“Search, Analyse, Trade” is a series of Price Action and Elliott Waves analyses. Its detailed step-by-step description can be found over here. I invite you to today’s review of selected currency pairs and potential trading opportunities. The analyses are based on the Dukascopy sentiment that you can get here.

“Search, Analyse, Trade” is a series of Price Action and Elliott Waves analyses. Its detailed step-by-step description can be found over here. I invite you to today’s review of selected currency pairs and potential trading opportunities. The analyses are based on the Dukascopy sentiment that you can get here.

The last consolidation just under resistance on the EUR/USD turned out to be the fourth wave of the third wave of the last upward movement. The pair on the basis of the of the fifth wave of the third defeated the key resistance zone and reached the vicinity of another resistance, which is a line drawn through the lows on the monthly chart. I expect a supply reaction in these areas and construction of a fourth wave of the movement started in November last year.

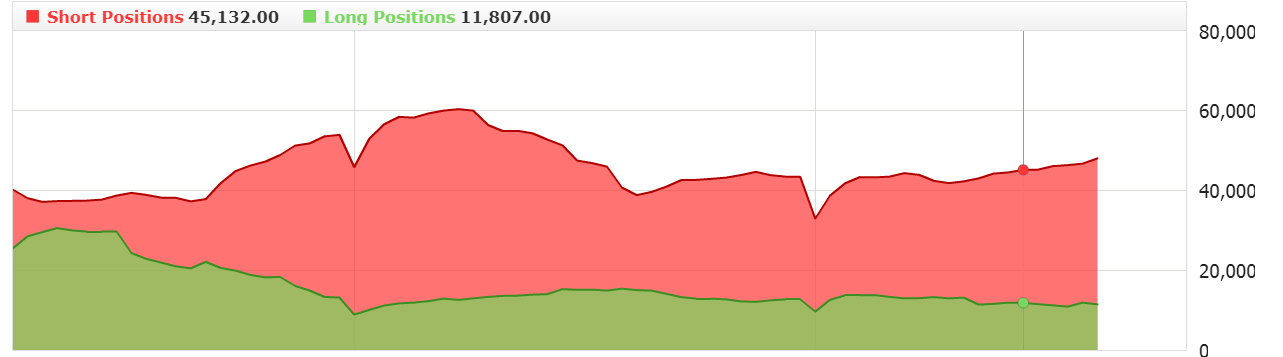

The sentiment is pro-bearish so we cannot open long positions.

The sentiment is pro-bearish so we cannot open long positions.

However, during the correction, this arrangement may change and if the pair reaches the last defeated resistance, you will be able to look for the fifth wave. The chart above shows that this level should match the Senkou Span A line and the rebound from it or the potential gold cross will be an opportunity to enter.

However, during the correction, this arrangement may change and if the pair reaches the last defeated resistance, you will be able to look for the fifth wave. The chart above shows that this level should match the Senkou Span A line and the rebound from it or the potential gold cross will be an opportunity to enter.

The partner of “Search, Analyse, Trade” series is a Dukascopy Europe broker who gives its customers access to ECN accounts in different currencies.

Trade on Forex, indices and commodities thanks to Swiss FX & CFD Marketplace. Open free trading account right now.

