DAX is one of the most popular indexes in the world. It is listed on the Frankfurt Stock Exchange. Virtually daily there is a very large volatility that gives many trading opportunities.

Summary of session 07/12/2017

Thursday’s session ended with an increase in the DAX index by 0.38%. The continuation of growth at the opening led to the resistance test, which I mentioned in yesterday’s comment, and in almost one session the market was back at the maximum levels of the consolidation.

Among components of the DAX index, the best result was recorded by Pro Sieben, which gained 3.06% and Commerzbank AG by 2.32%. The worst performers were BASF SE, which fell 0.87% and BAYER AG minus 0.67%.

Naga Markets is an investment company licensed by CySEC, offering access to SwipeStox, a social app for traders, where they can share their trading ideas about Forex, stock indices and CFD’s thanks to simple professional investors’ transaction mirroring.

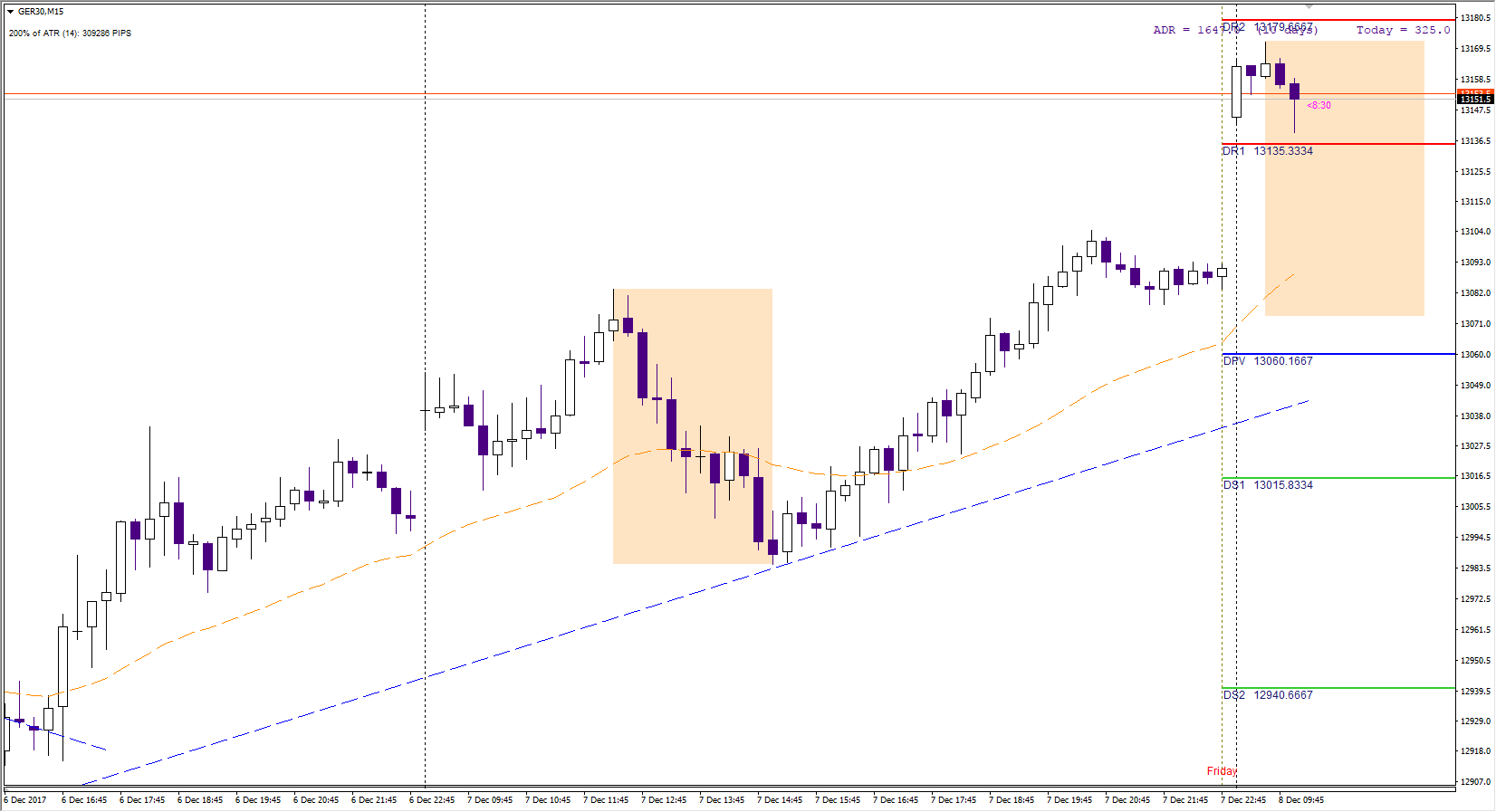

DAX Intraday

Today at the opening, DAX breaks resistance R1, which naturally should lead to another level of resistance R2 at 13,181. Such a strong reaction, makes us look towards the north and buy on corrections.The closest support is the level of yesterday’s close at 13,100 and lower the Pivot 13,062 point and support resulting from the equality of corrections.

