It is the most important day of the week – today we will know the decision of European Central Bank on monetary policy of the euro area. Forecasts do not involve changes to the current level of interest rates, investors’ attention is drawn to ongoing program of quantitative easing. Will Mario Draghi expand buying? Did nightly data from Japan influence Asian markets?

It is the most important day of the week – today we will know the decision of European Central Bank on monetary policy of the euro area. Forecasts do not involve changes to the current level of interest rates, investors’ attention is drawn to ongoing program of quantitative easing. Will Mario Draghi expand buying? Did nightly data from Japan influence Asian markets?

Beginning the overview chronologically we should first focus on the night data from Japan. Fifty minutes after midnight was published the final report on changes in GDP for the third quarter of this year. The data proved to be disappointing – quarterly economic growth was only 0.3% (instead of the forecast 0.6%). In annual terms, publication of the GDP also negatively surprised – the third quarter saw an increase of 1.3% against a forecast of 2.4%.

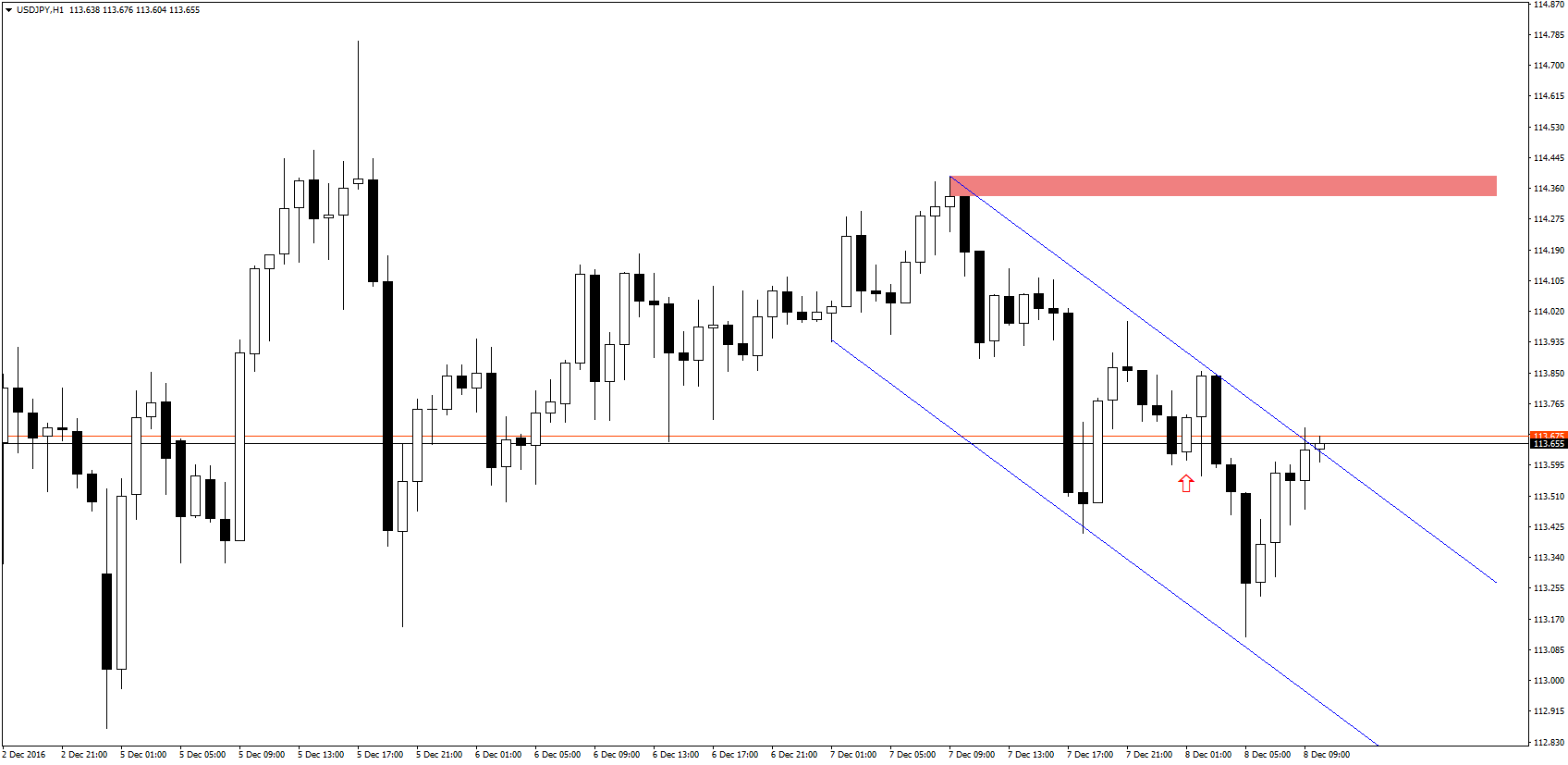

As noted by Reuters, the Japanese government adopted a new base year to calculate changes in the level of Gross Domestic Product which led to changes both in the previous readings and published today. This would explain the behaviour of the market which approached to the publication of the night quite coldly. USD/JPY went slightly up after the publication:

