DAX is one of the most popular indexes in the world. It is listed on the Frankfurt Stock Exchange. Virtually every day there is very high volatility which gives many trading opportunities.

Session Summary 23.06.2017

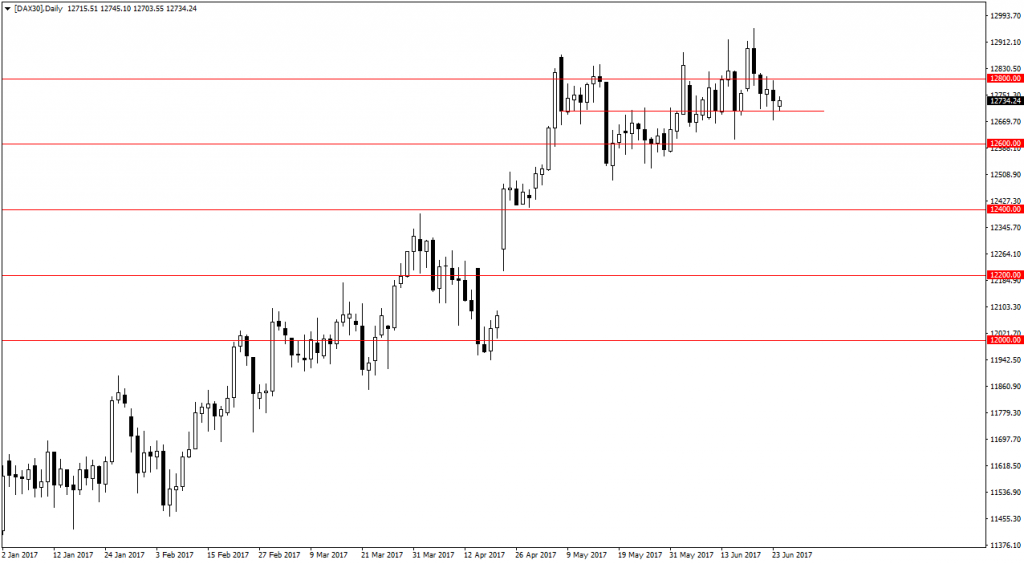

Last week we ended the stock market in Europe and in the United States in slightly better moods, although the week was quite volatile. Although the DAX index set new historical maxima, more in the second part of the comment, but has not managed to stay at this level for too long. Equity markets hurt oil, which fell sharply last week amid fears of an increase in supply, which could not offset the reduction in OPEC production levels and some outside the cartel. US production is the highest in nearly two years. In addition, production is increasing in Libya and Nigeria, where there is no agreement on lower oil production. Libya is currently mining almost 900,000. Barrels per day, the most since 4 years.

The focus was on PMI readings from the European economies and the euro area on Friday. Data in some cases was lower than in May, but still show a solid pace of economic expansion in Europe.

On Friday, the S & P 500 ended the day with 0.16%. DAX dropped by 0.47%. The German index set a new record around 12951 points. However, he did not manage to stay at this level and we observe an adjustment that broke the support level of 12800 points. Today we are attempting to return above 12800 points, and the rate has so far stopped at support of 12700 points. Breaking the level of 12800 points. will move to 12900 points.

DAX Intraday

DAX Intraday

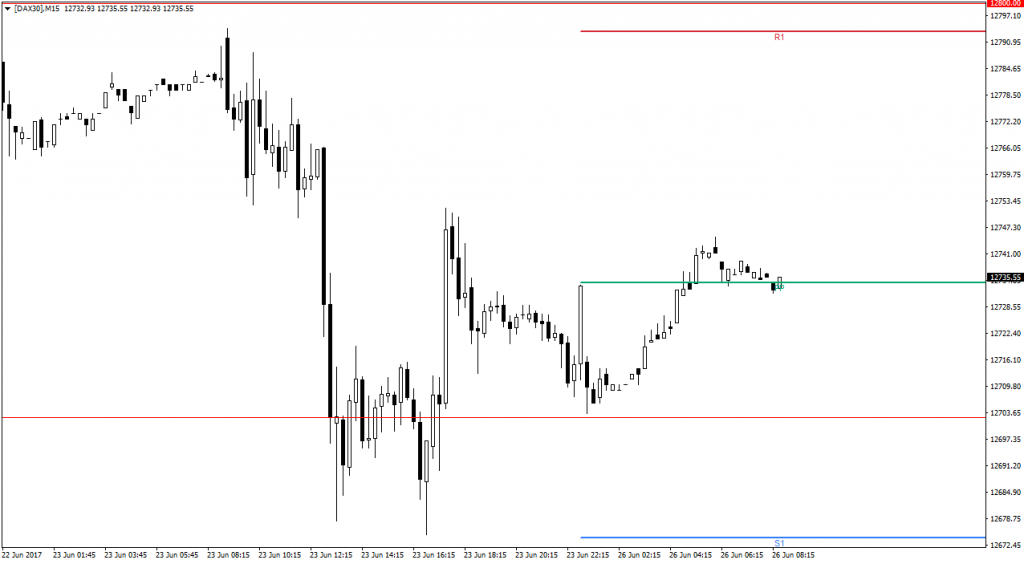

The DAX index consolidates around the pivot point of 12735 points. Defending this area will allow you to move towards R1 near 12790 points. In turn, descent below the pivot point will open the way to 12700 points. and S1 at around 12675 points.

Key data for the DAX index

Key data for the DAX index

10:00 – German Ifo Business Climate

17:00 – ECB President Draghi Speaks