“Search, Analyse, Trade” is a series of Price Action and Elliott Waves analyses. Its detailed step-by-step description can be found over here. I invite you to today’s review of selected currency pairs and potential trading opportunities. The analyses are based on the Dukascopy sentiment that you can get here.

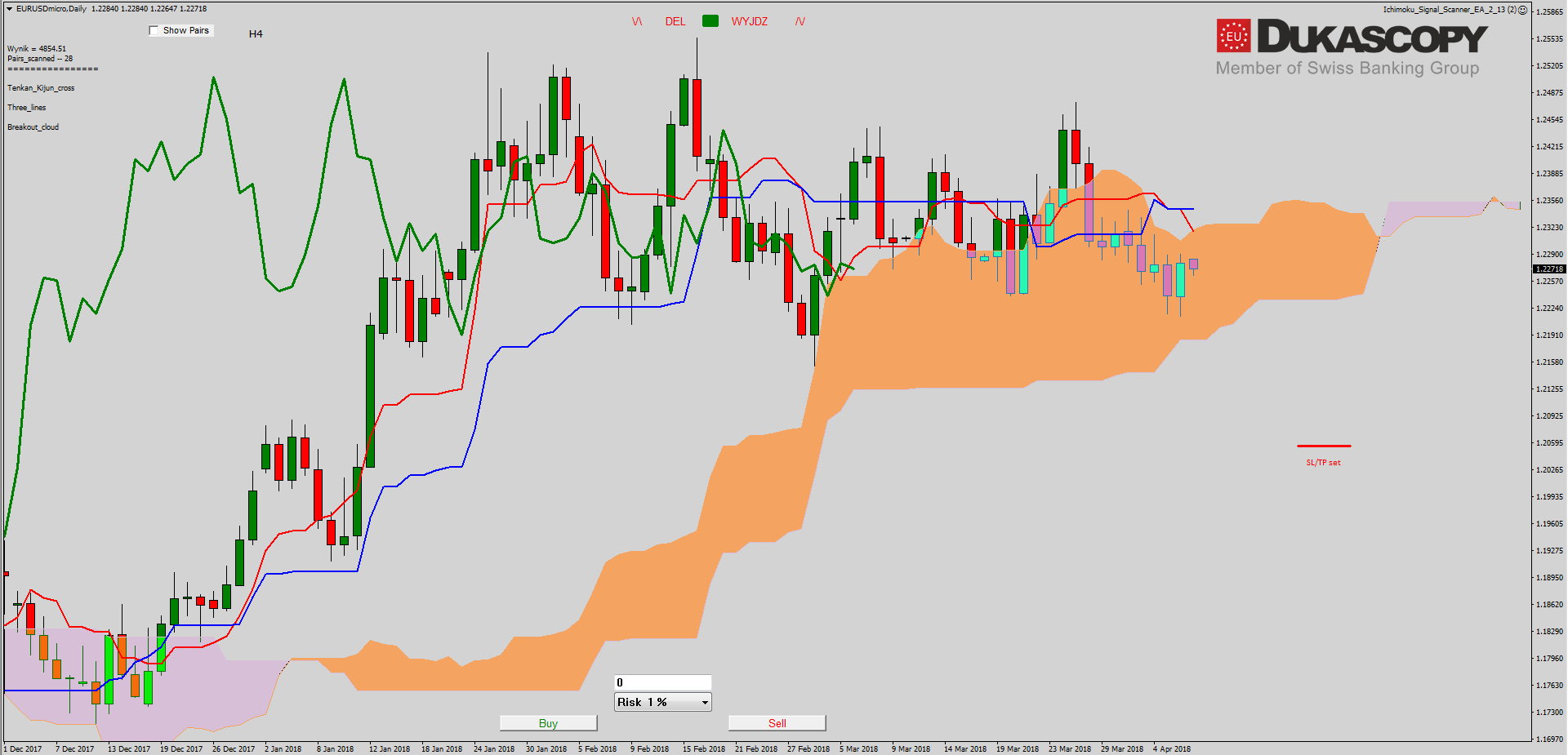

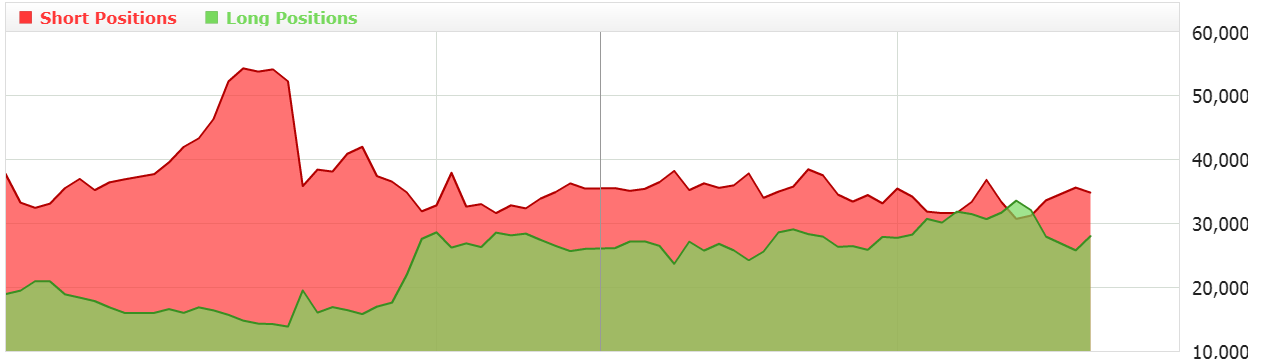

EUR/USD remains within a consolidation, which is more and more reminding a triangle. If this is the case, then we should now end the formation of the c wave. The pair is testing the trend lines and the upper limit of the support zone which is a good place to start the wave d. We should see the next three and the upper limit of consolidation. The bottom line below the trend line negates the triangle option and we will return to the C wave correction scenario.

On the Ichimoku chart, the pair stays in the cloud under the Tenkan and Kijun lines, which have cut through creating a weak sell signal. It is quite possible that the pair will want to test a line from the bottom on the last lows. Such a move combined with a neutral sentiment will be an opportunity to look for a bearish position and continue the move towards Senkou Span B.

On the Ichimoku chart, the pair stays in the cloud under the Tenkan and Kijun lines, which have cut through creating a weak sell signal. It is quite possible that the pair will want to test a line from the bottom on the last lows. Such a move combined with a neutral sentiment will be an opportunity to look for a bearish position and continue the move towards Senkou Span B.

The partner of “Search, Analyse, Trade” series is a Dukascopy Europe broker who gives its customers access to ECN accounts in different currencies.

Trade on Forex, indices and commodities thanks to Swiss FX & CFD Marketplace. Open free trading account right now.