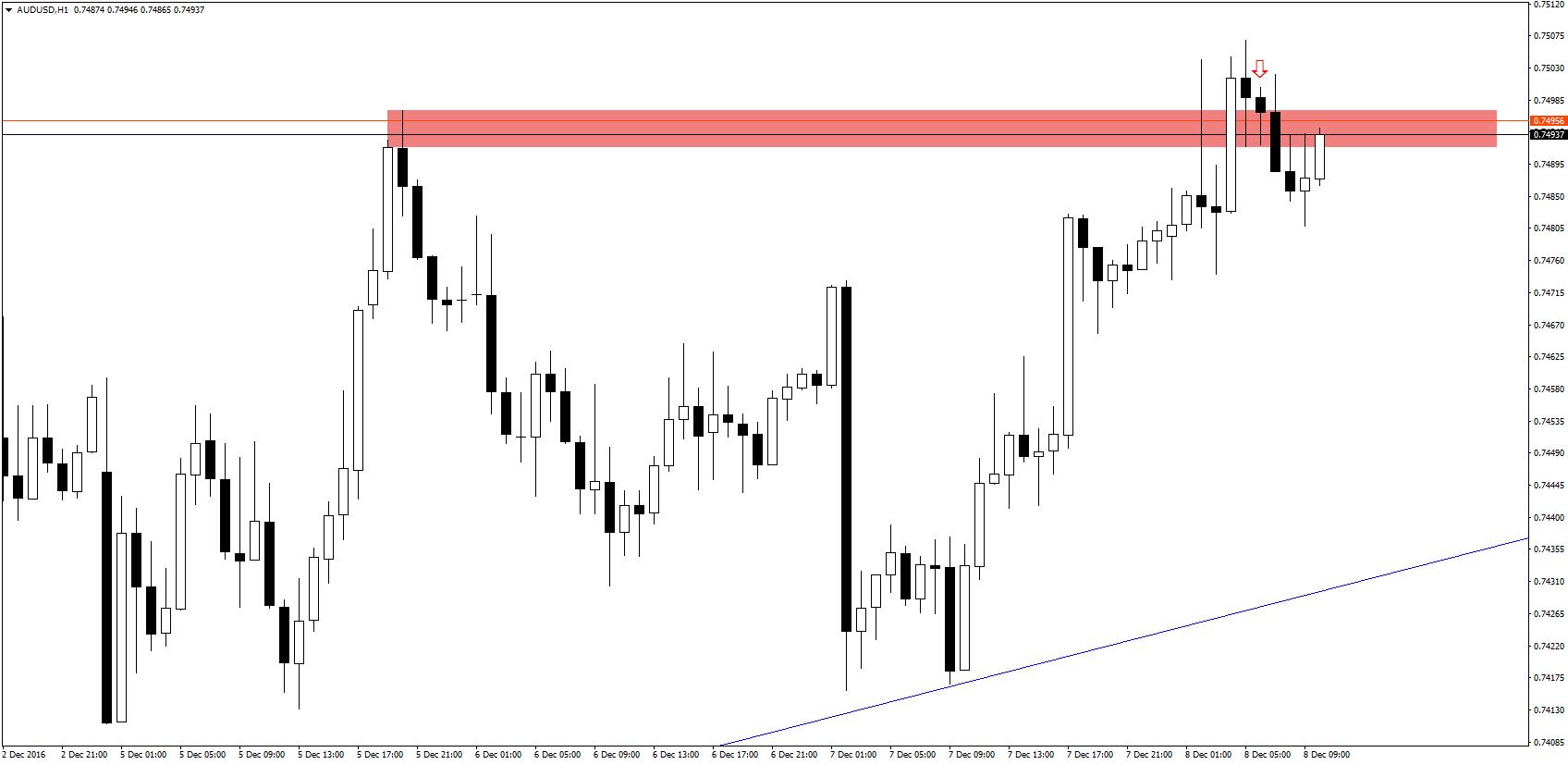

Second point of the Asian session was publication of Chinese trade balance for November. Although the trading surplus worked out last month turned out to be slightly smaller than assumed its forecast (44.6 to 46.3 billion USD), however, constituent indicators of exports (+ 0.1%) and imports (+ 6.7%) significantly differed from earlier forecasts. What can worry is dramatically higher level of imports, which resulted in valuation of Australian dollar associated with the Chinese economy:

