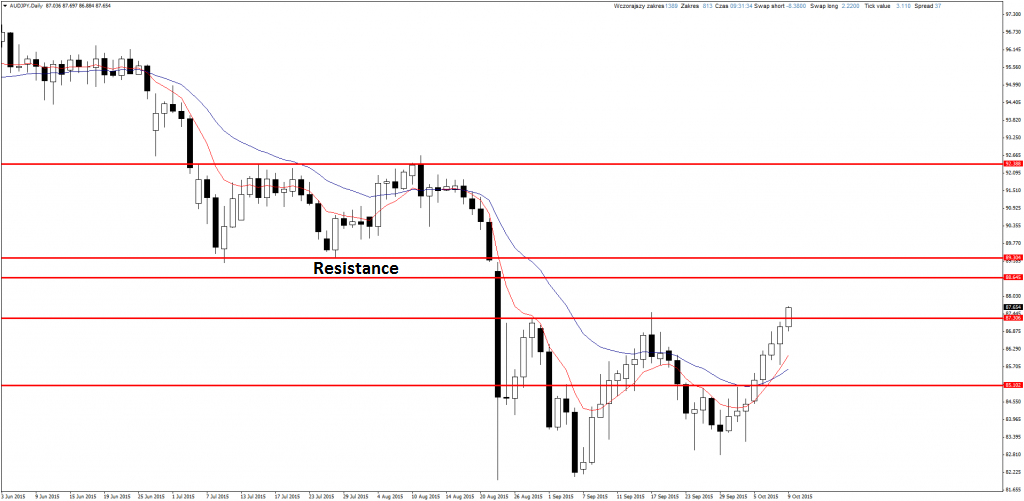

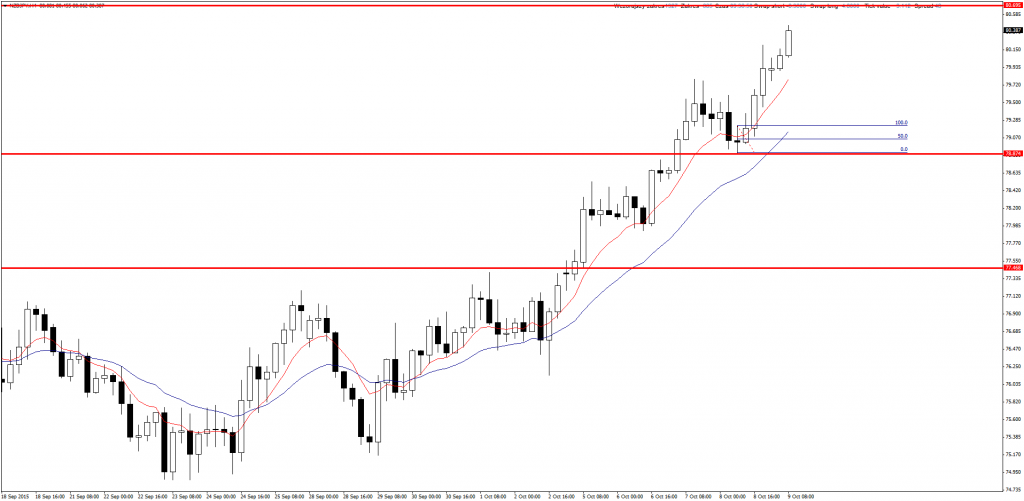

AUDJPY

This pair is an example of really good short, which was close to TP (+380 pips of profit with TP 400!) and came back to close on BE. Fortunately, 50% of position was close on profit, according to my system, so it is not so bad. However in the best moment equity was 20% higher than now.

Pair is breaking through resistance. If it will close above the sentiment will change and we can look for long positions after re-test of this level from above. If the price will come back, maybe there will be some sell signal.