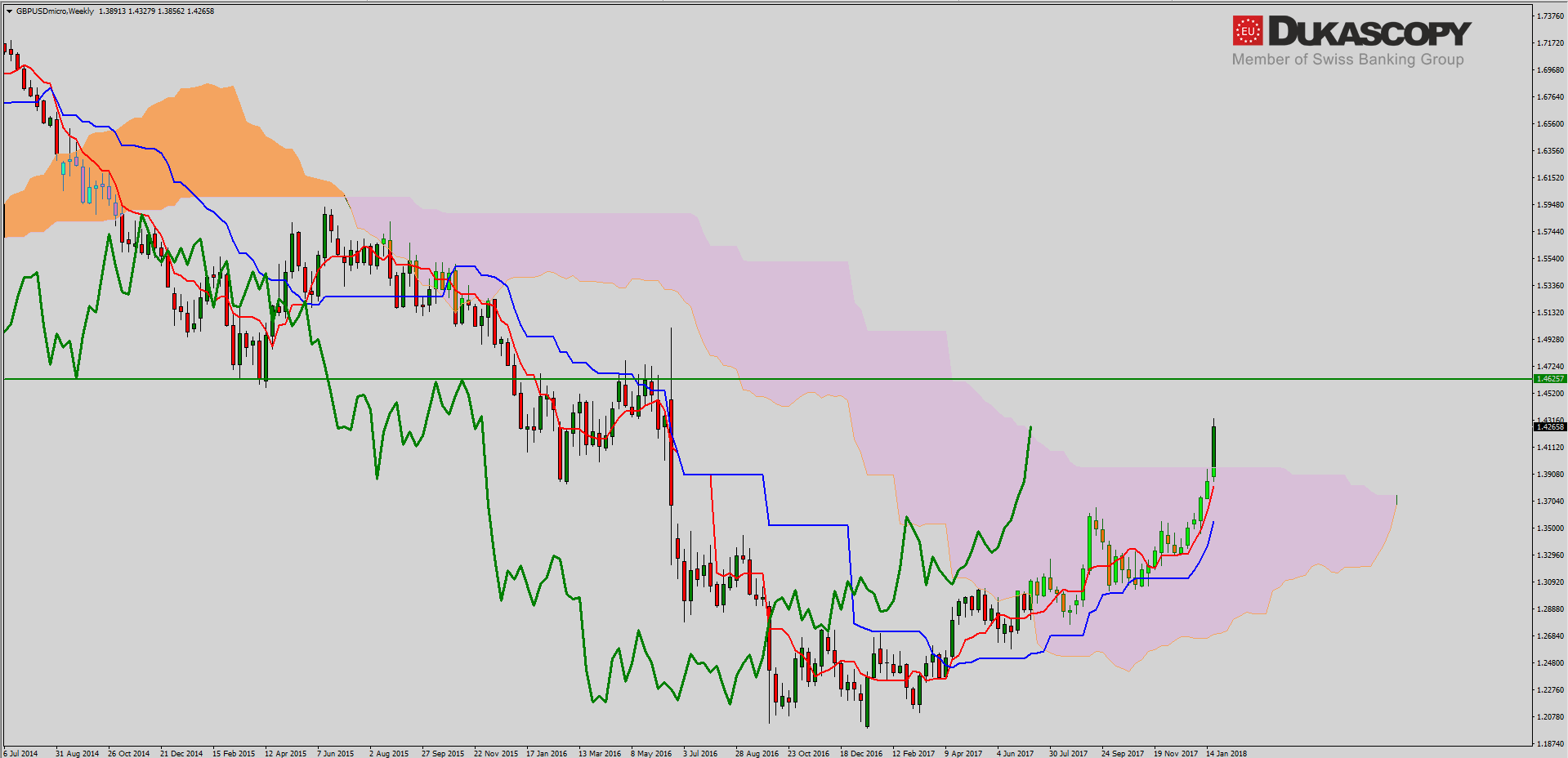

GBP/USD also remains in the third wave. A small consolidation, which was an Inside Bar, was created just before the resistance. Breaking the top from it was associated with overcoming the zone and continuing the growth movement. Currently, the pair has reached another resistance and some reaction of supply may take place already from these levels.

If we look at the graph with the Ichimoku indicator, we will see that the pair has broken up out of the cloud and is heading towards a strong resistance zone. The Chikou line fights with the Senkou Span B line which may contribute to the correction. Although the Senkou Span B line is flat and can attract the price, the impulse that has been created should not allow for such a deep drop.

If we look at the graph with the Ichimoku indicator, we will see that the pair has broken up out of the cloud and is heading towards a strong resistance zone. The Chikou line fights with the Senkou Span B line which may contribute to the correction. Although the Senkou Span B line is flat and can attract the price, the impulse that has been created should not allow for such a deep drop.

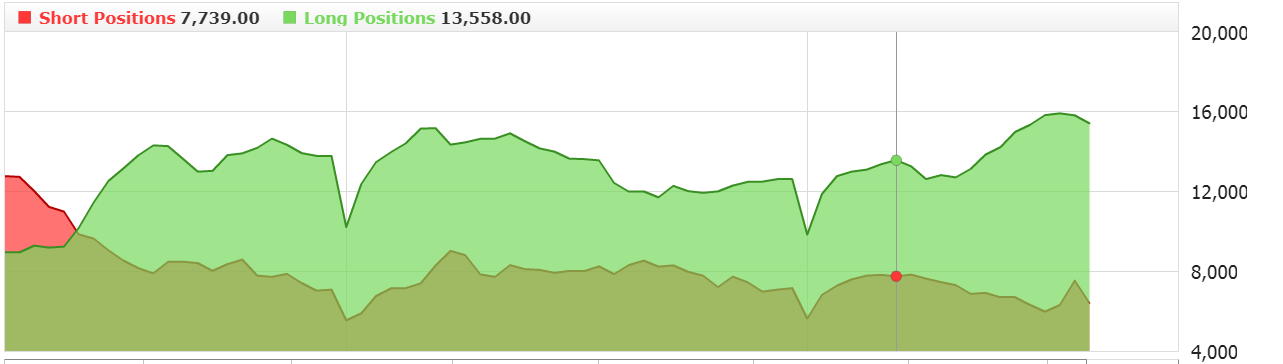

The sentiment level remains neutral, which allows us to open any position in opposition to that from EUR/USD. It remains to wait for the correction and the appropriate setup which is currently far away.

The sentiment level remains neutral, which allows us to open any position in opposition to that from EUR/USD. It remains to wait for the correction and the appropriate setup which is currently far away.

USDJPY after re-test and rejection of the support zone continues to decline. Currently, the paire has reached the support regions and the demand reaction seems quite possible. However, if we look at the pair’s chart in a broader perspective, then we can mark the whole consolidation as a simple correction. Wave A was zigzag, after it we had an irregular correction in the B wave, and now we should be in the C wave. If so, in the near future we will see an attempt to overcome support based on the A wave bottom.

USDJPY after re-test and rejection of the support zone continues to decline. Currently, the paire has reached the support regions and the demand reaction seems quite possible. However, if we look at the pair’s chart in a broader perspective, then we can mark the whole consolidation as a simple correction. Wave A was zigzag, after it we had an irregular correction in the B wave, and now we should be in the C wave. If so, in the near future we will see an attempt to overcome support based on the A wave bottom.

The sentiment still remains on the side of the longs and does not allow opening a position consistent with the trend. It’s a long way to a clear setup, so maybe it will change by then.

The sentiment still remains on the side of the longs and does not allow opening a position consistent with the trend. It’s a long way to a clear setup, so maybe it will change by then.