It’s a busy day for economic events with important data releases in both the UK and the US, along with testimony to a House of Commons Committee by BOE Governor Carney and colleagues. UK CPI inflation rose to 1.0% in September, its highest level since November 2014, while ‘core’ inflation also picked up. We expect another rise in ‘headline’ inflation In October to 1.1%.

It’s a busy day for economic events with important data releases in both the UK and the US, along with testimony to a House of Commons Committee by BOE Governor Carney and colleagues. UK CPI inflation rose to 1.0% in September, its highest level since November 2014, while ‘core’ inflation also picked up. We expect another rise in ‘headline’ inflation In October to 1.1%.

Further rises in core inflation are in the pipeline due to Sterling’s depreciation but we forecast a small dip in October to 1.4% from 1.5%. When the BoE cut its policy rate in August, Governor Carney suggested that a further reduction was likely in November. However, not only did the MPC fail to cut rates at its November meeting, it also moved to a more neutral guidance on future policy. At today’s HoC Committee hearing, Carney and his colleagues may be asked about the extent of upside risks for inflation and what would be needed to cause the MPC to tighten monetary policy.

In the US, October retail sales are expected to post a sizeable rise of 0.6% led by buoyant car sales. There are also a number of Fed speakers including Fed Vice Chairman Fischer. Of particular interest will be anything he has to say about the sharp rise in Treasury yields over the past week.

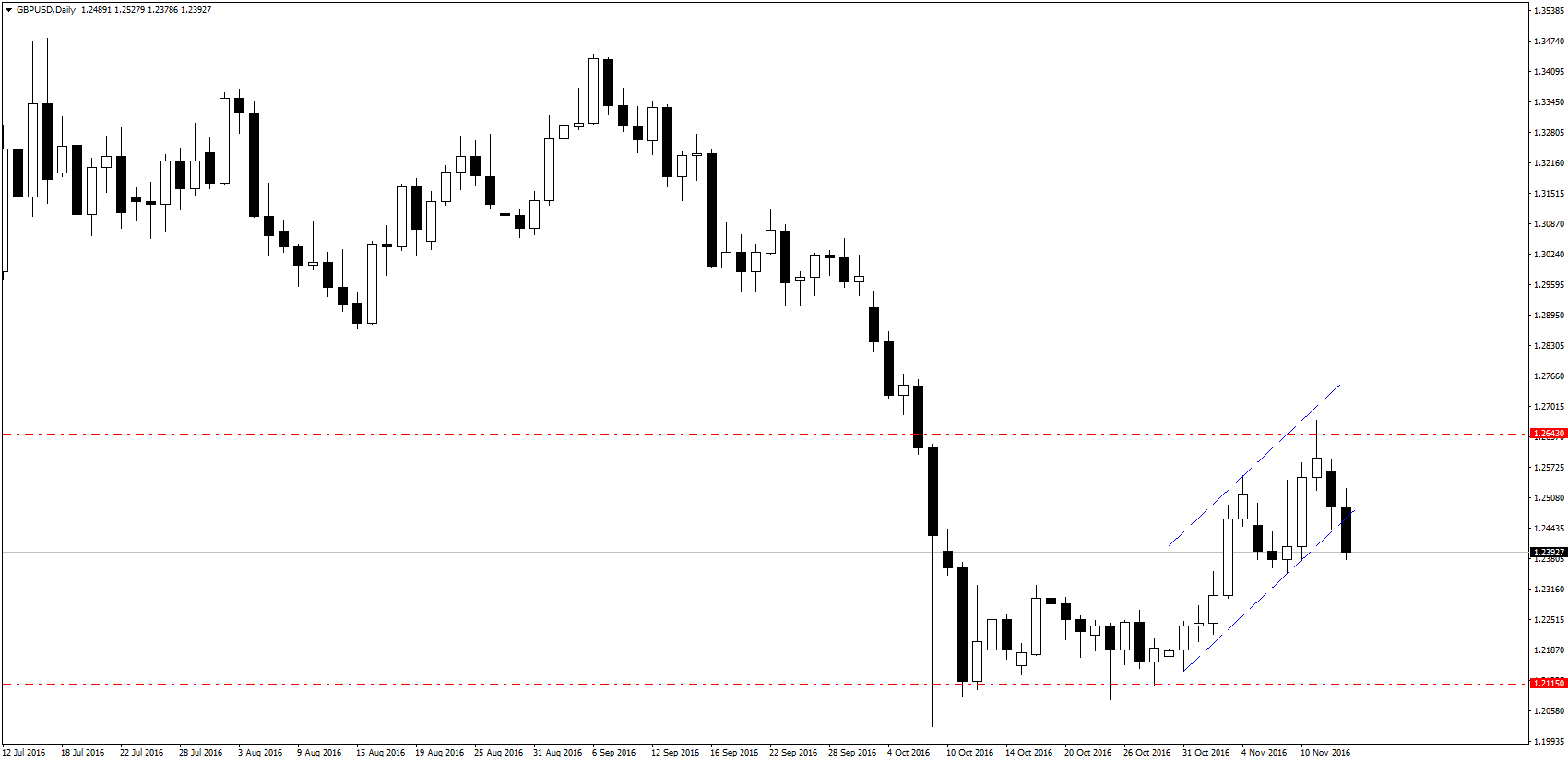

GBPUSD has dropped from the 1.2650-1.2700 resistance region to test but so far hold intra-day support in the 1.2450 region. We are watching rebounds closely, as the bias, while under 1.2645/55 resistance, is for a move back to range lows. A break of 1.2450 would add conviction that a lower high is in place, while 1.2330 is pivot support in this regard. 1.2080 is still seen as range lows for now. A move back through 1.2645/55 would risk a test of key resistance in the 1.28-1.30 region. Long term, we still see a greater risk of another downside test, but that move should complete the bear cycle we have been in from the 2007 highs at 2.1160. A major base is then expected to develop for an ultra-long term move back towards the 1.55-1.70 region.

Would you like to get more such informations directly on your email? Try out FxWatcher service for 5 days for free!