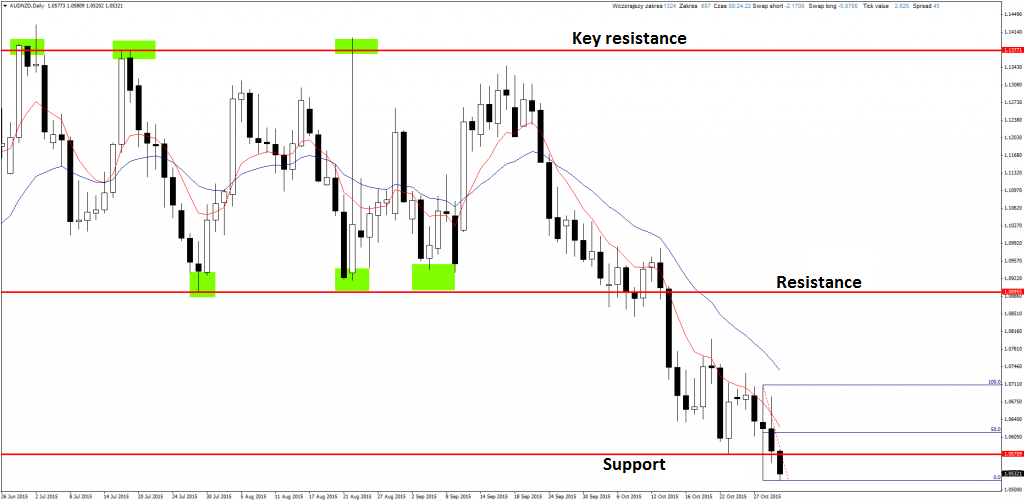

AUDNZD

Pair is testing Wednesday’s low and it looks like further decreases are just a matter of time. If decreases will be deepened and daily candle will close below support, it will be worth to look for short position.

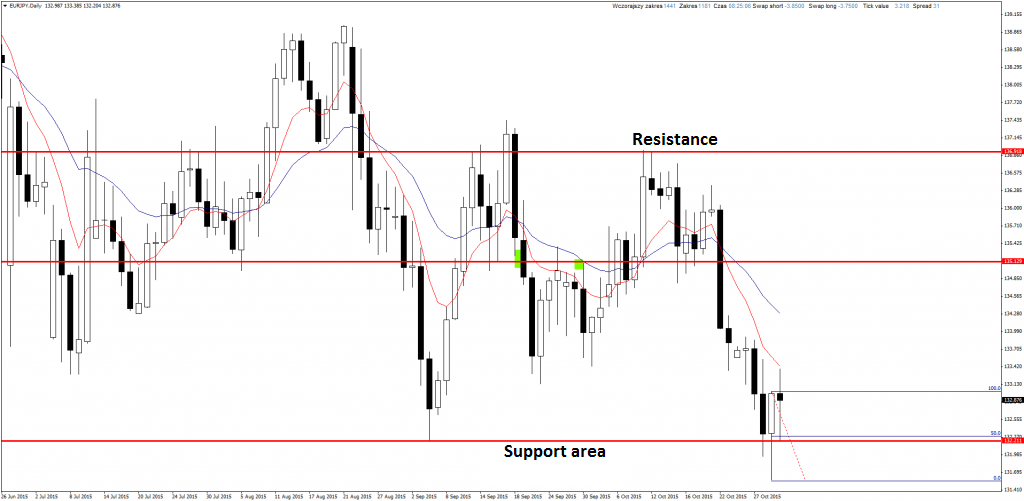

EURJPY

There is very large candle with long lower wick on this pair. We can assume that this is a Pin Bar and buy signal. However I have serious doubts if this signal can lead to test of resistance which is 200 pips above. Also I already have another position opened with yen.

