Christmas is rapidly approaching what for markets means almost two-week vacation. The period of Christmas and New Year is usually one of the quietest and most boring moments at the same time when it comes to world trade centres. Christmas atmosphere can also be seen in the macroeconomic calendar.

Christmas is rapidly approaching what for markets means almost two-week vacation. The period of Christmas and New Year is usually one of the quietest and most boring moments at the same time when it comes to world trade centres. Christmas atmosphere can also be seen in the macroeconomic calendar.

Japanese trade balance down – what else in the calendar?

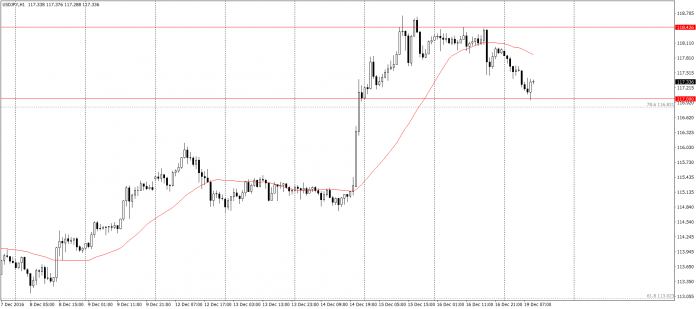

With the night data markets got familiar with the Japanese trade balance for November, which was ranked slightly below forecast of 0.54 trillion yen ( but still this result is better than 0.47 trillion reported for October). At the same time, export growth is rebounding from lows at level -0.4%, and also we had growth in imports (-8.8%).

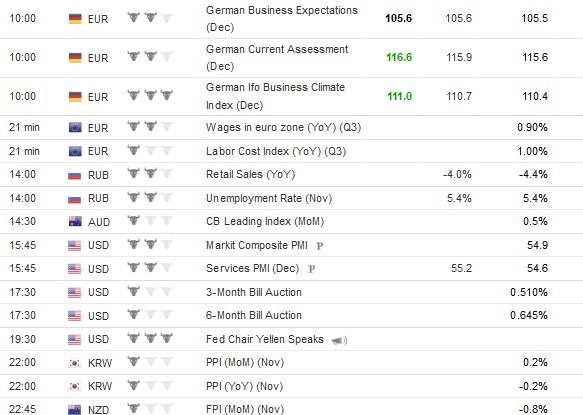

During Monday’s session, we will have readings from Germany and the entire euro area (10-11), at 14:00, we will focus on results of Polish industrial production and retail sales, and at 15:45 we will know the PMI by Markit for the United States.

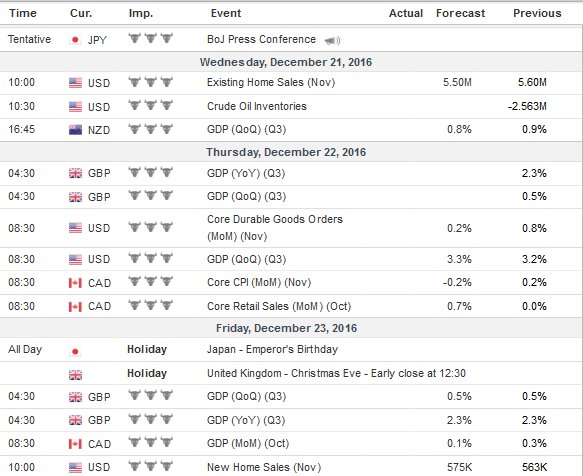

The most important economic data before Christmas

With each day of the week, markets will become more and more deserted. On Friday, December 23 we have bank holiday in Japan and in the United Kingdom shortened session will end at 12:30 pm already, therefore we should be careful to limited liquidity.

The most important event of the week is undoubtedly Tuesday’s Bank of Japan’s decision on interest rates, which will be announced on December 20 at night our time. Also interesting will be Thursday, December 22, when the UK and the US will share readings of GDP, and Canada will present the CPI and retail sales.