We think that a good way to express EUR weakness after the ECB meeting is to sell EUR/GBP. GBP has been helped by the UK government showing increasing sensitivities to avoid a ‘cliff edge’.

We think that a good way to express EUR weakness after the ECB meeting is to sell EUR/GBP. GBP has been helped by the UK government showing increasing sensitivities to avoid a ‘cliff edge’.

Yesterday, PM May agreed to publish her negotiation plans and promised that MPs could vote on the final exit deal. A hard or closed Brexit will be more difficult to achieve under these conditions, suggesting GBP reducing some of its Brexit risk premium. Other ways the Brexit premium could be reduced are via the UK Supreme Court asking the ECJ to decide whether Article 50 is ‘irrevocable’ or by Britain finding its negotiation enhanced by a possible interpretation of Article 127, suggesting that leaving the EU would not automatically cut the UK out of the single market.

Commentaries, trading setups and many more are provided by FxWatcher. Try out FxWatcher service for 5 days for free!

On the other side the ECB has made it clear that they intend to keep monetary accommodation in the market,especially if market volatility increases. The ECB buying bonds below the depo rate should keep front end rates low, pushing the EUR lower. The risk to this view is an increased market probability of a “hard Brexit”.

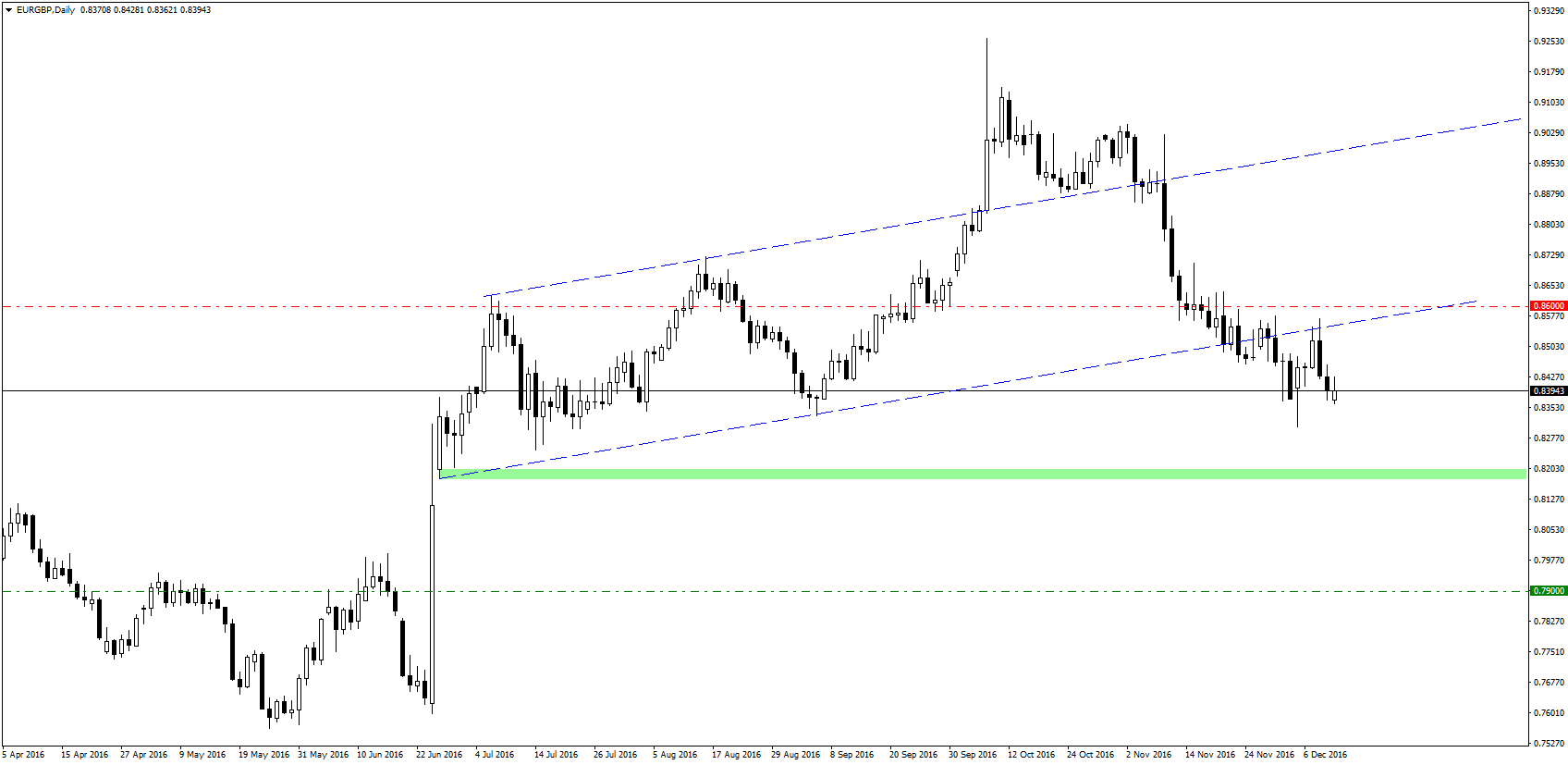

Morgan Stanley has entered in short position on EUR/GBP 8th December, at the NY close. Stop loss is placed above 0.8600, bank is targeting 0.7900.

Morgan Stanley has entered in short position on EUR/GBP 8th December, at the NY close. Stop loss is placed above 0.8600, bank is targeting 0.7900.