Daily Forex Market Preview, 10/08/2017

The Japanese yen, the Swiss franc and gold prices were supported as investors flocked to the safe haven assets. This comes amid mounting tensions between the United States and North Korea. Still, despite the gains, the US dollar was seen managing to maintain its gains from the previous days.

On the economic front, the RBNZ’s monetary policy meeting yesterday saw the central bank holding the OCR unchanged. The central bank decision was widely in line with economists’ forecasts. The RBNZ’s decision saw the Kiwi give up some of the gains.

Looking ahead, the economic data today includes the UK’s manufacturing, industrial and construction output data. The median estimates suggest a recovery in most of the sectors. The US producer prices data is also expected today, and the forecasts show a 0.1% increase on a monthly basis.

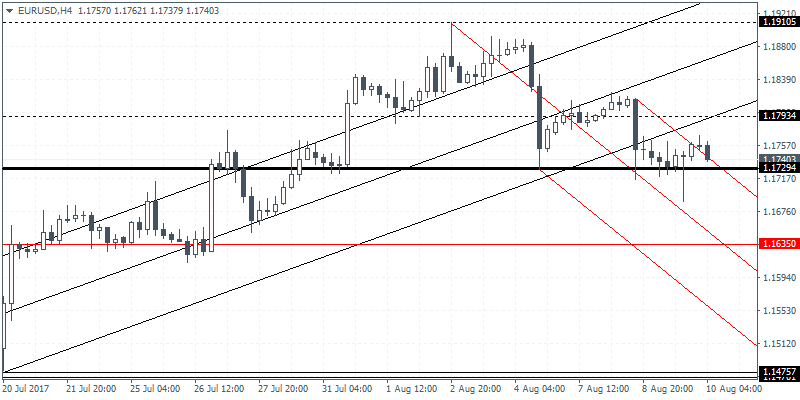

EURUSD intraday analysis

EURUSD (1.1740): The EURUSD touched an eight day-low yesterday before prices pulled back to close near the day’s open. The pullback in prices coincided with price action bouncing off the support level at 1.1730. A break down below this support level is required for the EURUSD to post further declines. The next support level that will be tested is 1.1635. Further downside in prices can be expected in the near term below 1.1635. The current support level at 1.1730 is likely to be tested on a rebound off 1.1635. If resistance is established here, then we can expect further downside although EURUSD could remain range bound between these levels in the near term.

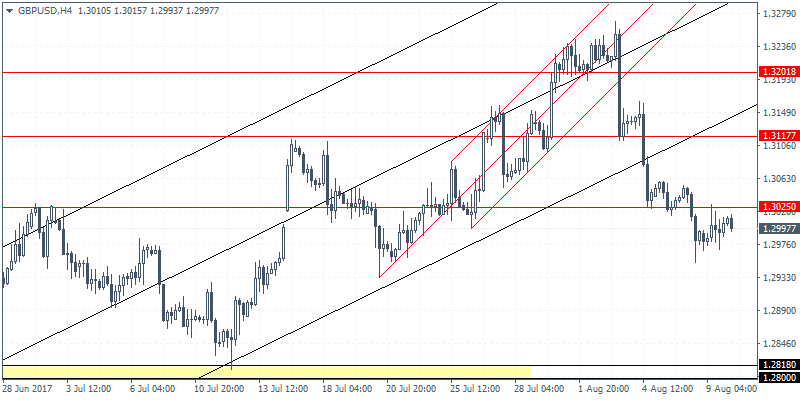

GBPUSD intraday analysis

GBPUSD (1.2997): The British pound briefly retested the resistance level at 1.3025. We could expect some consolidation around this level in the near term although the bias to the downside is quite clear. Support at 1.2800 is the likely target to the downside. In the event that GBPUSD rises above 1.3025, then we could expect a retracement towards 1.3117. Still, the bias is to the downside. This is likely to change only on a continuation of the rally above 1.3117.

Above article was provided by Orbex – Serving Traders Responsibly. Check the trading conditions and open your own account.

The Latest News covering forex, commodities, and indices in addition to exclusive CFD and forex trading opportunities identified by the Orbex research team

USDJPY intraday analysis

USDJPY (110.01): The USDJPY continued to trade within the range of 110.80 where resistance has been formed and the support at 109.58. The sideways price action does signal a near-term breakout off these levels. Price action so far suggests a sideways movement on the daily and higher time frame charts. The falling trend line will be a key indicator as USDJPY is showing signs of turning flat near the support of 109.85. An upside breakout from the trend line could see further gains back to the resistance level of 110.81.