USDCAD and EURUSD look very interesting when we have harmonic trading in our minds. On both currency pairs we had clear trend in one direction. Those trends were broken recently and movement with opposite direction had been started. Currently, we can see these as potential ABCD formations. Until AB = CD equality won’t be a fact.

USDCAD and EURUSD look very interesting when we have harmonic trading in our minds. On both currency pairs we had clear trend in one direction. Those trends were broken recently and movement with opposite direction had been started. Currently, we can see these as potential ABCD formations. Until AB = CD equality won’t be a fact.

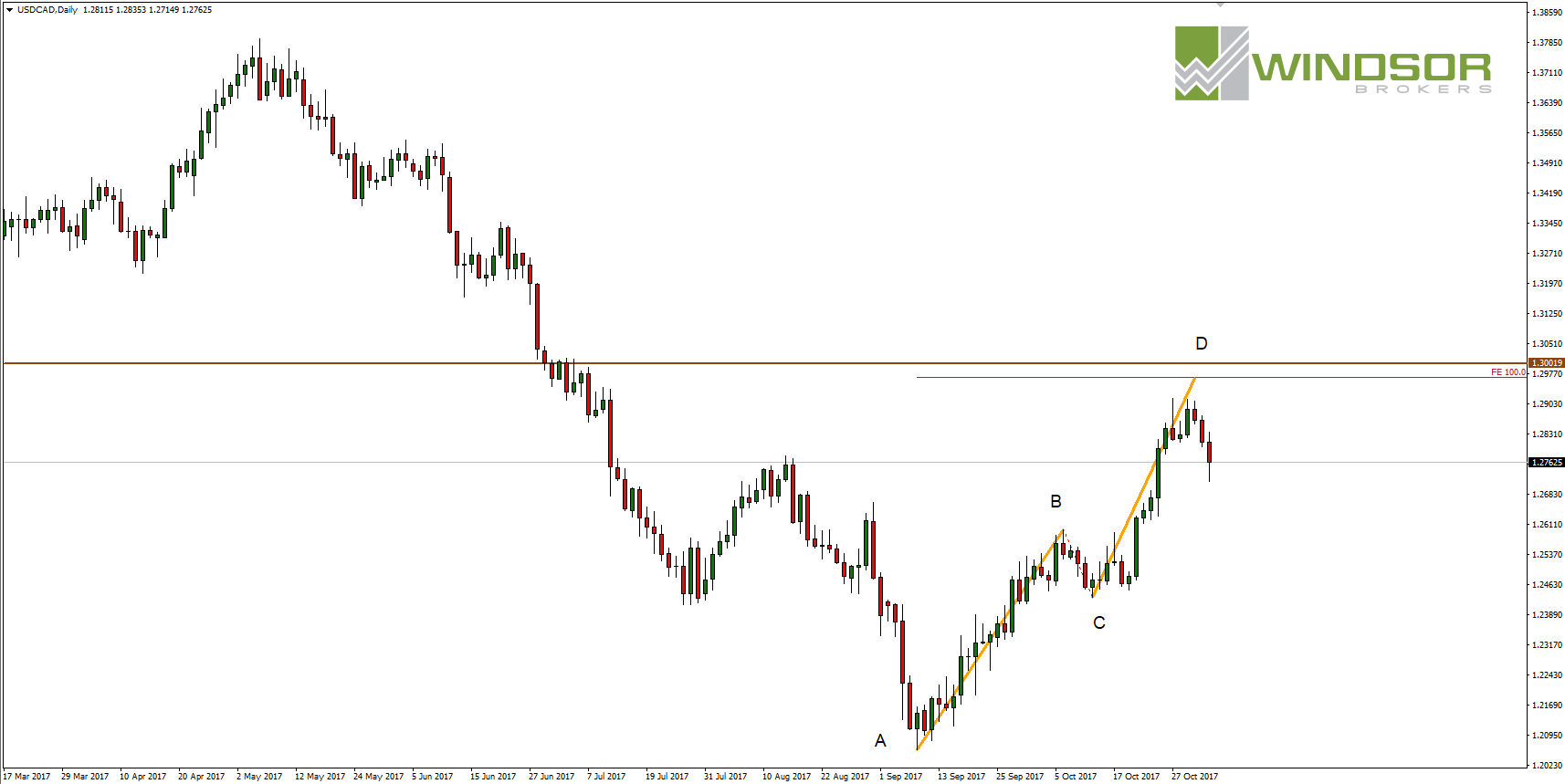

USDCAD – waiting for the test od D point

USDCAD was falling between May 2017 and September 2017. In this period price fell from 1.3790 to 1.2100. Currently, we have the upward correction of the previous trend. Bulls were able to reach nearly Fibonacci 50% level of the previous movement. USDCAD tested 1.2914 level last week. Upward movement has formed ABCD pattern. However, length CD must be equal to length AB. To achieve this USDCAD should test 1.2970 level at this week.

