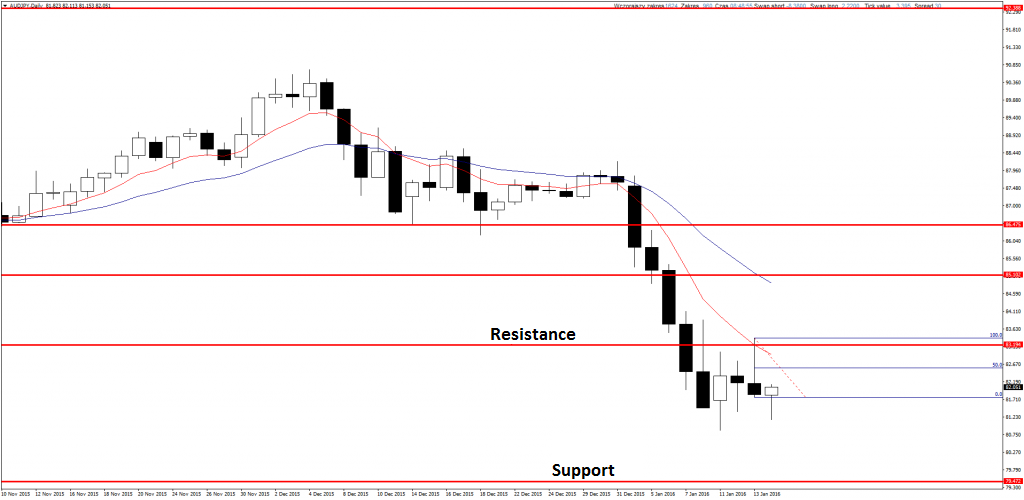

AUDJPY

Sell signal on this pair. Yesterday bullish correction showed up, it tested important resistance, but session ended with clear decrease and we could see nice Pin Bar. I set sell limit order on 50% retracement of it. Stop Loss is about 100 above yesterday’s high, Take Profit is 300 pips, right above closest support (79.50 area).

If you are interested in Price Action Strategy description, you can read it here.

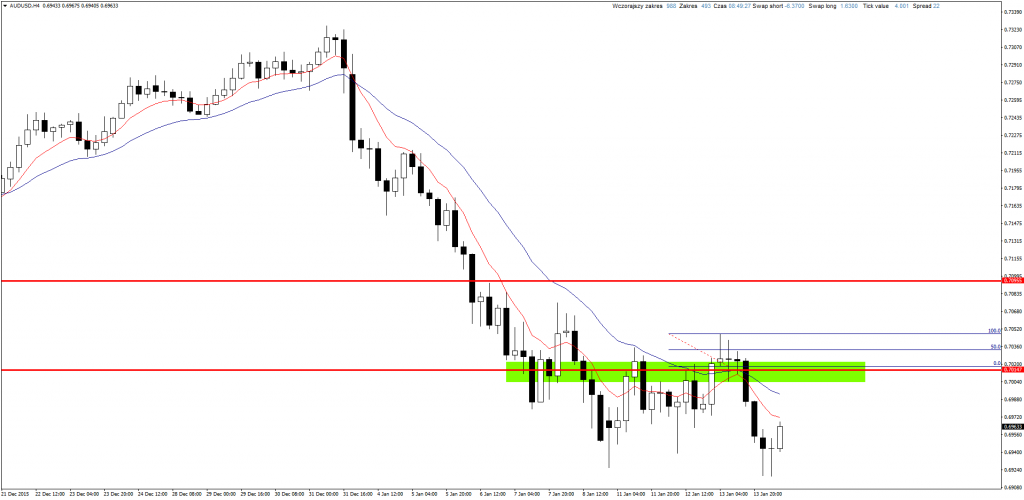

AUDUSD

Quick position from yesterday. I wrote about bearish Pin Bar on H4 chart and decided to use it. In the beginning price almost reached Stop Loss but then it decreased and realized Take Profit on support. Parameters of transaction – SL 25 and TP 90 pips.

YOU CAN START USING PRICE ACTION AND INVEST ON FOREX MARKET USING FREE XM BROKER ACCOUNT.

EURAUD

Another interesting transaction which also almost hit Stop Loss in the beginning. I opened long order after Pin Bar on H4 chart, a little lower than 50% retracement, I noticed it a little too late. SL was just 40 pips and TP was huge – 320 pips. It gives RR 8:1. This is how my account gained 15%!

