Hack attacks don’t die from old age, they die from upgrades.

Over the past 48 hours, tens of thousands of computers have been affected with a new ransomware called Petya. ATM machines in Kiev, the Chernobyl nuclear facility, the major shipping conglomerate Maersk, and yes, even the Cadbury chocolate factory in Australia all fell victim to Petya.

Just like the WannaCry virus at the beginning of the month, infected systems are encrypted and the user is asked to pay a small amount of Bitcoin in order to unlock it.

Petya is essentially WannaCry’s ugly child. The virus takes advantage of a flaw in Microsoft Windows that was exposed when a group of hackers revealed some secret tactics used by the NSA. The flaw was patched by Microsoft in March but it seems many people and companies haven’t upgraded in a while.

So please, for the love of Pete, don’t blame bitcoin for this, blame negligent IT teams who hit the snooze button when they heard about the NSA file dump and still refused to wake up when they read about WannaCry. Get with the times and do your job.

–Mati Greenspan

eToro, Senior Market Analyst

Today’s Highlights

- Super Mario Killed Deflation

- The way of the Dollar

- Is it time to buy the dip yet?

Please note: All data, figures & graphs below are valid as of June 28th. All trading carries risk. Only risk capital you can afford to lose.

Market Overview

There has been lots of talk from central bankers yesterday and even more today. Usually, these speeches are quite boring but every once in a while, they throw us a curveball.

President of the European Central Bank, Super Mario Draghi started some tidal waves yesterday morning by making a simple yet far-reaching statement…

Deflation has been a major issue around the globe for the past few years. Businesses and bankers like it when money loses its value over time. They enjoy most when the rate of inflation is just under 2%, so when money is gaining in value like it has been lately, this is a real “threat” that needs to be dealt with.

Their way of dealing with it is by printing more and more money until supply and demand start to drag down the value.

So our friend Mario’s statement above was taken by the markets to mean that the ECB may actually start to slow down their monthly printing regime.

The Euro really took off…

Later that day, in the United States, Draghi’s counterpart Janet Yellen followed up with an even more ridiculous statement.

Please excuse me for taking that statement with a truckload of salt.

Bye bye USD & Stocks

It’s not just me though. These bankers don’t seem to be fooling anybody. Stocks around the globe, especially in the tech sector, along with the US Dollar are taking some major hits.

The Nasdaq 100 fell 1.6% and most major indices around the world are talking losses of more than 0.5% over the past 24 hours.

Here’s a chart of the US Dollar index in freefall…

At this point, it is difficult to say how far this can go. At 1:30 PM GMT we have four central bankers speaking all at once.

On to Crypto

With the US Dollar (and the Japanese Yen) dropping like a stone it’s even making bitcoin look that much more stable.

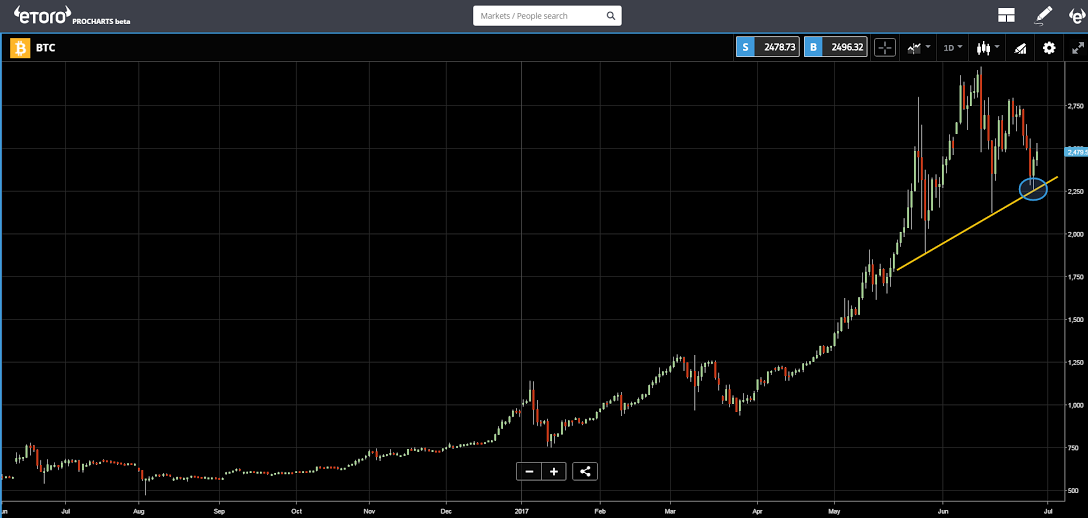

Of course, we always need to remember that cryptocurrencies are an incredibly high risk asset but for those of you who are currently waiting for a dip to buy in at, please pay attention.

Bitcoin indeed bounced off of her support line yesterday…

Does that mean the fall is over?

Not necessarily. Given the volatility of this market, I would not be surprised if it went all the way to $1900 before turning around, as Goldman Sachs predicted two weeks ago.

However, for those who believe that within the next 5 years we’ll get to a value of $10,000 it might be a good time to start putting in your entry orders.

Don’t even ask me about Ethereum. I have no idea where this is going in the long term or where it will settle. As far as short term trading goes, with small amounts and understanding the risk factor, there’s a lot of gains that can be made by playing the short term direction, IF you can read the momentum of the market.

Many thanks to all loyal readers of the daily market update. Very glad to hear that you’re enjoying my posts. Keep up the comments and feedback and I’ll keep on writing. 🙂

![Reltex Group Reviews: Explore business opportunities by Trading [reltexg.com]](https://comparic.com/wp-content/uploads/2023/12/image001-218x150.jpg)

![Mayrsson TG Reviews: Why Choose Crypto-Trading with Them? [mayrssontg.com]](https://comparic.com/wp-content/uploads/2023/12/image1-218x150.jpg)