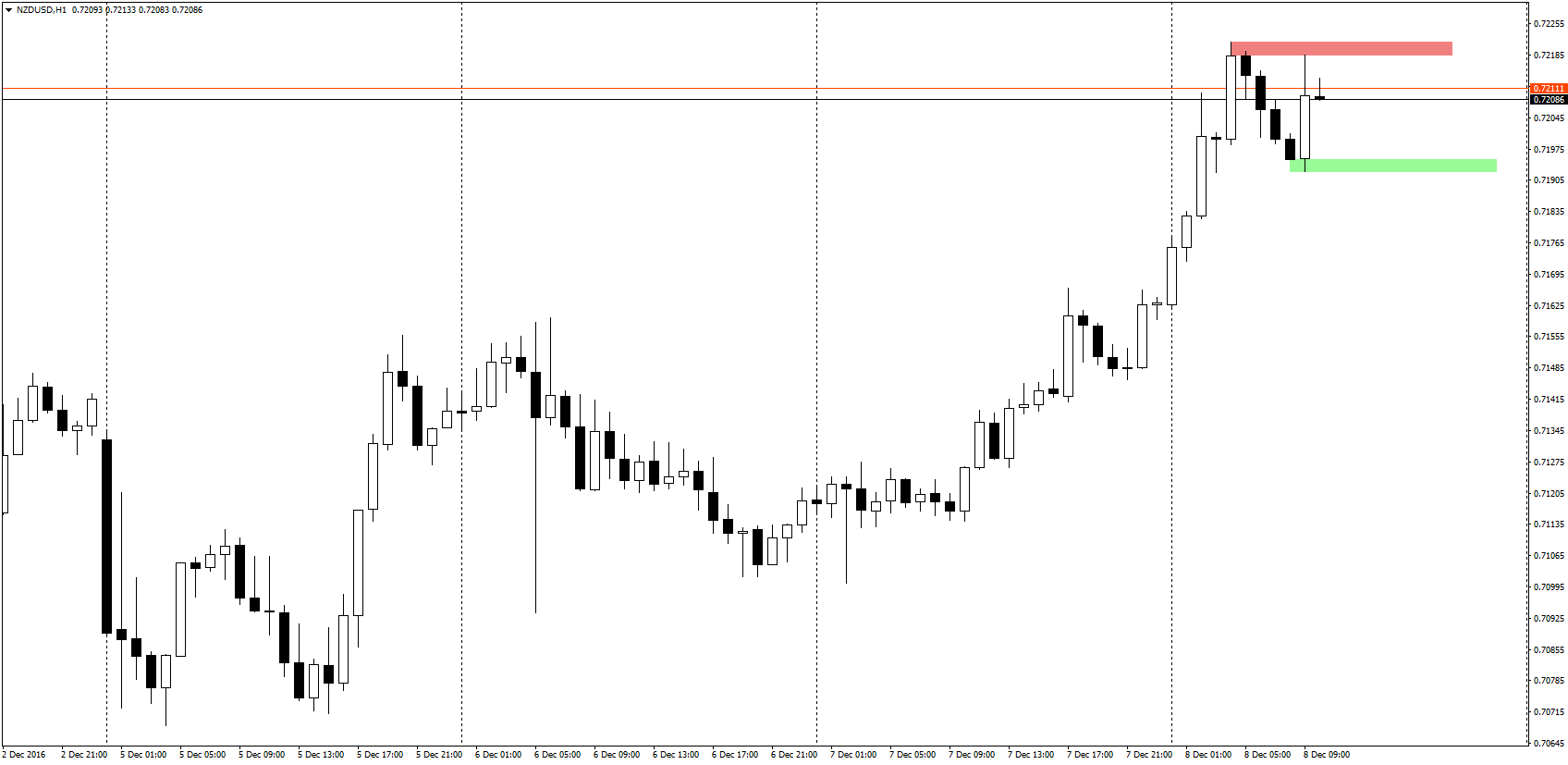

Particularly well in the morning is doing kiwi. NZD/USD gains after comments from the RBNZ governor, Graeme Wheeler, who said that the current level of interest rates is sufficiently low and further rate cuts in the near future are not needed.

In coming hours, we will focus primarily on the decision of the ECB. Until 13:45 are not planned any, noteworthy publications, so monetary decision of the European Central Bank will be the first macroeconomic event of the today’s European session. Projections for interest rates remain unchanged – the deposit rate at 0.4%, and the main interest rate at 0%.

At 14:30 will be published Initial Jobless Claims showing the number of applications for unemployment benefits in the United States. In parallel, Canadians will share a report on building permits and index of real estate prices. However, in focus will remain just beginning at that time press conference of Mario Draghi. Markets speculate about a possible prolongation in time and extend in volume the ongoing purchase of bonds under the QE program.