DAX is one of the most popular indexes in the world. It is listed on the Frankfurt Stock Exchange. Virtually daily there is a very large volatility that gives many trading opportunities.

Summary of session 11/12/2017

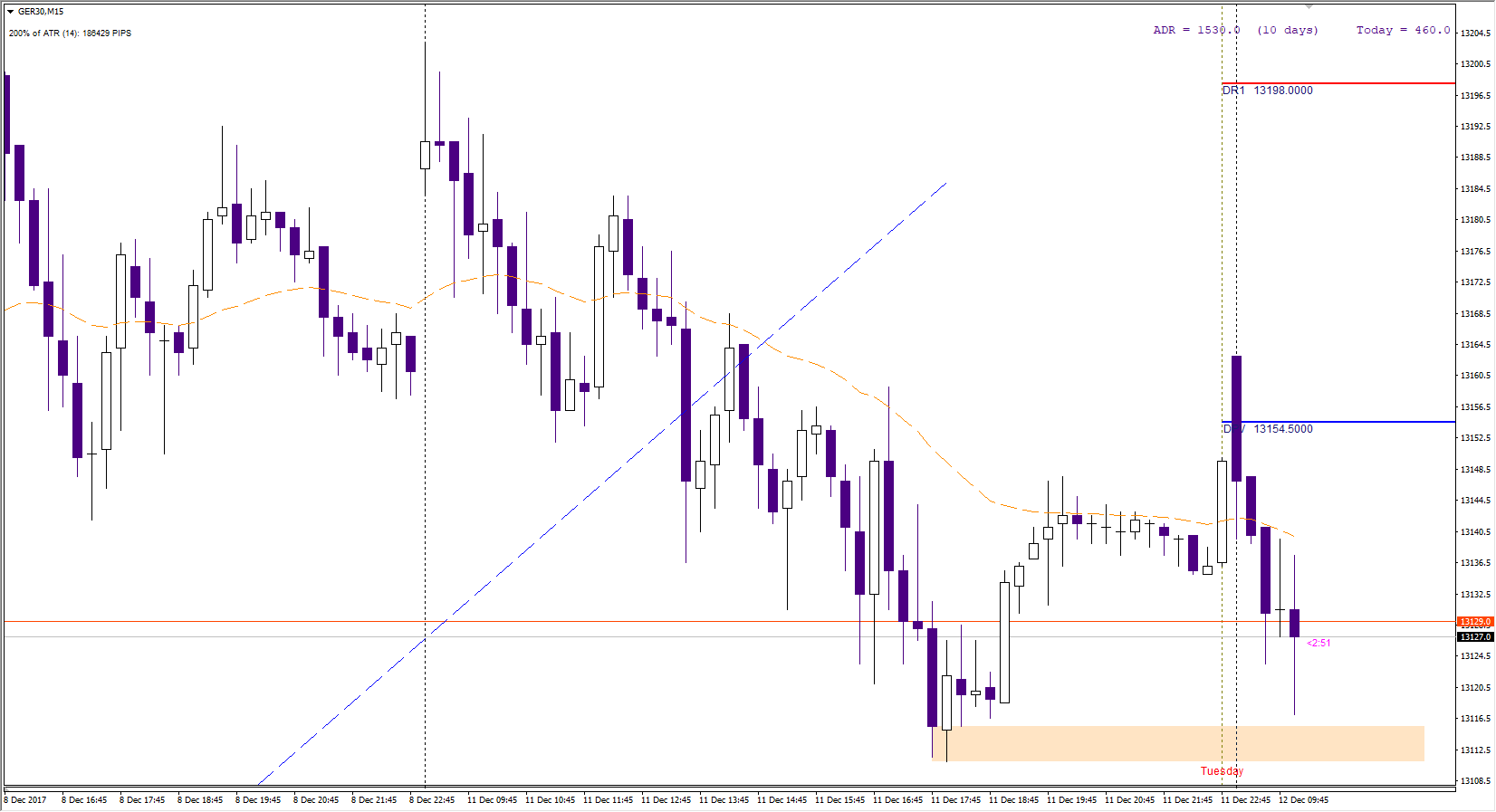

The first session of the week on the German index ran very calmly, DAX slipped by a modest 0.23%. Already at the beginning of quotations, he came under the daily Pivot (13180) and stayed there until the end of the day, slowly moving towards supporting S1 (13120), from which he managed to rebound slightly after closing the cash market.

Among the components of the DAX index, the best result was recorded by Siemens AG, which gained 1.56% and Merck KGaA by 1.10%. The weakest was the company Adidas falling by 3.10% and also E.ON minus 1.53%.

Naga Markets is an investment company licensed by CySEC, offering access to SwipeStox, a social app for traders, where they can share their trading ideas about Forex, stock indices and CFD’s thanks to simple professional investors’ transaction mirroring.

DAX Intraday

Today at the start of the session, the higher opening was used immediately for selling, the course reacted by rejection to the area code (13,155). It seems that initial downward trend may persist, an important point on the historical chart will be the yesterday’s minimum where traders from Europe ended the session.

Maintaining 13115- 13105 would be a positive signal for bulls, and a fast charge in the area of 13200 will create an interesting opportunity to sell for a short time.

Maintaining 13115- 13105 would be a positive signal for bulls, and a fast charge in the area of 13200 will create an interesting opportunity to sell for a short time.

DAX Longterm

Leaving Friday highs is under-way, for now it is small compared to the scale of the upward movement (previous week). After the strength of correction – because so we have to call the movement started yesterday – we will find out who controls the market. It seems that bulls have advantage on start pushing DAX over 13200.