DAX is one of the most popular indexes in the world. It is listed on the Frankfurt Stock Exchange. Virtually every day there is very high volatility which gives many trading opportunities.

Session Summary 30.06.2017

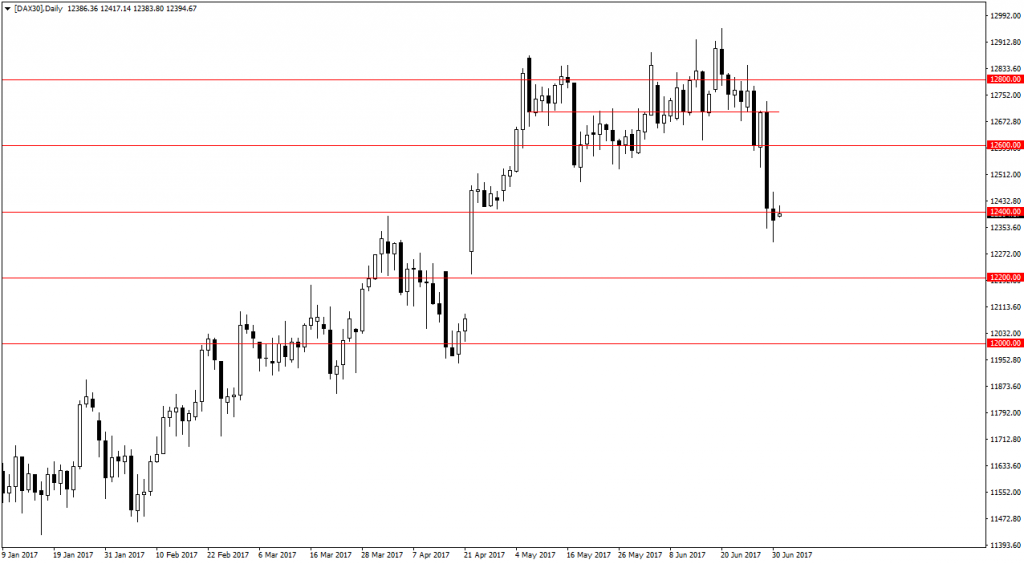

The end of the week brings rather weak sentiment in the equity markets. Investors do not believe in the explanation of the head of the ECB, who supposedly did not want to suggest a move away from loose monetary policy. Let us remind you that Mario Draghi, at the ECB’s annual central banking forum, stated that the factors for higher inflation are temporary and that the ECB will respond to the economic recovery in the euro area and the world. The reaction of the markets shows clearly how profoundly investors are counting on the actions of central bankers.

We can also summarize the entire half year of the stock markets that ended last Friday. We must admit that this was a good time for investors who bet on the stock markets, especially in Germany and in the USA. The DAX index gained at this time above 7%, and the S&P 500 above 8%. However, one should not forget that these markets are heavily redeemed, as evidenced by Shiller’s P/E ratios, as we wrote more in this comment. In addition, even the Federal Reserve itself warns of possible overheating, and a few months ago it spoke in a completely different tone. So great caution.

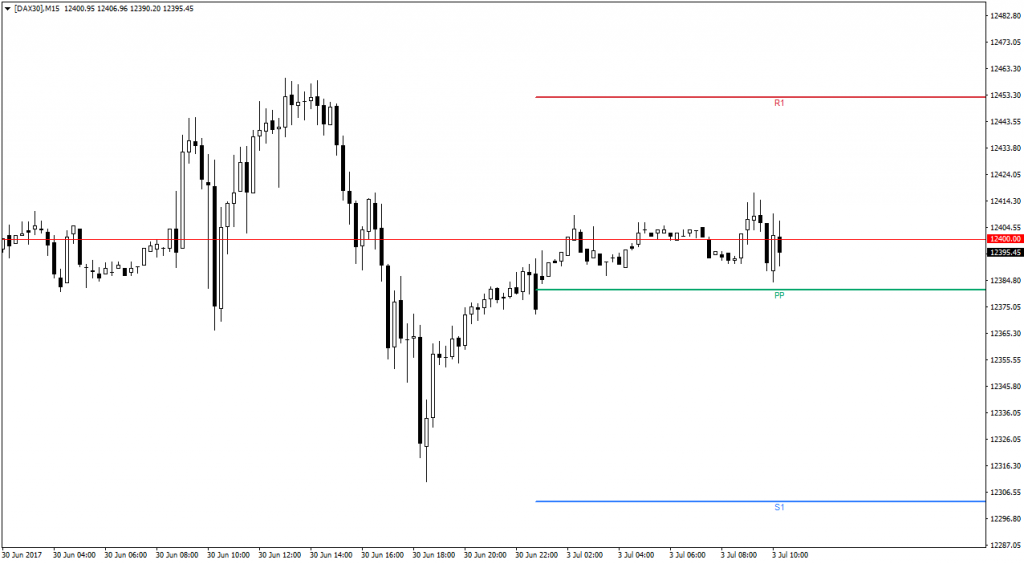

DAX Intraday

DAX Intraday

The index is around 12400 points. Descent below pivot point at around 12380 points it will open the way to S1 near 12300 points. In turn, the entrance above 12400 points will move to 12450 points.

Key data for the DAX index

Key data for the DAX index

09:55 – German Final PMI

10:00 – Eurozone Final PMI