Despite being with the consensus we underline our bullish USD view, butunlike November/December when the USD rise was mainly driven via low yielding currencies seeing USDJPY gaining 15% within seven weeks, we put our bearish focus towards Asia and Australia. The dominance of USD strength prevented the AUD from benefiting from rising commodity prices and the associated terms of trade improvement.

Despite being with the consensus we underline our bullish USD view, butunlike November/December when the USD rise was mainly driven via low yielding currencies seeing USDJPY gaining 15% within seven weeks, we put our bearish focus towards Asia and Australia. The dominance of USD strength prevented the AUD from benefiting from rising commodity prices and the associated terms of trade improvement.

First, improving terms of trade may not necessarily lead to better investment spending should Australian companies regard higher commodity prices as only a temporary development. Indeed, mining investment plans have not picked up as much as terms of trade have. During the 2009/2012commodity boom, Australia’s mining sector had built up overcapacities putting the return of equity during the following commodity slump under additional downward pressure. Nowadays, mining companies seem to be more careful, improving corporate cash positions instead of engaging in new investment activities. Hence, better commodity prices fail to develop growth supportive second round effects.

Secondly, there are two major risks for the global growth outlook and both of these risks will not bode well for Australia. Global trade growth has stalled since 2013, which may be linked to trade growth reaching its natural limitations as global imports and exports reach 60% of global GDP. This observation is already a negative for overcapacity-running and manufacturing-oriented economies, of which most are located in Asia. Should the incoming US administration provide new trade hurdles it will hit trade surplus countries most.

Commentaries, trading setups and many more are provided by FxWatcher. Try out FxWatcher service for 5 days for free!

Note, China’s State Information Centre suggested a one-off devaluation of the yuan exchange rate should be considered to maintain the currency’s stability at a balanced level. These comments from the State information Centre may have to be seen within the context of the current trade discussion in the US.

We expect GBP to reach its cyclical low point within Q1 2017. This quarter should reveal post Brexit investment spending weakness finally coming to the surface. The lag between investment planning and execution is around 6-8 months suggesting that increased planning insecurity should now finally show up in data weakness. Ahead of the government triggering Article 50 late March the split position concerning the hard and the soft Brexit camp will come increasingly to the surface. Tensions within the government camp may become increasingly visible especially in the case the Supreme Court providing the Parliament with additional rights deciding on the exitnegotiation strategy. The risk to this trade is an improvement in the UK political environment.

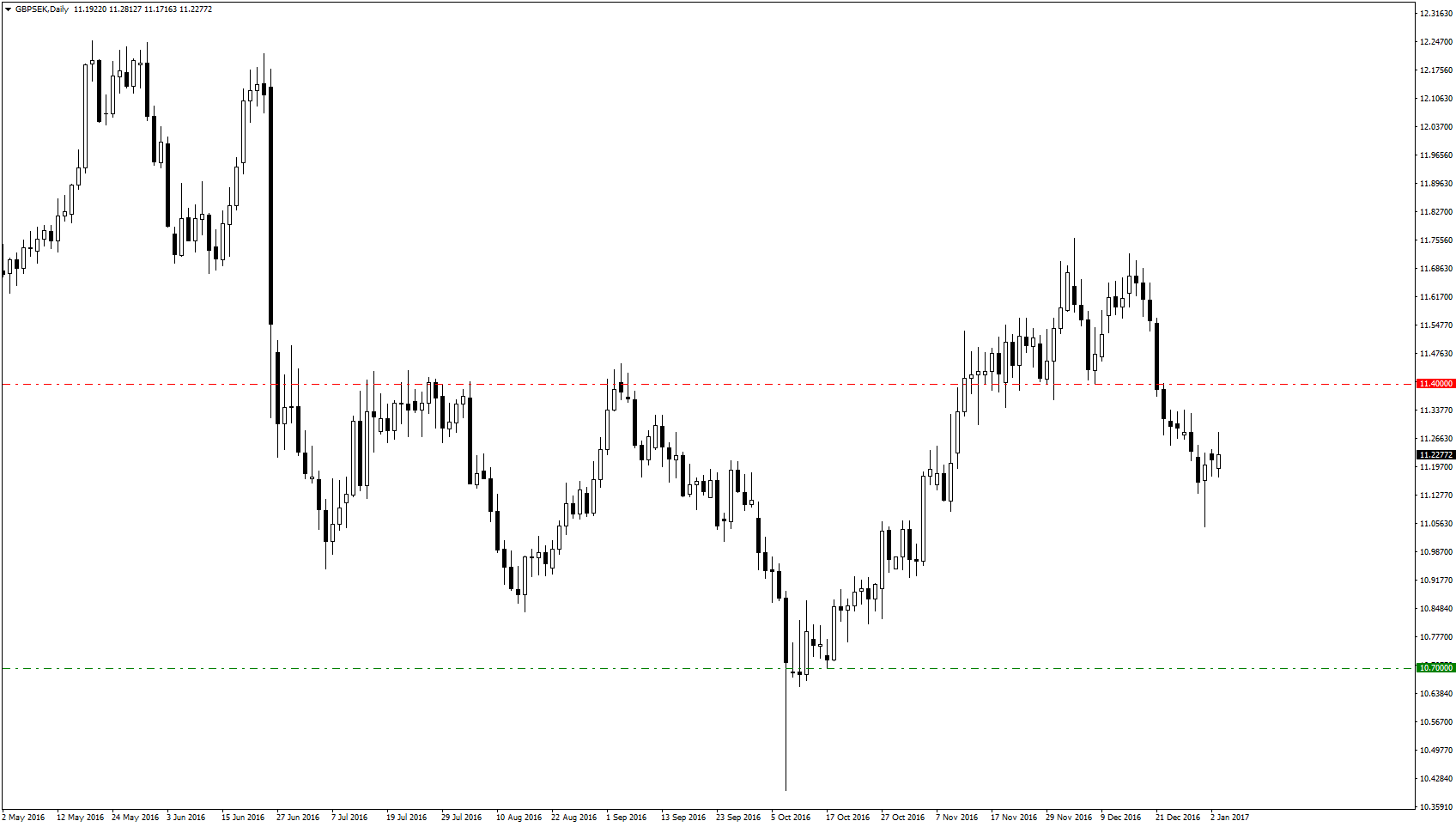

The SEK TWI has rallied by 2% in December underlining the pro-cyclical stance of the SEK. Yesterday saw ECB’s Coeure taking a more hawkish stance by emphasising the upside risks to the ECB’s 2017 inflation projection. The more relaxed ECB may allow the Riksbank to move away from its accommodative stance. Given the better performance of the Swedish economy, including its core inflation rate trading at 1.6%, the need of the Riksbank to tighten is significant. GBPSEK should trade lower with falling rate differentials leading the way.

We like to sell GBP/SEK at market with a target of 10.70 and stop at 11.40.