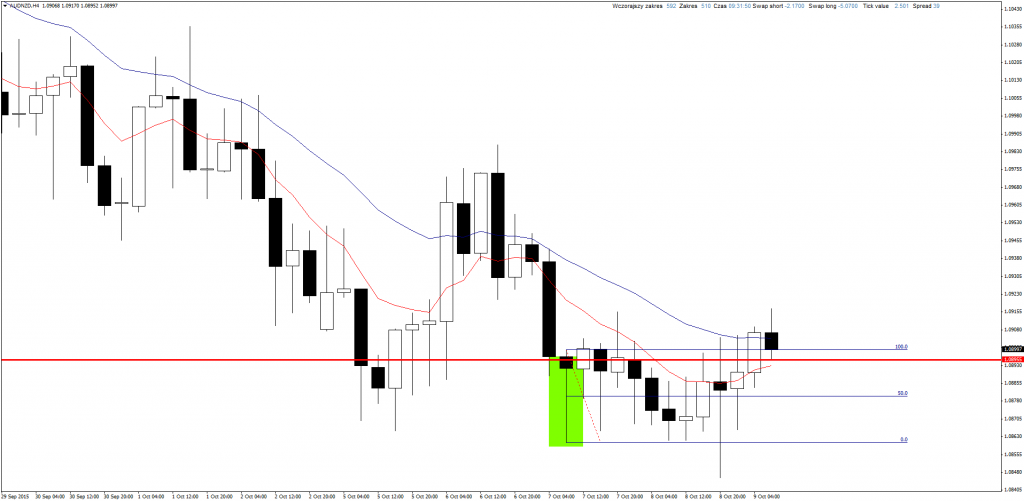

AUDNZD

First of my mistakes in today’s analysis. I entered after Pin Bar on H4 chart, when after these long decreases I should enter on D1, what I mentioned many times but I wanted to be more clever than market. As you can see I was punished so fast. Yesterday’s candle is a pin bar and on 50% retracement you can set buy order, SL is 40 pips and TP 400.

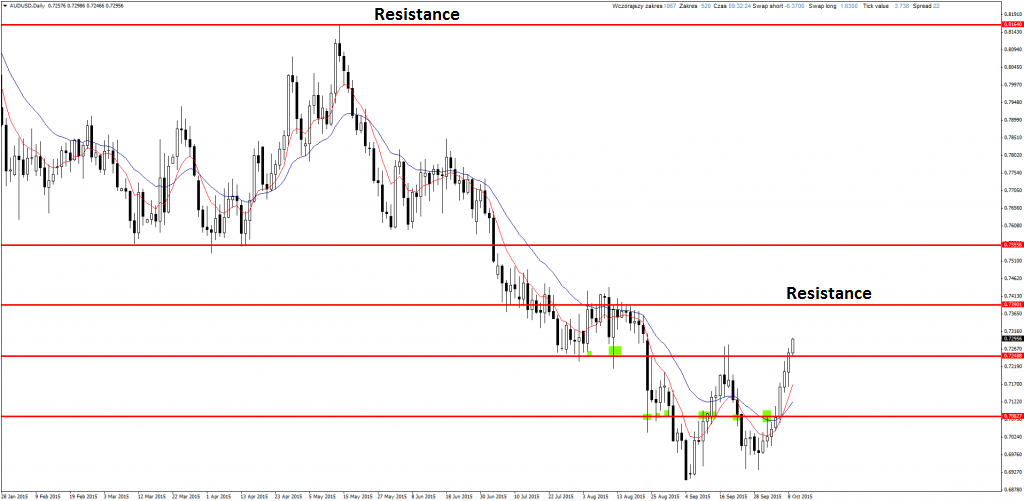

AUDUSD

On Aussie there is similar situation. If the price will close above resistance we will look for long positions on H4 chart, if price will drop we will look for short positions on D1.

