Summary of the session 19/09/2018

It was a successful session on the German trading floor, the main index increased by 0.50%, going above 12,200 points. On futures contract, rolling positions for the December series before expiration takes place. The US is in a good streak, especially as it was seen after the Dow Jones index which shortens the distance to the SP500 and is now getting closer to the January highs.

Among the components of the DAX index, the best result was recorded by Linde, which gained 7.83%, and Deutsche Bank closed gaining 3.09%. The worst result was E.ON falling 2.88% and RWE was down 1.52%. The total number of growing companies outnumbered losing ones 364 to 334. DAX New Volatility, which measures the implied volatility of DAX options, has reached a new 1-month low.

Start trading with leading CFDs on over 10,000 global markets. Trade in currency pairs, indices and commodities.Entering global financial markets has never been easier.

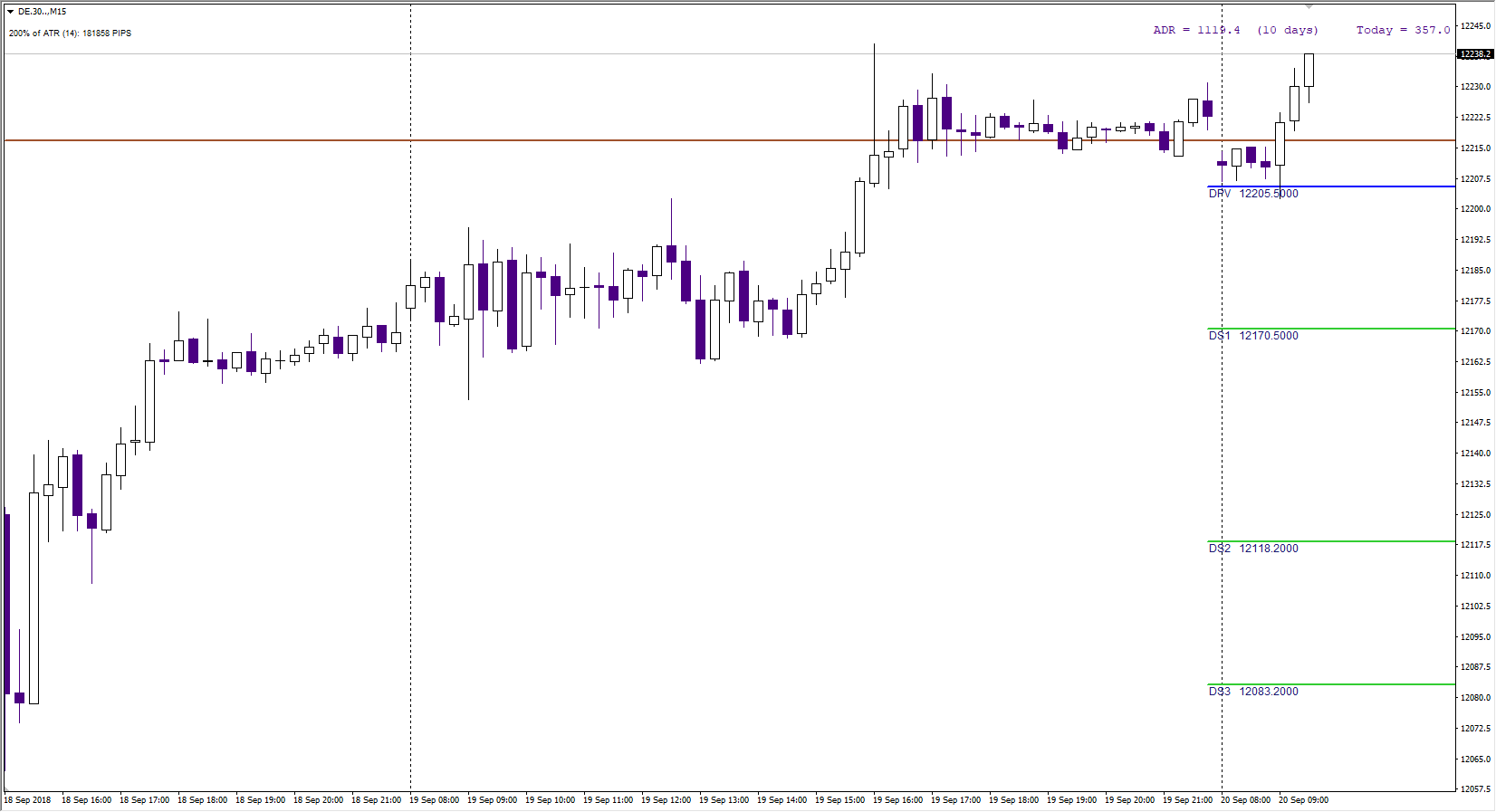

DAX Intraday

DAX at yesterday’s session reached the first target of 12 215, which coincides with the weekly target, but for the time being the profits are not visible. From the beginning of the Thursday session, the bulls wisely lead the game allowing for a lower opening and then close the gap, the daily pivot served as a base and R1 – 12 257/60 is on the horizon. Buyers also supported by the volume, at least until prices are above 12,195 points. Another important resistance is the 12 315/20 already mentioned yesterday; however, when it comes to support, it will be S1 – 12 170.

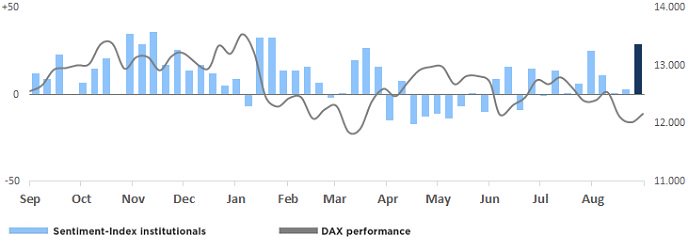

According to a weekly survey conducted by Xetra, among institutional investors, the percentage of bulls increased by 11% and bears dropped by as much as 15%. This translates into 53% of optimists, 24% of pessimists and 23% of investors outside the market. It can be seen, therefore, that with the increase of 150 points during the week, the conviction is growing about further increases in the month.