Summary of the session 10.04.2019

The middle of the week was a good for DAX, it increased by 0.47% – mainly due to the low base, i.e. the low closure on Tuesday. In the USA, yesterday’s session was an opportunity to buy shares, while in Europe the rebound was quite subdued. The Governing Council of the ECB left the basic interest rates unchanged – we learned at the conference, while the American FED is considering halting interest rate increases in 2019 due to the risk for the perpsective GDP growth.

Among the components of the DAX index, the best result was recorded by Wirecard company, which gained 1.87%, while HeidelbergCement company increased by 1.51%. Deutsche Bank was the weakest performer with a 0.73% decline and Infineon Technologies lost 0.36%. The total number of growing companies exceeded the number of losing companies listed on the Frankfurt Stock Exchange by 389 to 308.

Among the components of the DAX index, the best result was recorded by Wirecard company, which gained 1.87%, while HeidelbergCement company increased by 1.51%. Deutsche Bank was the weakest performer with a 0.73% decline and Infineon Technologies lost 0.36%. The total number of growing companies exceeded the number of losing companies listed on the Frankfurt Stock Exchange by 389 to 308.

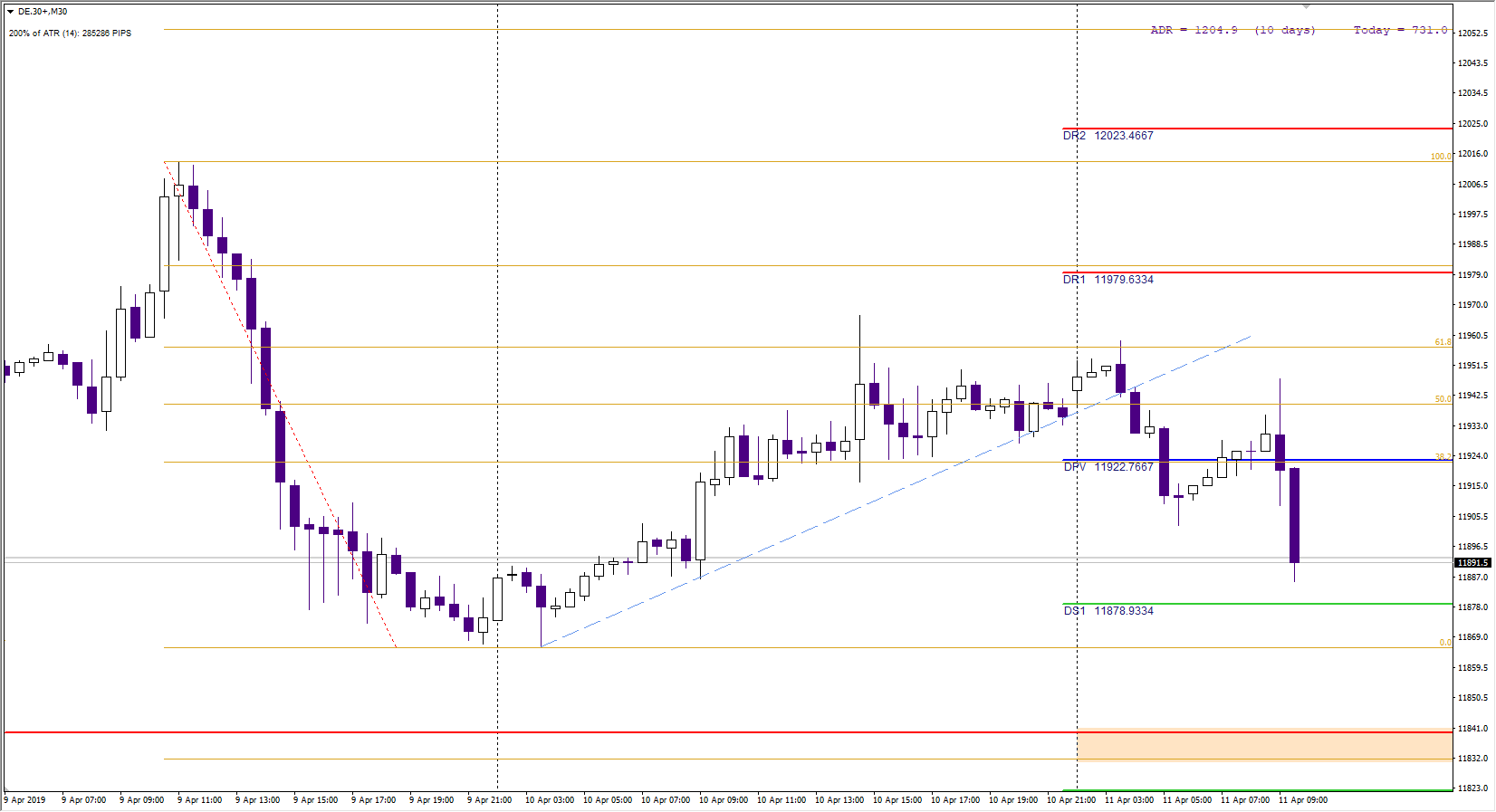

DAX Intraday

As I wrote in the first paragraph, yesterday’s rebound was subdued on the DAX, while the SP500 made up almost the entire drop and returned to 2900 points in the night. DAX today does not react to the evening rises on Wall Street. Quite close support S1 11 878 points, defending this level can encourage to play on the double bottom and rebound in the area of the point of direction 11 925 points.

Otherwise, a stronger drop may lead to a move to 11,830 points, only from this point I expect a recovery in the next few hours of trading. In a few days’ perspective, however, I expect the downward correction of the last growth impulse to around 11,750 points to continue.