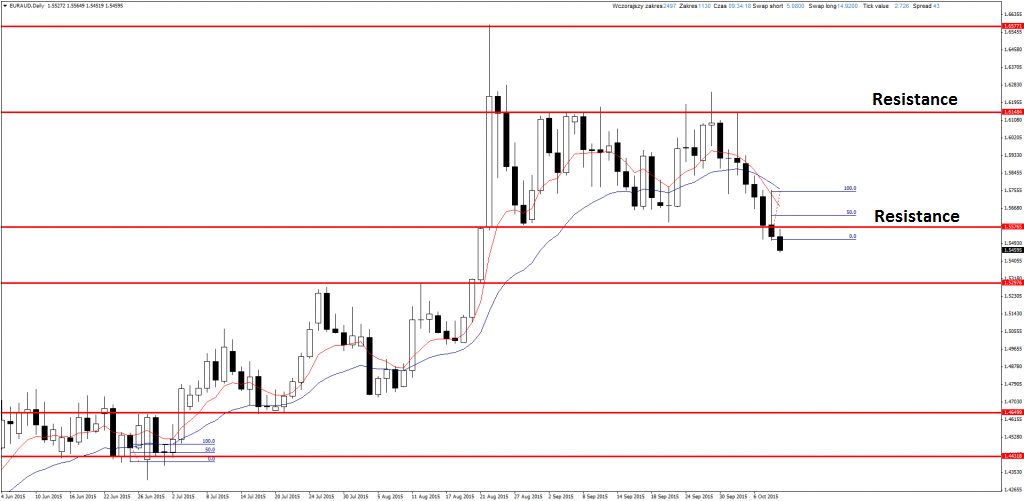

EURAUD

Another Stop Loss. Long position on H4 after 6 bearish candles. I should look for signal on D1, but it wasn’t there. Situation changed and there was sell signal yesterday. Sell Limit on 50%, TP near support. Transaction potential is small, just 2.5:1, but signal is strong and consistent with momentum.

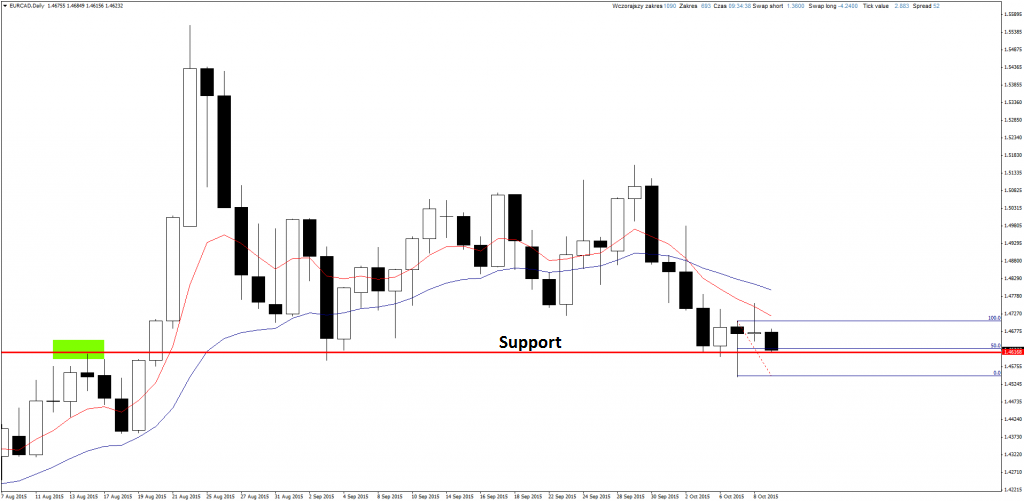

EURCAD

Here I opened long position. Correct buy signal on D1 chart on the support. We can still open it.

YOU CAN START USING PRICE ACTION AND INVEST ON FOREX MARKET USING FREE XM BROKER ACCOUNT.

