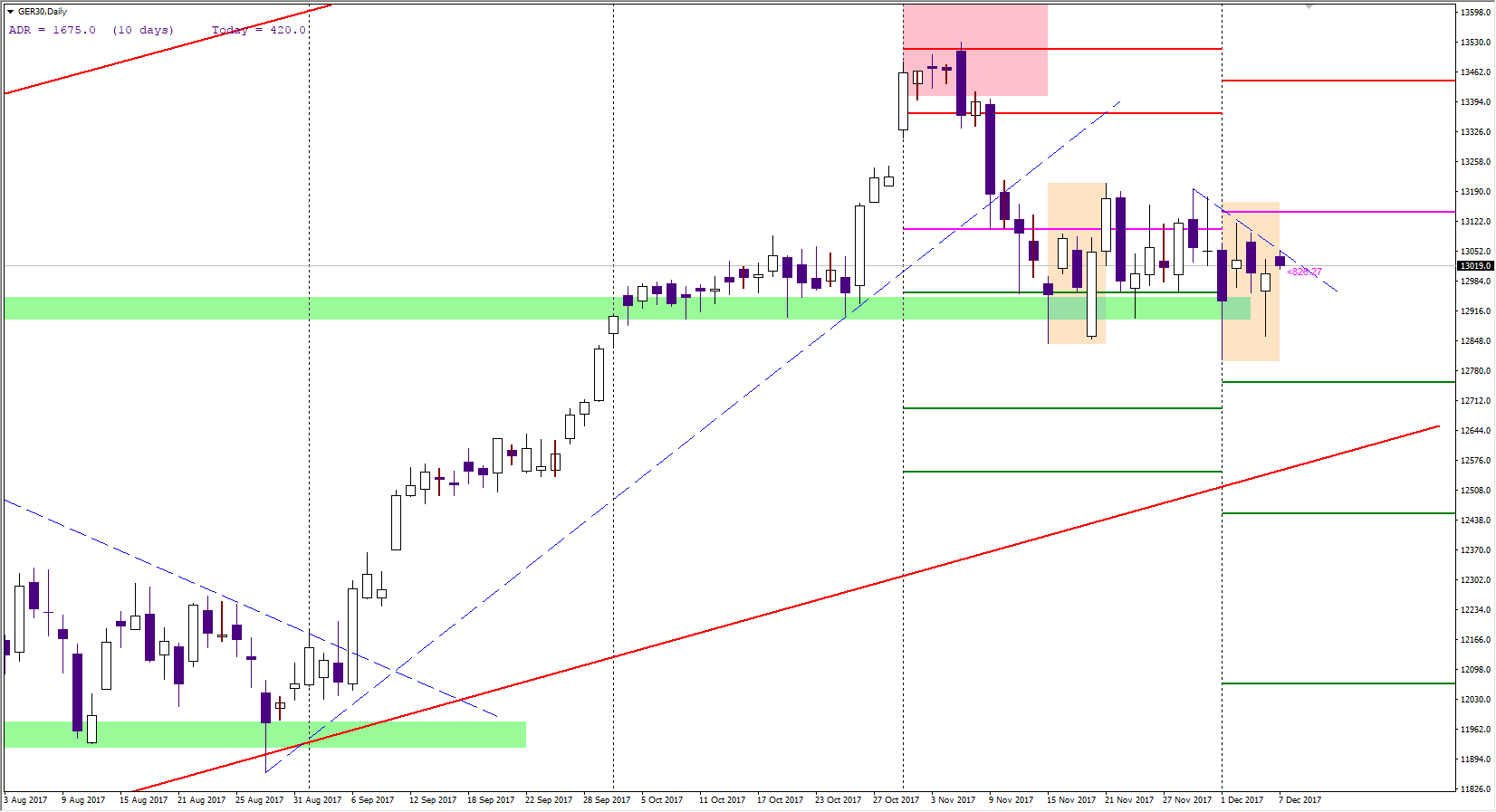

DAX Longterm

On a daily basis, a candle with a long shadow was created, this situation took place three times during the last consolidation and each time resulted in an increase of at least 150 points. Will it happen this time? – very possible, however, the remaining space as well as time on the chart shrinks.