AUDJPY

Pair broke key support and fell in direction of another. If there will be any bullish correction it will be great opportunity to open shorts consistent with the trend.

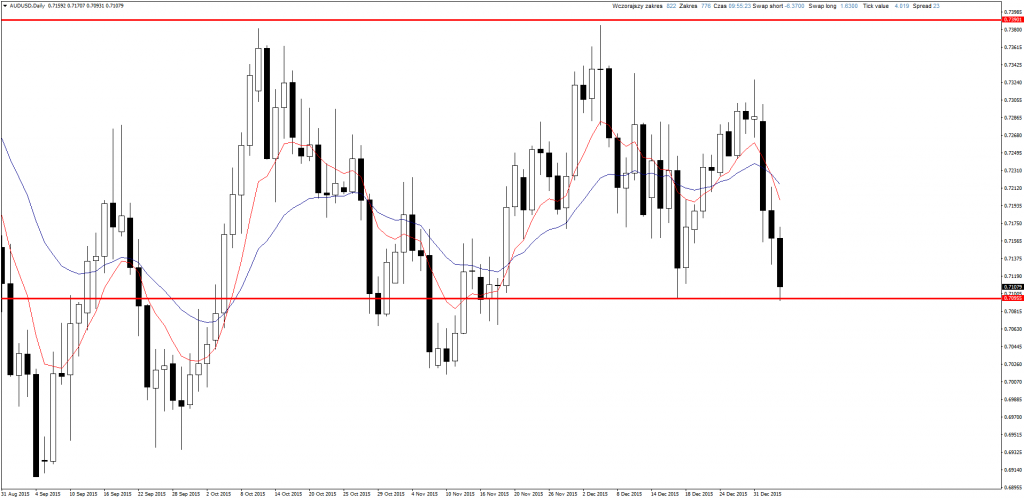

AUDUSD

This pair reached to the support too. Aussie is in steady bullish trend since August which should be assumed as a correction of earlier decreases. When we look at daily chart we can look for a chance to open long position, but we need buy signal on the daily chart because momentum is clearly bearish.

If you are interested in Price Action Strategy description, you can read it here.

EURCAD

Buy signal on this pair. Trend is bullish, but last sessions were full of decreases which brought the pair to the support. Here we can see clear Outside Bar signal. Bullish trend covers the bearish one before. I set buy limit order on 50% retracement of the signal candle and SL below its low.

YOU CAN START USING PRICE ACTION AND INVEST ON FOREX MARKET USING FREE XM BROKER ACCOUNT.

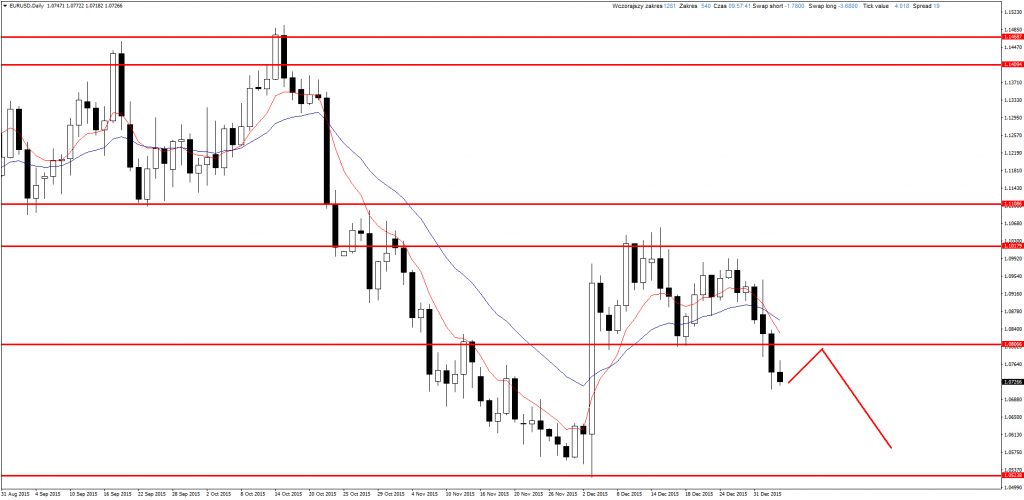

EURUSD

Eurodollar broke support and yesterday’s session ended clearly below, this changes sentiment to bearish. Now I will wait for bullish correction which will test support from below (now resistance) and after sell signal on H4 or D1 chart I will open shorts.