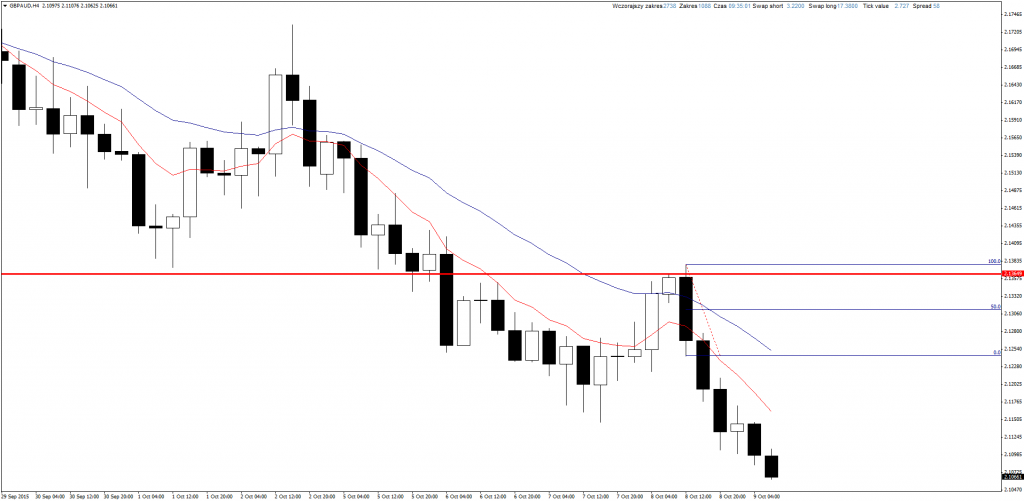

GBPAUD

Very nice sell signal created yesterday on this pair. Unfortunately there was no correction to 50% retracement of Outside Bar. Take a look on small white candle which reached resistance and another one engulfs it. Price went for more than 2.5x SL so I have to delete order.

GBPCAD

There is also correct sell signal – Outside Bar and rebound of Inside Bar. Order on 50% retracement of signal candle should be opened soon.

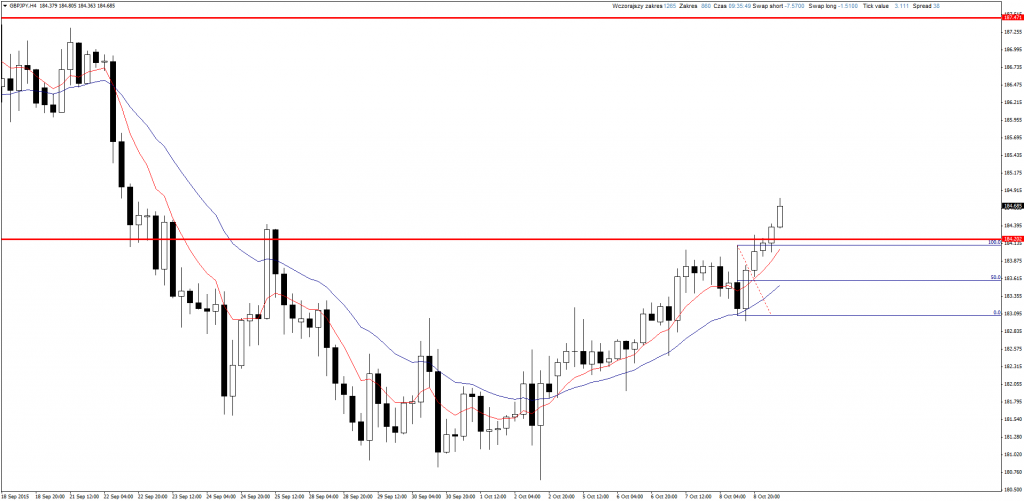

GBPJPY

Here I have biggest doubts if it is my mistake or just normal variance and bad luck. Considering series of bullish candles on D1 chart, I should wait for sell signal on D1.

Currently the pair is breaking resistance and there is similar situation like on AUDJPY and AUDUSD. If it will close above I will look for long positions. If not, probably there will be sell signal on D1.

GBPUSD

On Cable I don’t have any doubts. Bearish trend, strong correction and sell signal in form of Outside Bar. I have short position opened which ended with Stop Loss, but the play was consistent with trend. Now I will look for long position if there will be bearish correction, because yesterday pair closed above resistance. Maybe it isn’t perfect candle but it change situation on pair.