Above 1.2970 there is important resistance at 1.3000. It is possible that some upward candle will have upper shadow and area 1.2970 – 1.3000 will be tested. This area looks good for setting Stop Loss order.

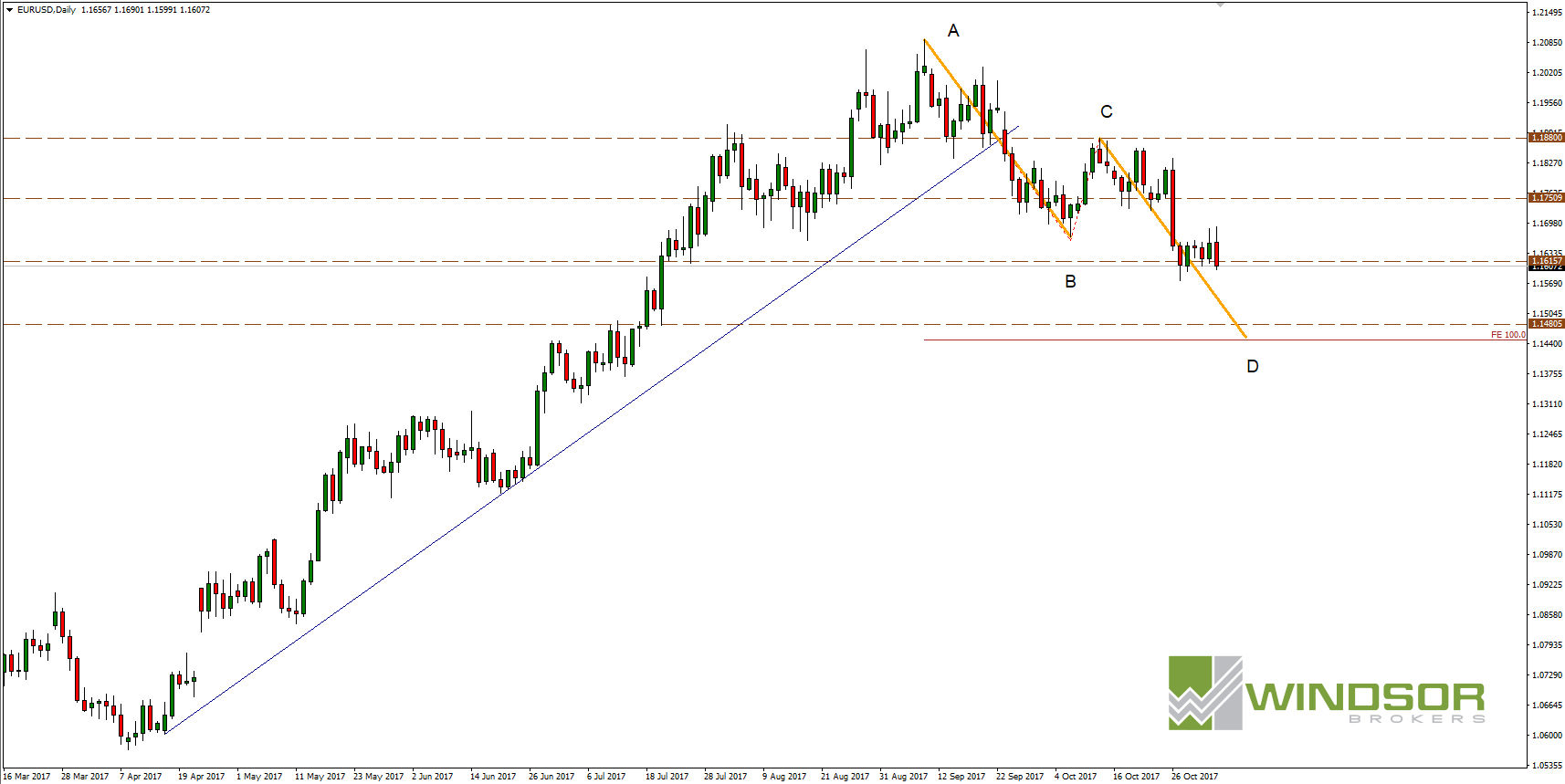

EURUSD – upward movement should start at 1.1450 level

EURUSD has a similar situation. It gains since the beginning of January 2017 and there were only a few downward corrections during that movement.

The downward correction was started at 1.2090 level and that movement has last till today. EURUSD should test 1.1450 level to have AB = CD. When that equality will occur the price should return to upward trend.