OIL.WTI – the price of this raw material, which is necessary in every economy, depends to a large extent on international political and economic events. Recent events in the Strait of Oman – fires on two tankers caused by a mysterious attack – should theoretically increase the price of oil, but the week ended in a bearish mode. This may indicate that the price of this raw material may be more affected by fear of reduced demand caused by a drop in industrial production due to the customs war between the USA and China.

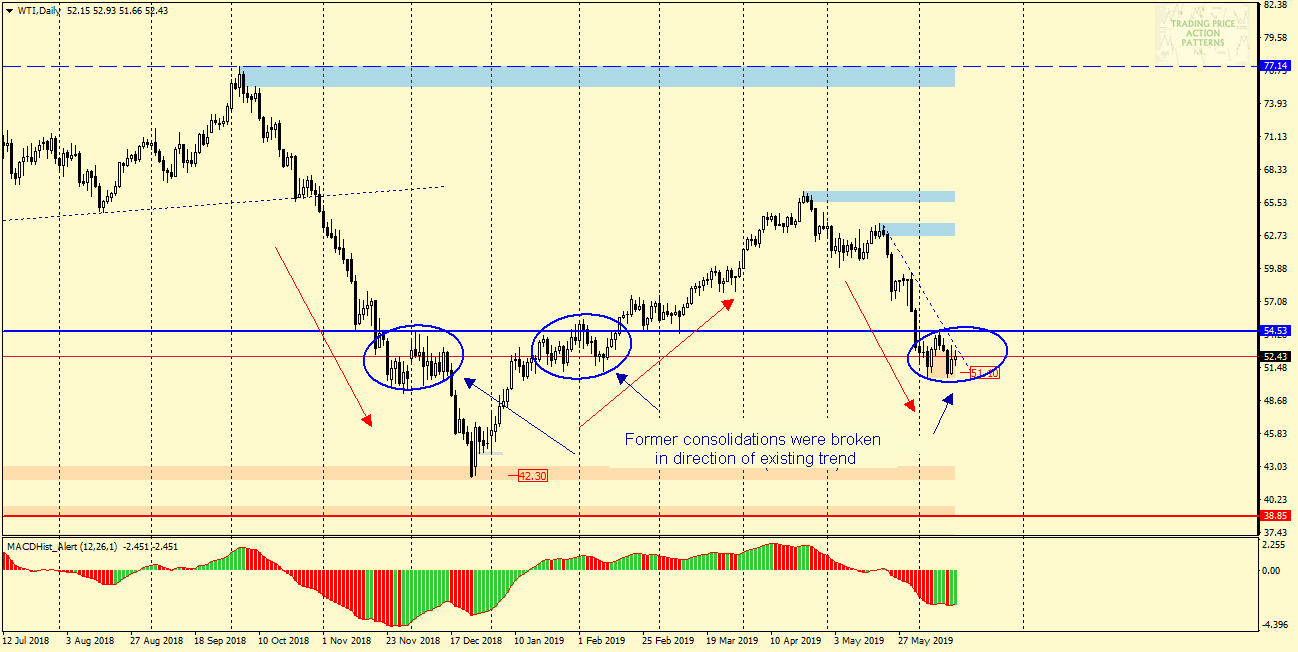

Let’s take a look at the situation of OIL from the technical point of view. Looking at the Daily chart, we can see that the price is in the consolidation zone, where such formations have already occurred several times. Breakout from former consolidations usually was in line with actual trend.

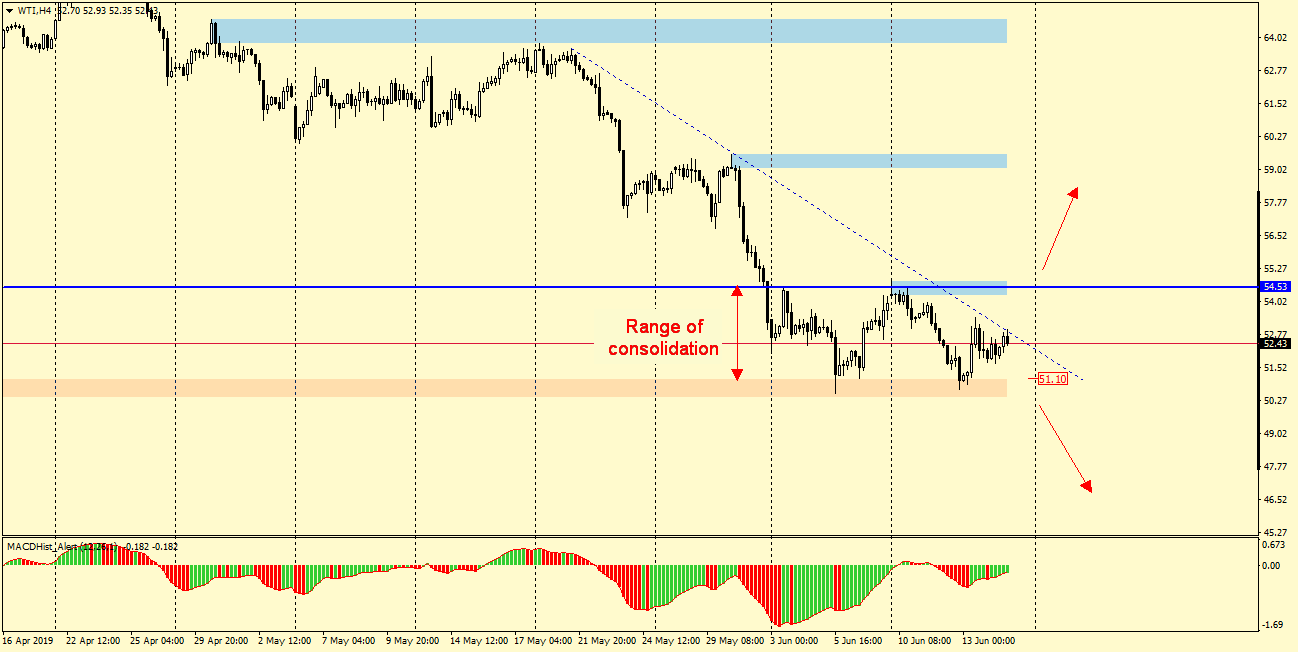

When you look at the H4 interval chart, you can see that the price on Friday reached the local downward trend line and is at the same time in the middle of the consolidation. The direction for the upcoming sessions will probably be determined by the direction of the breakout from consolidation, if history is to repeat itself, it will be in the south direction. It is worth to wait until the breakout is confirmed and join the impulse only after overcoming the consolidation boundary.

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities