DAX is one of the most popular indexes in the world. It is listed on the Frankfurt Stock Exchange. Virtually daily there is a very large volatility that gives many trading opportunities.

Summary of the session 05/01/2018

The last session in the shortened week allowed the DAX index to increase by 1.15% and it was the third consecutive growth session. Weekly candle (W1) with an increase of over 3% looks impressive.

Among the components of the DAX index, the best result was recorded by BAYER AG, which gained 3.80% and Merck KGaA plus 3.11%. The worst performers were Deutsche Bank AG, which dropped 5.16% and Commerzbank lost 1.72%.

Naga Markets is an investment company licensed by CySEC, offering access to SwipeStox, a social app for traders, where they can share their trading ideas about Forex, stock indices and CFD’s thanks to simple professional investors’ transaction mirroring.

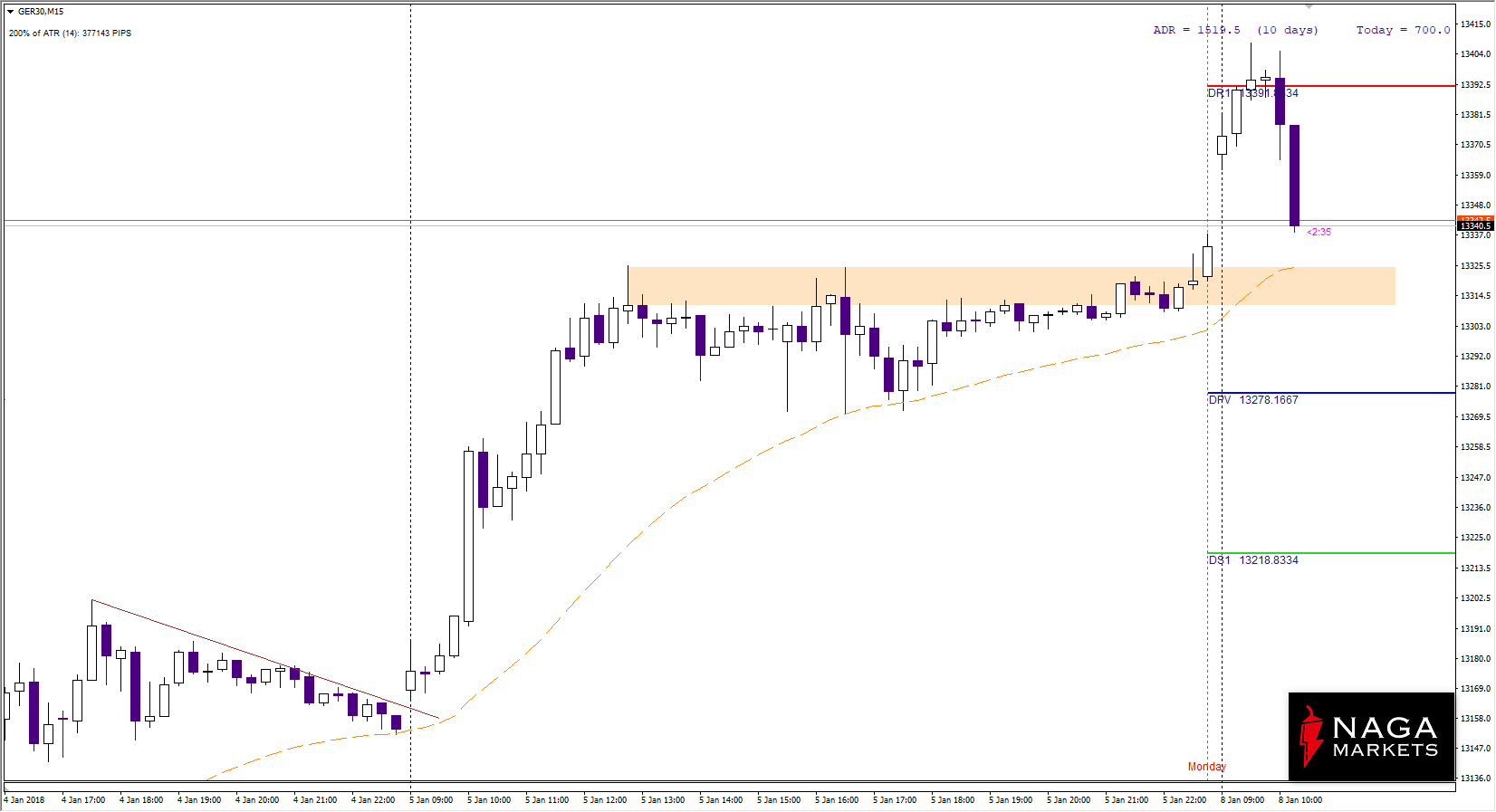

DAX Intraday

On Friday, the market showed a nice growth, so we have the effect of January and the entire fall from December has been very quickly resolved. The bears were put against the wall after the high week’s closure, and today the increases at the opening are continuing with a gap. During this approach, we had only one small gap, which means that the market “smooth” and is not torn as at the turn of October and November.

The index is already reacting with a decline after 9:00 on the local resistance R1 at 13 390, while the first important level of defence is the opening gap and Daily Pivot 13 280.

The index is already reacting with a decline after 9:00 on the local resistance R1 at 13 390, while the first important level of defence is the opening gap and Daily Pivot 13 280.

DAX Longterm

In the context of the full week of trading, it is worth looking at the layout of forces on the daily chart, where demand scores by breaking a significant medium-term high above 13,350. Now, after the nature of the correction, we will know the strength of the impulse, in other words, the task of bulls has been done. The January monthly pivot 13,200 seems to be a good place to joint to the trend.