Yesterday macro calendar was empty, so previous session did not bring anything fascinating. Today, situation changes significantly – there are lots of readings and also potential setups on most popular currency pairs and crosses.

EUR/AUD

Cross touched a key support 1.4100. If long-term uptrend wants still to be active, price should react to this very level. It is important zone, thus Price Action purchase signal may be used to open long positions. Yesterday’s daily candle may be considered as pin-bar. In that case we have three ways of trading such setup:

- Purchase after breaking above maximum, SL below minimum,

- Purchas after breaking above maximum, SL below 50% retracement of a candle (better RR ratio than in the first case),

- Buy limit at 50% retracement of a candle, SL below minimum. Better RR ratio than in the first case, and safer SL than in the second one. But there is still a risk that market will not correct the price and we will be left without a position in developing trend. Personally, I prefer this method – so I activate buy limit order at 50% retracement of this candle.

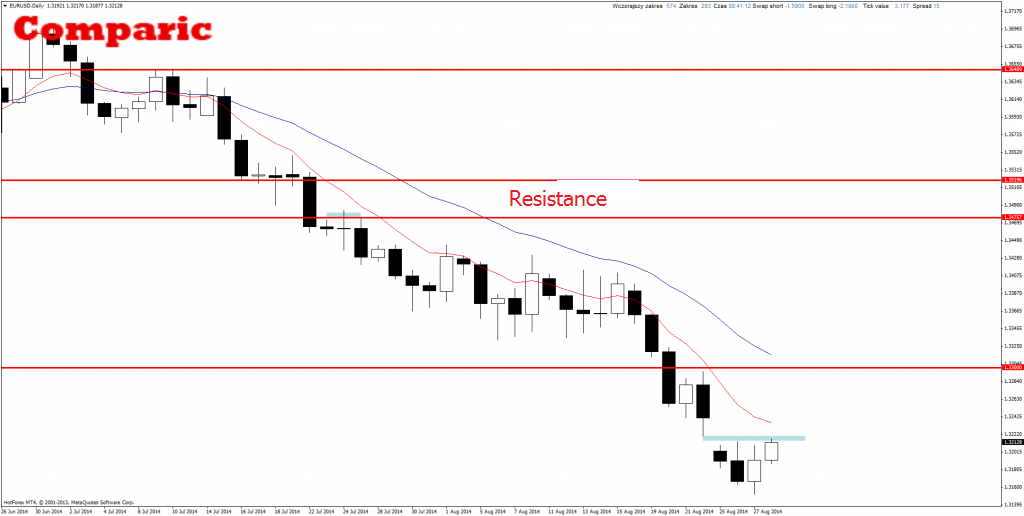

EUR/USD

Single currency to American dollar approached an interesting demand zone. It is interesting due to its untypical form when it comes to Forex trading. Weekend gaps – which would not involve the scope of Friday’s candle appear very rarely recently, so it is an unusual situation. On the daily chart we can see a narrow rectangle, that covers closing of the gap. It will form the resistance and another sale may start there. Because there is no doubt that EUR/USD is in a strong downtrend.

GBP/AUD

Cross stopped near very important support level. Price on the H4 timeframe clearly reacted to it and now we can consider long positions – activating at support 50% retracement. Such position may be riskier than setup on daily TF, but risk/reward here is really big.

