Markets still are quite interesting. Investors slowly come back to their trading desk, and holidays are becoming just a memory. Lots of pairs are in worth-to-look places and may give position opening signals. In today’s Price Action setups preview you can find:

EUR/AUD

After buy signal from Monday (clear pin bar candle), today price tested vicinity of recent minimum, however did not break below. Traders with buy limit orders on 50% retracement of before mentioned candle are still in the position. Rate is little bit higher than the entry point, so there is still an occasion to consider potential buying. However, there is a downtrend, so such position may be quite risky.

EUR/JPY

Pair rebounds from key resistance. Downward trend and quite strong level which can be seen due to number of earlier bounces. It is worth to look for entry signals at lower TF (e.g. H4).

GBP/JPY

Another situation on the next yen cross. Here the trend is upward, price broke above the resistance and test it from the top. It may be a great opportunity to play long – position is consistent with recent momentum and the general situation on the pair.

GBP/USD

Cable stopped on the support and before yesterday session consolidated around it. If clear buy signal shows, we will consider long positioning – remembering however, that it is against strong, downward momentum.

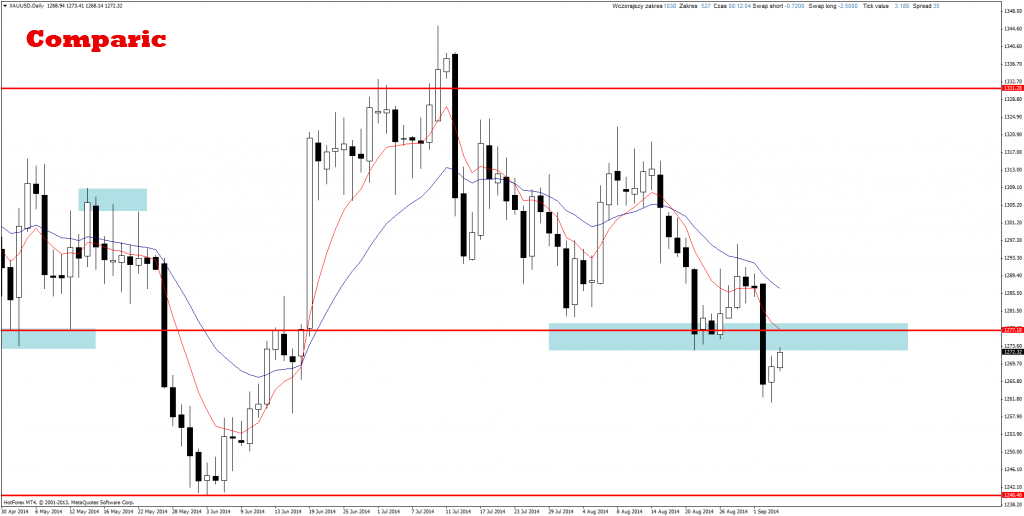

XAU/USD

Gold after breaking key support zone is in ongoing upward correction. Testing the previous support (now resistance) with simultaneous appearance of Price Action sell signal, will be a great occasion to open short positions, which are consistent with ongoing mid- and long term.