Daily Forex Market Preview, 09/08/2017

The US dollar continued to post some gains yesterday across the board. However, the gains were limited with the Japanese yen staying firm. The gains in the yen came about due to ongoing escalating tensions from North Korea which kept investors appetite in check.

The US President Trump, in response to North Korea’s actions, said that the United States would respond with “fire and fury.” The economic data released yesterday included the German trade balance data which widened more than expected. Earlier today, inflation data from China showed that consumer prices rose 1.4% on the year. This was less than the forecast of a 1.5% increase. Producer prices index was also seen rising at a softer pace of 5.5%

Looking ahead, the markets will be focusing on the RBNZ’s meeting coming up later this evening. No changes are expected to the interest rates at today’s meeting. Canada will be releasing the building permits figures.

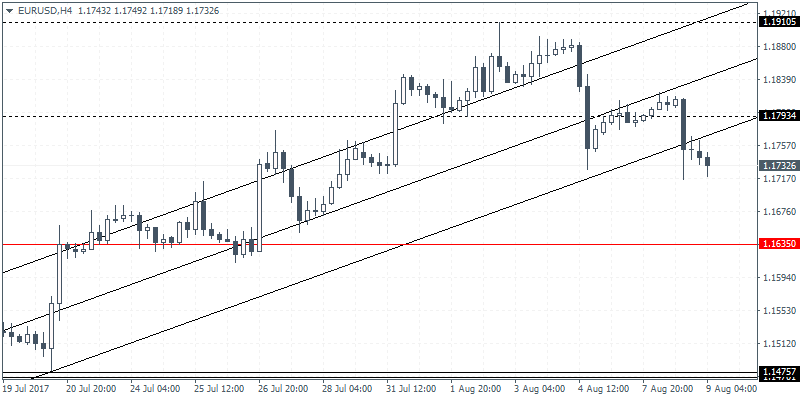

EURUSD intraday analysis

EURUSD (1.1732): The EURUSD closed bearish yesterday after price action formd an outside bar. A continued decline in the currency pair coould see further downside being confirmed. The brief reversal to 1.1793 saw price action break down strongly. Support is seen at 1.1635 currently which remains the strong downside target in prices. To the upside, any reversals will once again be met with the resistance at 1.1793. Any upside in the currency pair will need to see price action break past this resistance level.

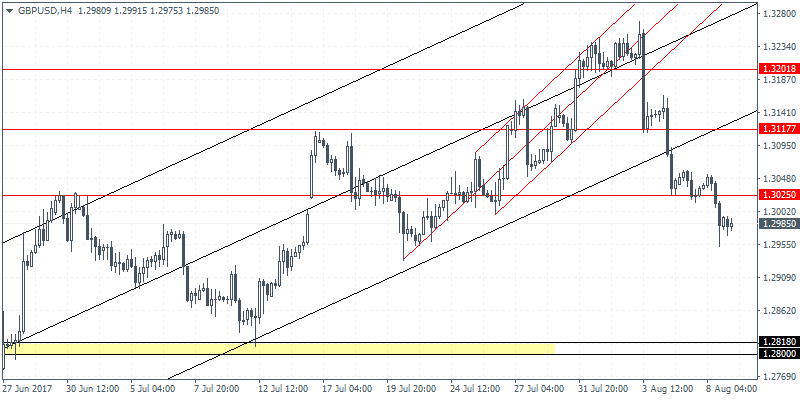

GBPUSD intraday analysis

GBPUSD (1.2985): The British pound closed on a bearish note below 1.3025 level of support yesterday. This would suggest further downside in the cable. In the near term, we can expect to see price action consolidate near the resistance level at 1.3025 which could be tested. The next main support for GBPUSD comes in at 1.2818 – 1.2800. This would mark a strong decline in the currency pair. So far, price action in GBPUSD has been falling in a step fashion. Resistance levels are seen at 1.3025 and 1.3177.

Above article was provided by Orbex – Serving Traders Responsibly. Check the trading conditions and open your own account.

The Latest News covering forex, commodities, and indices in addition to exclusive CFD and forex trading opportunities identified by the Orbex research team

USDJPY intraday analysis

USDJPY (109.81): The USDJPY failed to breakout past the 110.80 resistance level. This resulted in some downside in prices. Currently, USDJPY is seen retesting the previous lows formed near 109.85 levels. This is a support level that was previously tested. We could, therefore, expect to see some reversal at this support level followed by an upside move in prices. However, in the near term, USDJPY could remain range bound within 110.81 and 109.85 levels of resistance and support.