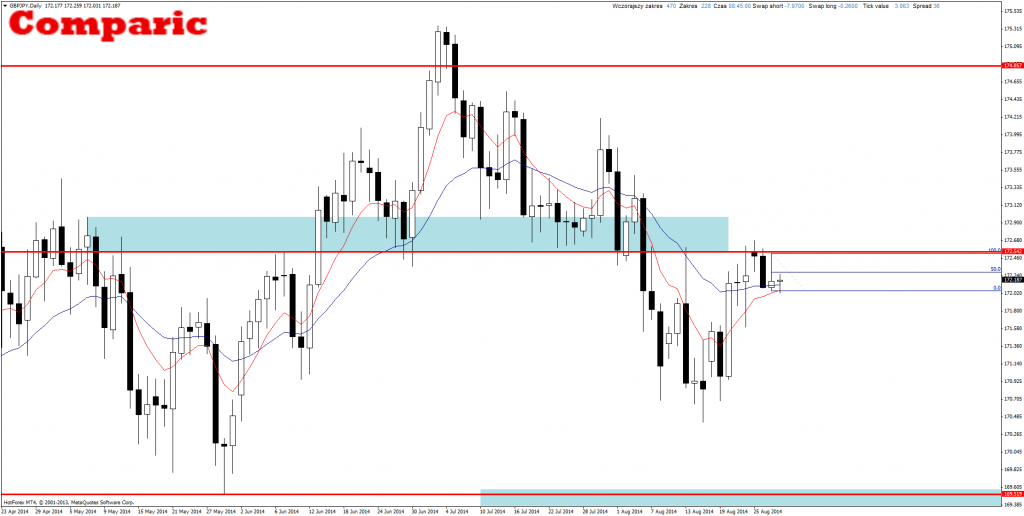

GBP/JPY

Price reacts to resistance and inside pin-bar candle formed yesterday. This setup may be traded in three different ways:

- Sale after breaking minimum, SL above maximum,

- Sale after breaking minimum, SL above 50% retracement of a candle (better RR ratio than in the first case),

- Sell limit at 50% retracement of a candle, SL above maximum. Better RR ratio than in the first case, and safer SL than in the second one. But there is still a risk that market will not correct the price and we will be left without a position in developing trend. Personally, I prefer this method – so I activate buy limit order at 50% retracement of this candle.

Stop loss should not overpass 30 pips here, so event targeting the last minimum, risk-to-reward ratio will be around 4-5:1.

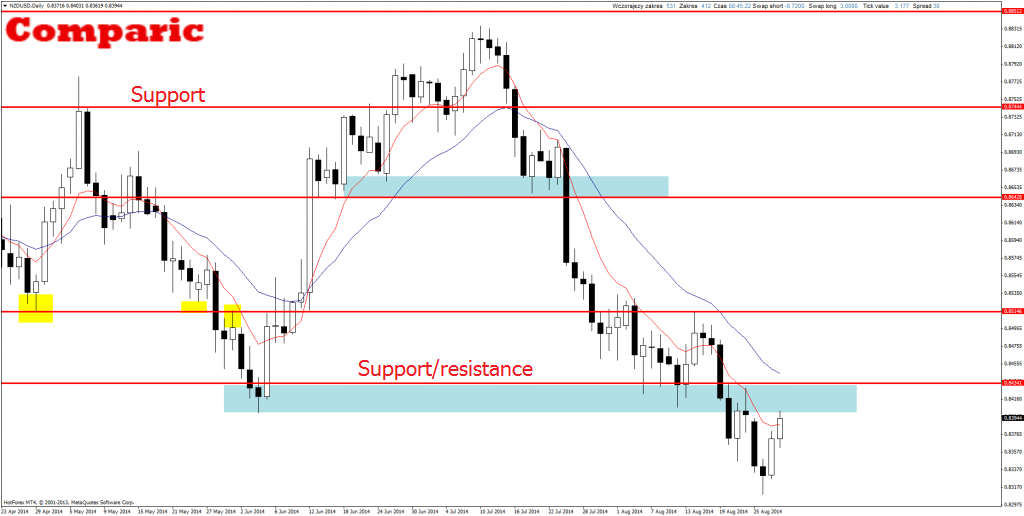

NZD/USD

The last pair for today is Kiwi, which is now in dynamic downward trend. Currently there is an upward correction, which approaches the previous support (now it may act as resistance). If any signal shows in the blue-marked zone, it will be worth to consider long positions. Such signals are one of the best, because they appear after pole change (support to resistance) and are consistent with mid- and short-term trend.