Markets are quite interesting nowadays. The yesterday FOMC statement maybe did not show anything spectacular, but few currency pairs are approaching key levels and they might give position-opening signals. Let’s take a look at AUD/USD, EUR/JPY, GBP/USD and USD/JPY.

Markets are quite interesting nowadays. The yesterday FOMC statement maybe did not show anything spectacular, but few currency pairs are approaching key levels and they might give position-opening signals. Let’s take a look at AUD/USD, EUR/JPY, GBP/USD and USD/JPY.

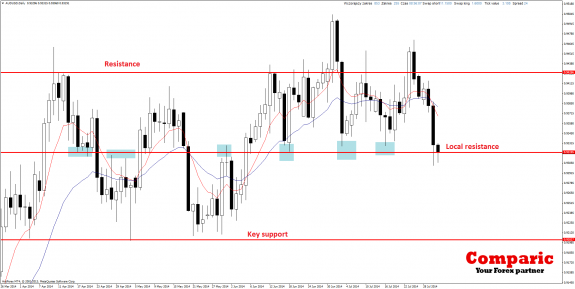

AUD/USD:

Aussie fell to the important support, which few times in the past stopped downward movements – historically it worked also as a resistance. It may be a great opportunity to open long, trend-following positions. Observe the pair and look for price action purchase signals.

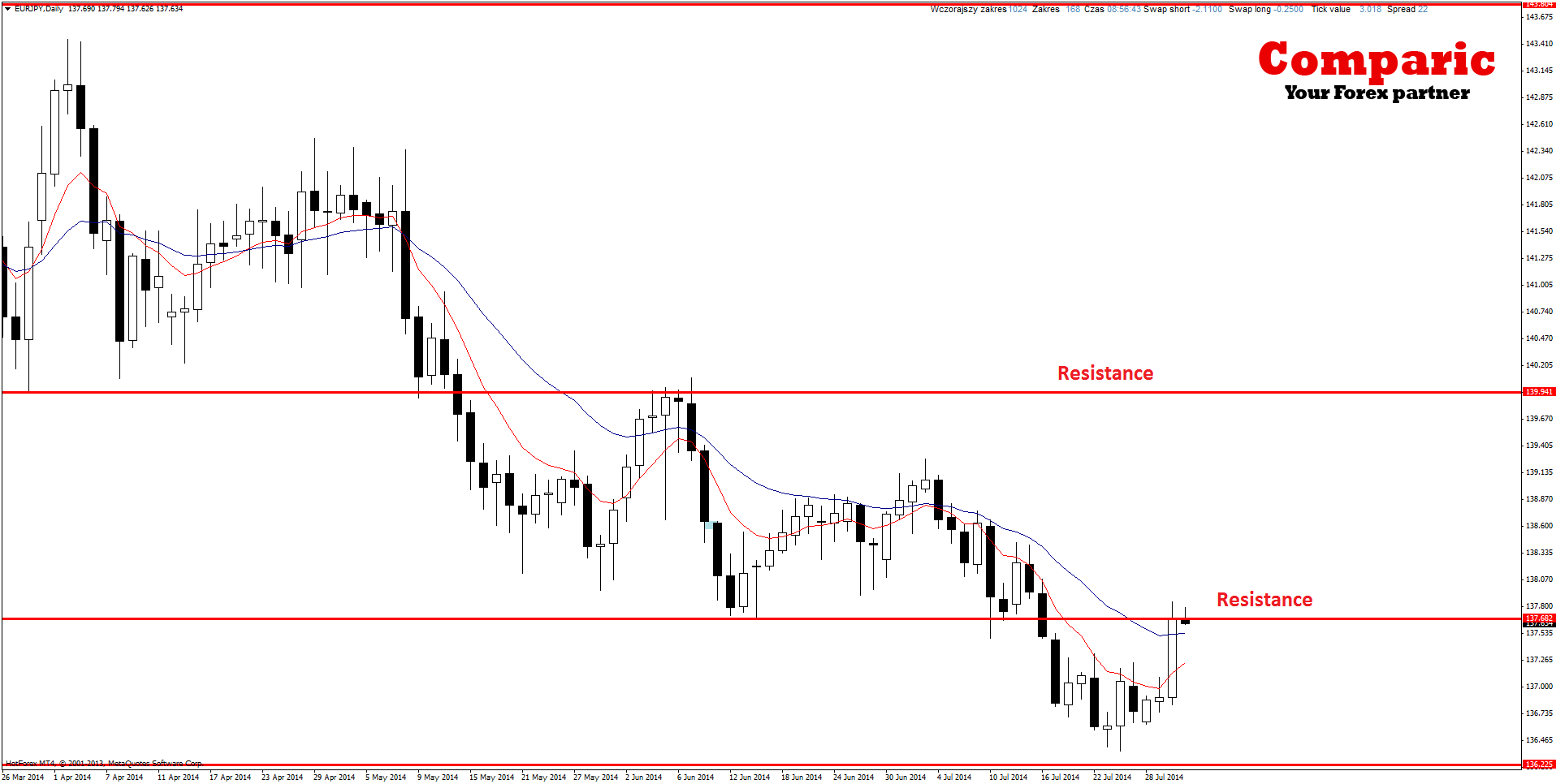

EUR/JPY:

Yesterday cross rallied and reached a resistance (which earlier functioned as support). If PA sell signals occur in the vicinity of this area it will be possible to consider short positioning.

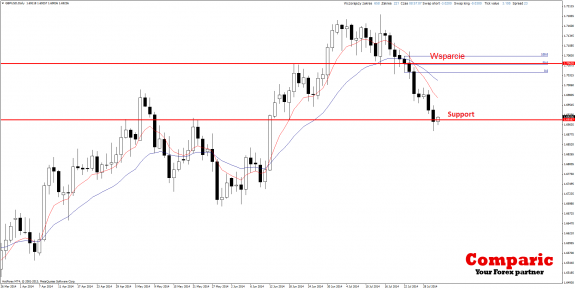

GBP/USD:

Cable yesterday also catch a key zone – which may stop the further slippages. Currency pair is in a dynamic upward trend, so long positioning looks like the best option currently. Of course to open them, we firstly need some buy signal.

USD/JPY:

Ninja generated a really long (100 pips) daily candle (which normally on this pair is rather rare). It took the dollar vs yen near important resistances. The next key level draws itself in the area of 104.00 and it may be short-term goal for USD/JPY. Currently there is ongoing resistance re-test from the top which may give an opportunity to consider long positioning.