NZDJPY

This time some good news. Perfect signal after re-test on support of earlier resistance from above. SL 22 pips, position closed on 50% and TP on 130 pips. Profit/loss ratio 6:1.

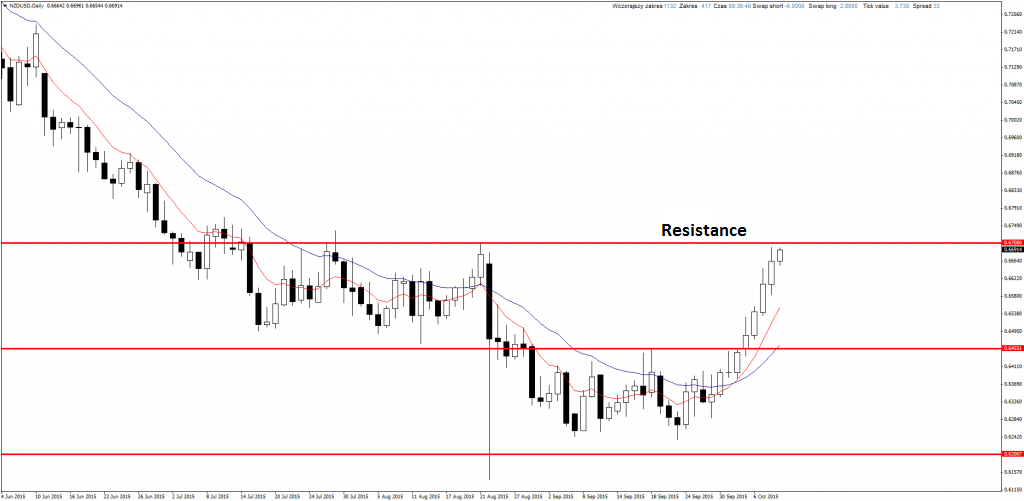

NZDUSD

Pair is getting close to resistance. If there will be sell signal (what’s important – and this is note to myself – on D1 chart!) we can consider short positions consistent with long term bearish trend.

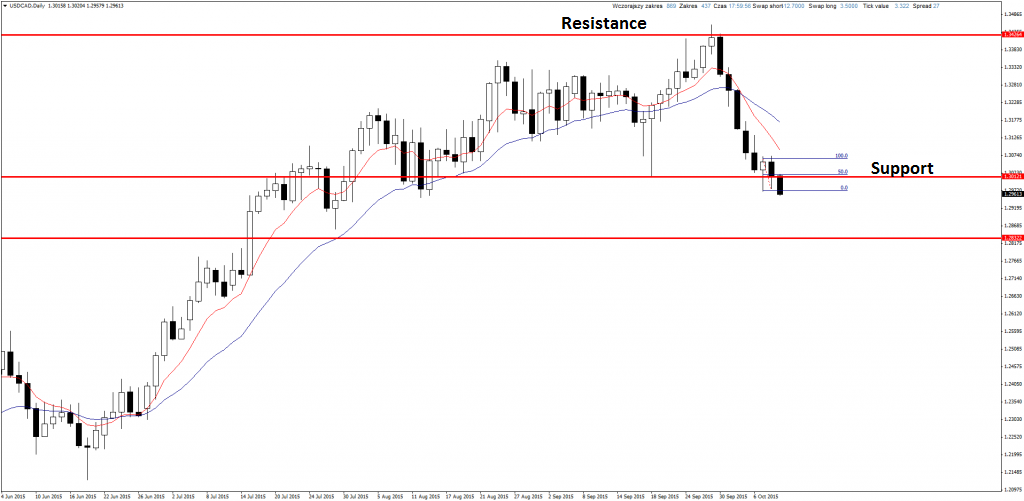

USDCAD

Another right signal ended with SL. Pin Bar candle on D1 chart however it was broken and price can go lower. I will stay aside and just look for long positions.