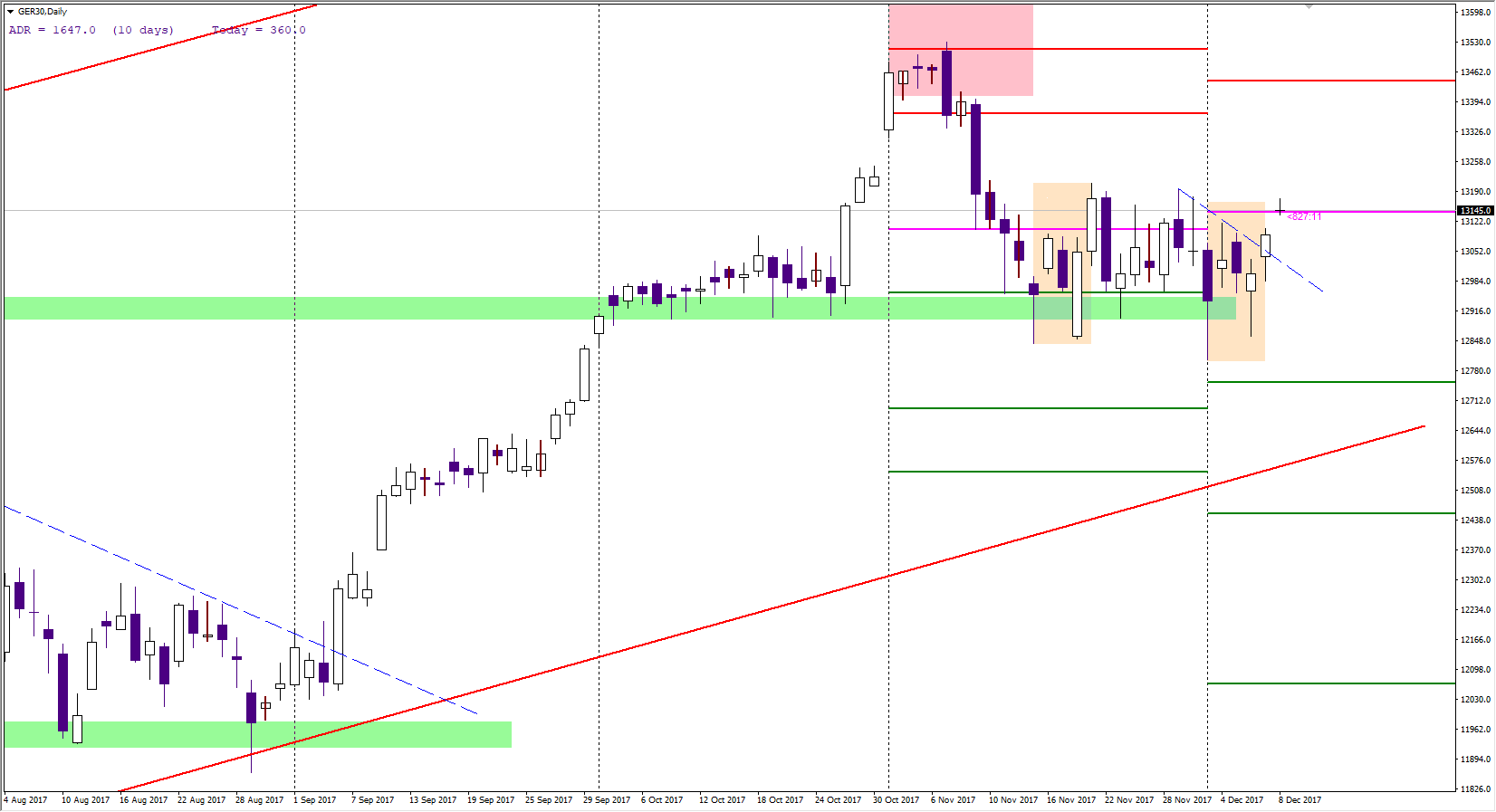

DAX Longterm

Shortly after 9:00 am, the index tests the level of R1 from the top. Yesterday’s session broke the bearish trend line and price quite efficiently arrived at the upper limit of consolidation. Currently, buyers face the monthly pivot, its breakthrough would create opportunities for joining medium-term increases. The situation regarding the further direction may be clearified by today’s data from the US NFP labor market.