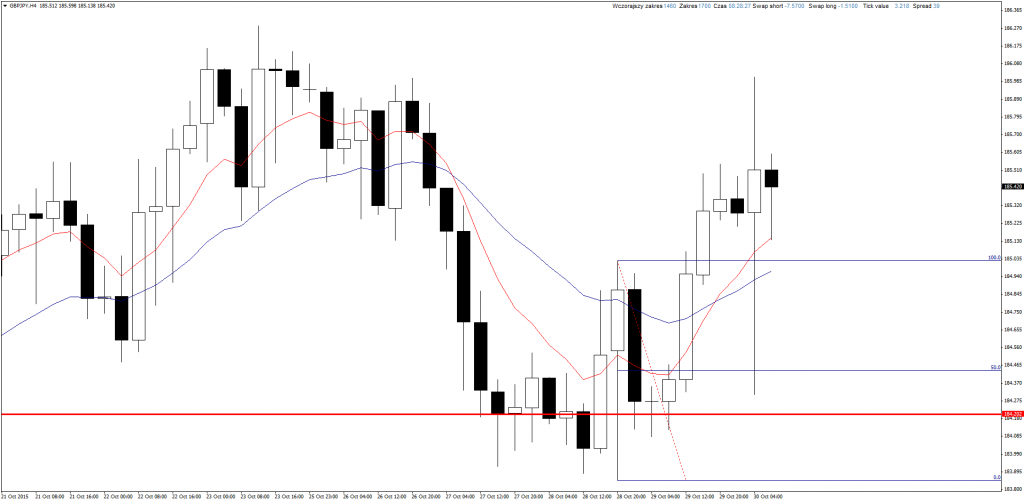

GBPJPY

I just noticed that on Wednesday there was buy signal on this pair. I hope some of you have opened this position because it already would be closed on 50%.

YOU CAN START USING PRICE ACTION AND INVEST ON FOREX MARKET USING FREE XM BROKER ACCOUNT.

NZDJPY

This is my opened position with yen. Practically from the beginning it is making profit and I just have to wait. TP is about 60 pips higher than current price.

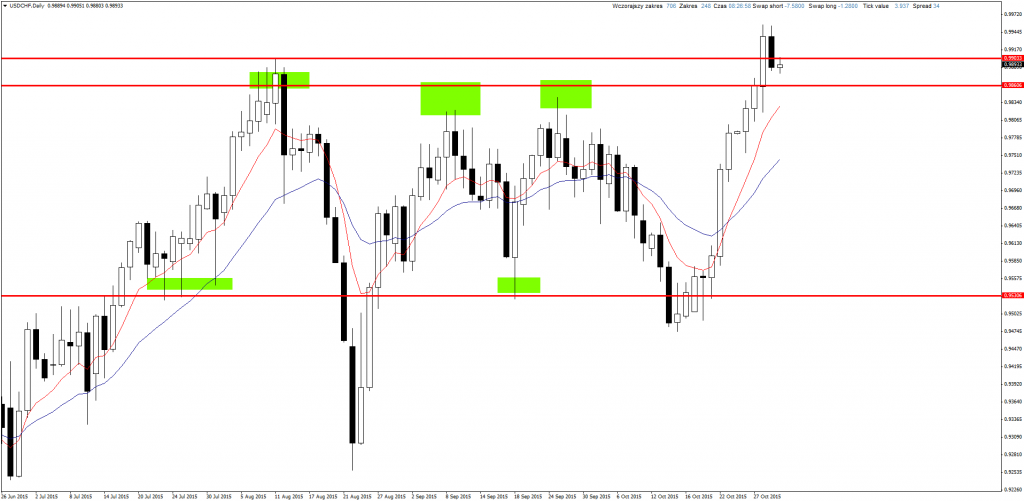

USDCHF

I wait for buy signal on this pair. Currently new support is tested from above (earlier it was a support) and if there will be any Price Action signal on H4 or D1 chart, I will open long position. Very similar situation is on GBPCHF.

If you are interested in Price Action Strategy description, you can read it here.

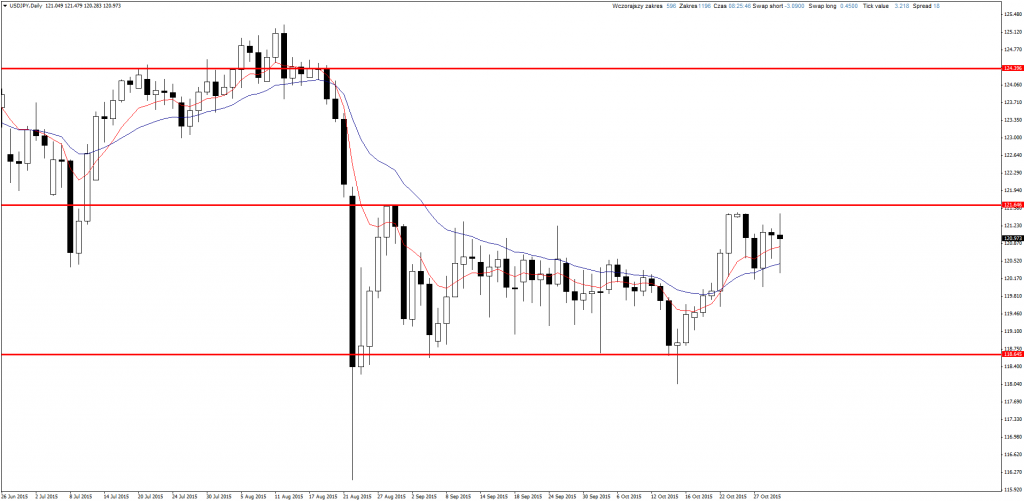

USDJPY

Pair is closed within consolidation and currently it rebounded from upper band. If there will be sell signal near it and RR will be at least 2:1 we can consider opening sell position.