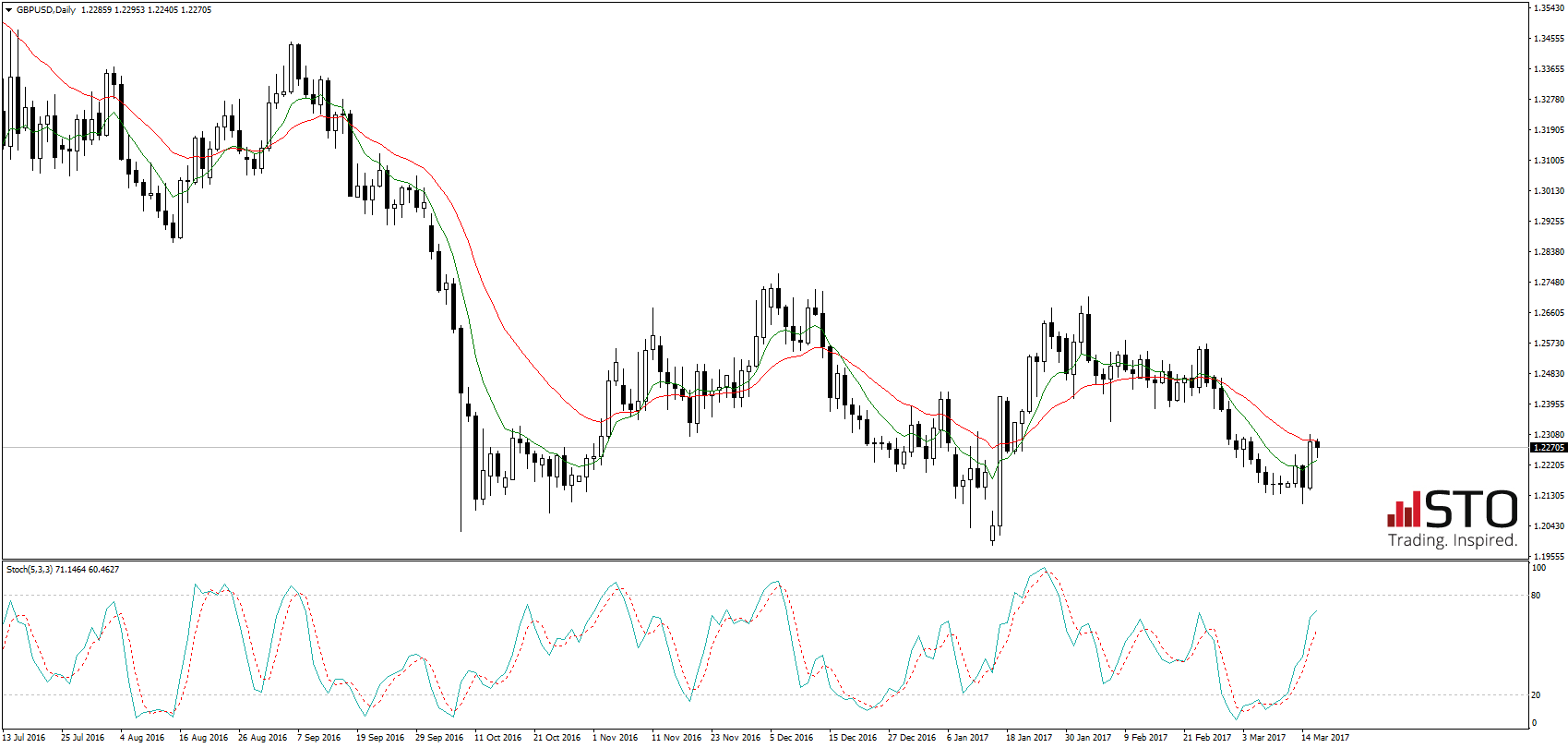

GBP rebounded amid USD weakness (in reaction to FoMC). Pair was last seen at 1.2270 levels. Bearish momentum on daily chart is waning while stochastics is rising. This remain in line with our potential rebound risks in the short term.

GBP rebounded amid USD weakness (in reaction to FoMC). Pair was last seen at 1.2270 levels. Bearish momentum on daily chart is waning while stochastics is rising. This remain in line with our potential rebound risks in the short term.

Rebound could re-visit resistance at 1.2390. Support remains at 1.2050 levels. We remain bearish on the GBP – UK’s Brexit journey has barely just begun (May likely to trigger in the last week of Mar) and negotiating for trade deal with the EU is likely to be a long-drawn process.

Try out free trial of FxWatcher service and check out the rest of today’s big banks commentaries!

Investors and business confidence are likely to be affected; risk of slowing capital inflows amid twin (budget and current account) deficit worries, relocation of HQs, job losses and potentially slowing personal consumption (due to real wages falling), could pose downside risks on UK’s 3-9months growth prospects and the GBP. There is also a risk of Scottish referendum on independence and slight risk of PM May calling for snap elections.

Week remaining brings BoE Meeting on Thursday – which we expect no change in monetary policy stance. We acknowledged there were reports that BoE could be preparing for rate hike but we think it remains too soon. Growth momentum is showing early signs of coming off; while wage inflation has slowed; this could put some near term pressure on household consumption. A premature rate hike amid slowing growth momentum may put the economy under further pressure. We expect BoE to hold off rate increases for the time being.

Week remaining brings BoE Meeting on Thursday – which we expect no change in monetary policy stance. We acknowledged there were reports that BoE could be preparing for rate hike but we think it remains too soon. Growth momentum is showing early signs of coming off; while wage inflation has slowed; this could put some near term pressure on household consumption. A premature rate hike amid slowing growth momentum may put the economy under further pressure. We expect BoE to hold off rate increases for the time being.