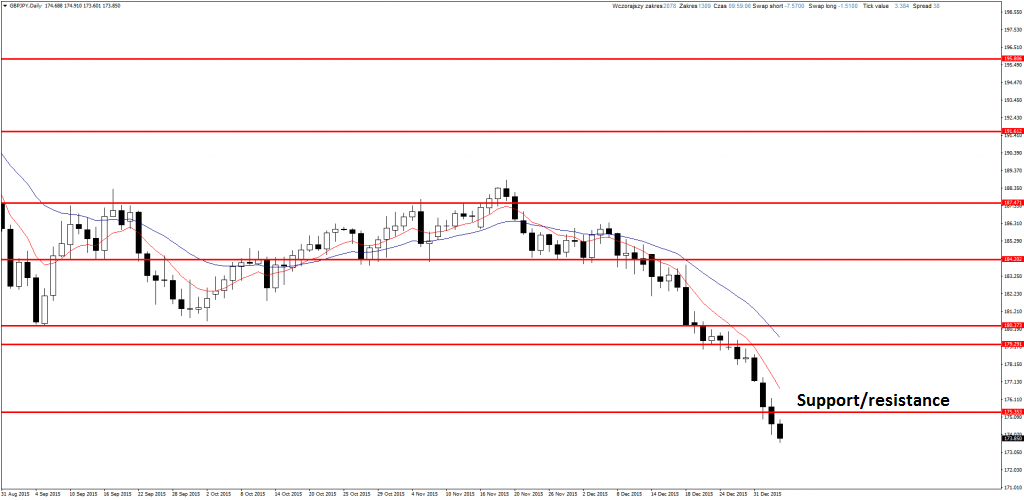

GBPJPY

Similar situation here. Support was broke, now it should become resistance. Another support is about 500 pips lower so potential is big. It is worth to wait for bullish correction and open shorts.

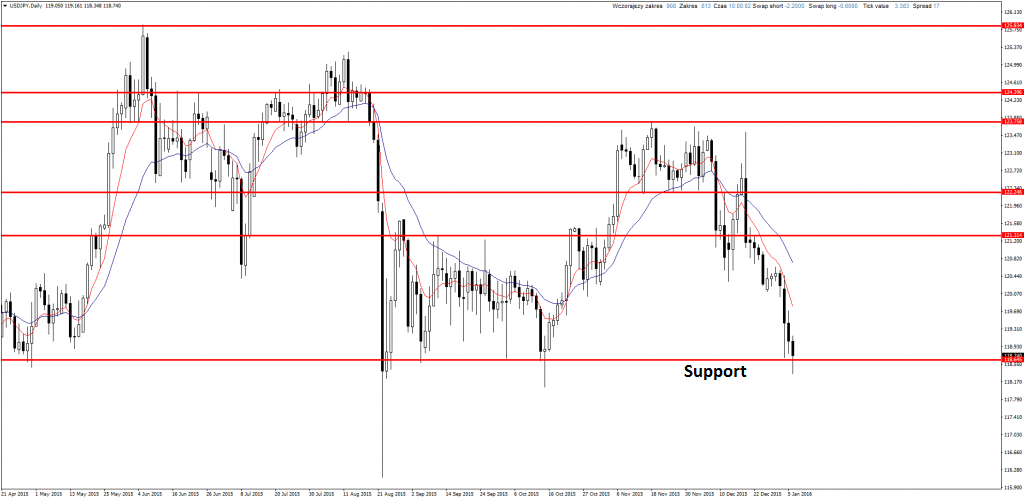

USDJPY

Support is still defended on this pair. If there will be some buy signal we can consider opening long position.