I invite you to today’s PA setups review before the long weekend. Tomorrow most of the European markets are closed and it will have a huge impact on liquidity. On Friday, it may be very interesting as some trader probably will not return to trade – when we combine it with important data it may cause a lot of confusion. Here we go:

EUR/AUD:

Yesterday I wrote about the sale signal on this currency pair. After reaching the resistance EUR/AUD formed the pin-bar candle, which is one of the price action signals. Then, it was abolished in 50% which allowed to entry the position with about 15 pips SL. Currently, the positions is 140 pips in the green which gives a nearly 10:1 profit-to-risk ratio.

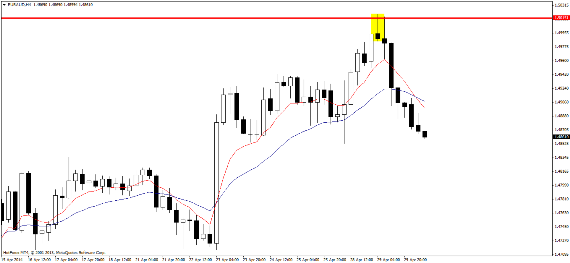

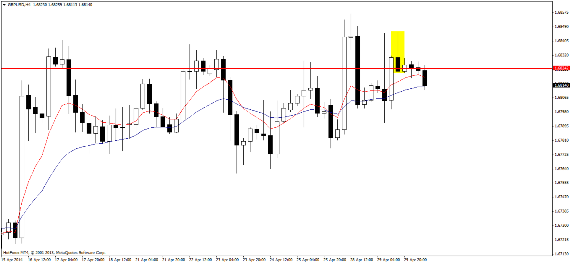

GBP/USD:

Cable is still unable to break the maximum and enter the new one, which has not been seen since 2009. On the H4 chart we saw a sell signal yesterday, which is marked in yellow. It must be remembered however, that the trend is strong, upward and it will be better to wait for correction and then search the long positions than playing against the market movements.

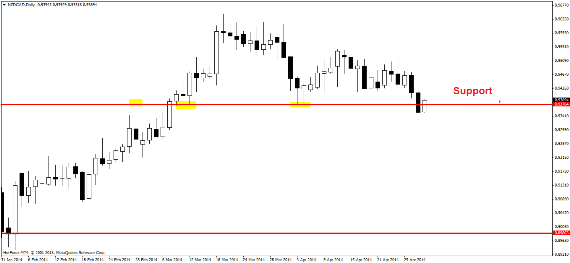

NZD/CAD:

Yesterday’s session ended up falling below a key support and today we should see, whether it is a false breakout (then we play long positions consistent with the trend direction) or a signal of a longer correction. If so, it will be worth to look for sell signals after test of 0,9376 level surroundings.

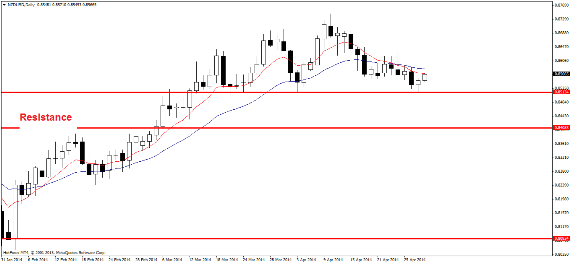

NZD/USD:

Kiwi being in an uptrend approached yesterday the support and rebounded. On the daily chart you can see the pin-bar candle. Such situation as always can be managed in three different ways:

-Buying after breaking the maximum, stop loss below the minimum,

– Buying after breaking the maximum, stop loss below the 50% of candle’s abolition (better risk/reward ratio than in the first case – where the likelihood of losses is greater),

– Buy limit on 50% of candle’s abolition, stop loss below the minimum. Better risk/reward ratio than in the first case and safer SL than in the second one. There is still a risk of lack of correction – in that scenario we will be out of position and just observing the developing trend.