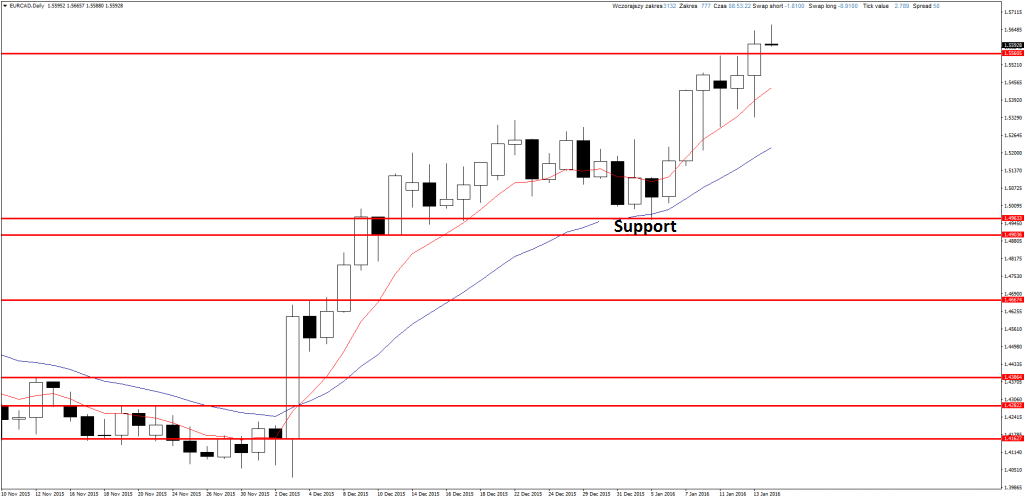

EURCAD

This pair broke above resistance and daily candle closed above it. Now it is worth to watch H4 chart and look for opportunity to open long positon during re-test of it.

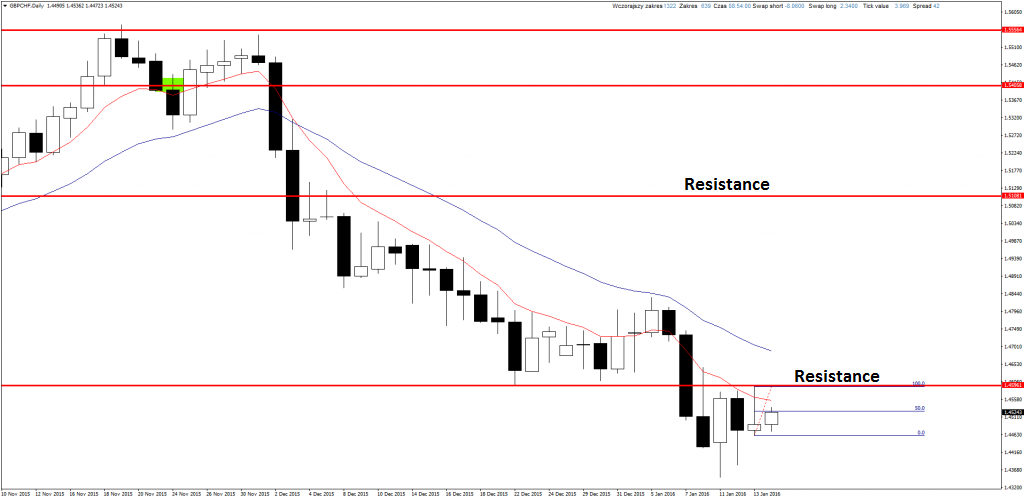

GBPCHF

Another sell signal on this pair. I already have short opened after big Pin Bar last Friday but you can enter position again, with smaller SL.

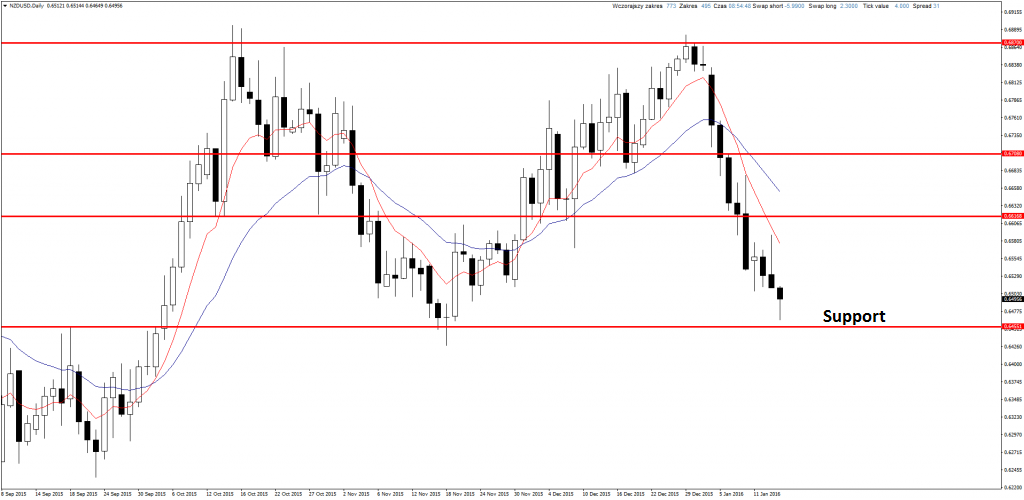

NZDUSD

Pair is moving in direction of support and if there will be any clear buy signal on daily chart I will consider opening long position.