DAX is one of the most popular indexes in the world. It is listed on the Frankfurt Stock Exchange. Virtually every day there is very high volatility which gives many trading opportunities.

Session Summary 22.06.2017

Yesterday was relatively calm in the markets. Oil yesterday tried to bounce back from a 10-month low, but investors are still worried about rising supply of raw materials from Nigeria, Libya and the United States, despite efforts by OPEC countries to curb oil production. Low oil prices may weaken inflationary expectations in the short term, and if they continue to stay at that level may result in looser monetary policy by the major central banks, threatening to blow up even more bubbles in the equity market. Rising oil production from slate, which is currently the highest in almost two years, completely abolishes the OPEC plan to reduce the supply of this raw material.

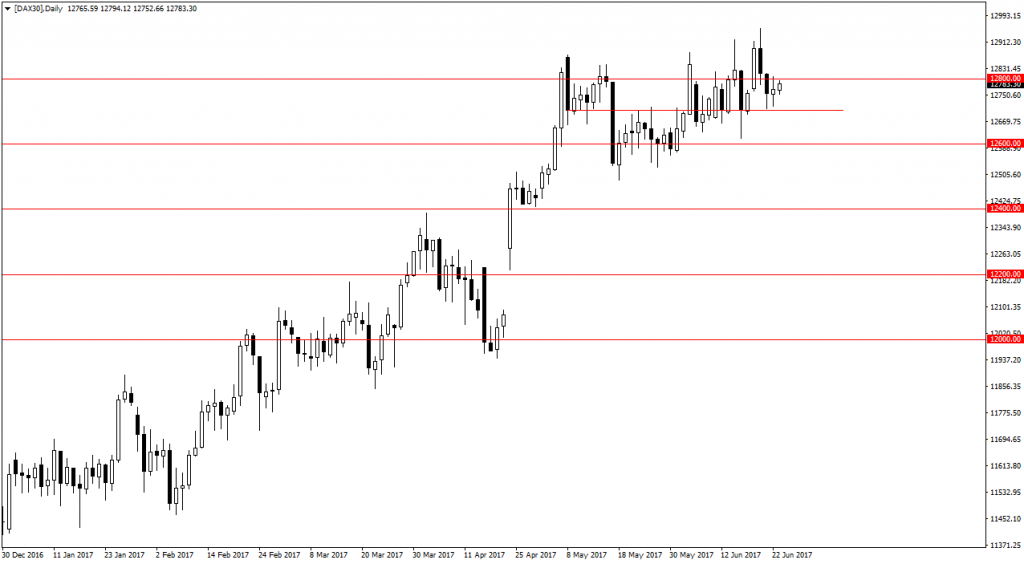

Today morningthe Nikkei index gained 0.11% . Yesterday the S & P 500 ended the day with a slight minus of -0.05%. DAX increased by 0.15%. The German index set a new record yesterday at around 12951 points. However, he did not manage to stay at this level and we observe an adjustment that broke the support level of 12800 points. Today’s attempt to return above 12800 points. The nearest support is around 12700-12600 points.

DAX Intraday

DAX Intraday

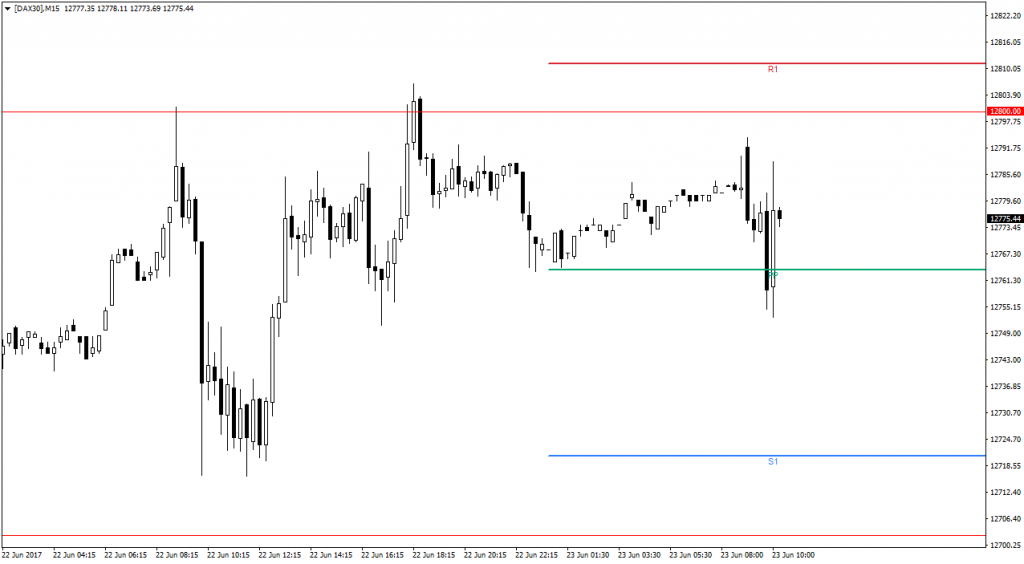

After opening the spot market, the DAX index defended the pivot point at around 12760 points, which opened the way to 12800 – 12810 points. A descent below the pivot point can give way to S1 near 12720 points.

Key data for the DAX index

Key data for the DAX index

09:30 – German Flash Manufacturing and Services PMI

10:00 – Flash Manufacturing and Services PMI eurozone