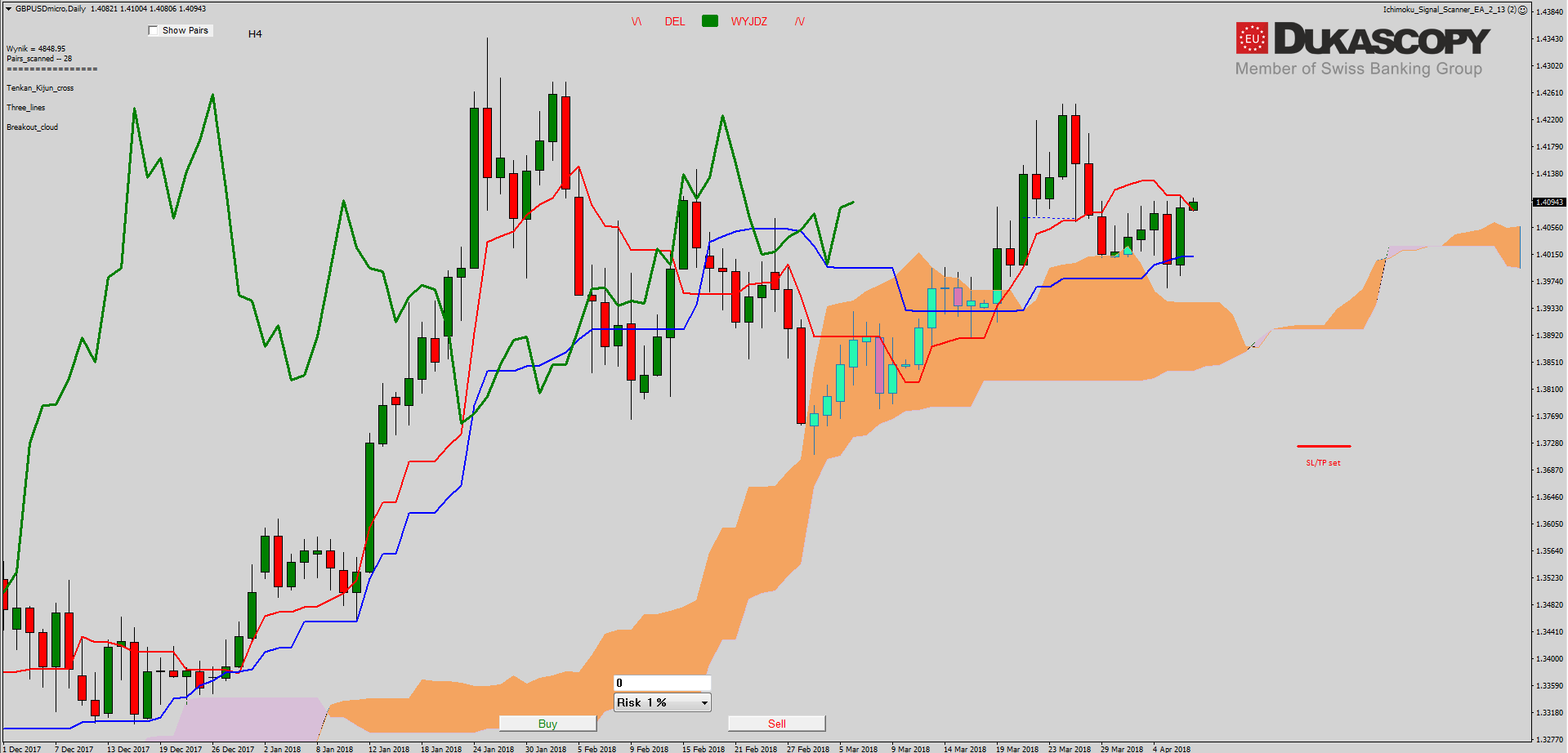

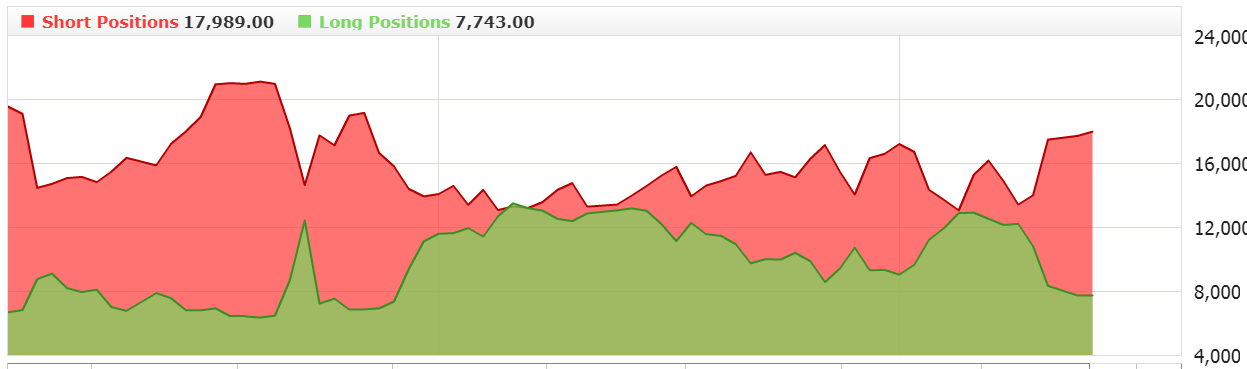

GBP/USD pair reacted to support in a form of a trend line and from that moment we are seeing increases. A very interesting layout has been created. We have a downward impulse and then its continuation which can be considered as the ending of the straight correction (wave c is 0.62 of wave a). The emerging growth wave is slowly becoming the fifth and either the correction has actually been completed and we will see a continuation of increases towards the high or the aforementioned five is a c wave in an irregular correction. In this case, the real downside C wave is just ahead of us.

GBP/USD pair reacted to support in a form of a trend line and from that moment we are seeing increases. A very interesting layout has been created. We have a downward impulse and then its continuation which can be considered as the ending of the straight correction (wave c is 0.62 of wave a). The emerging growth wave is slowly becoming the fifth and either the correction has actually been completed and we will see a continuation of increases towards the high or the aforementioned five is a c wave in an irregular correction. In this case, the real downside C wave is just ahead of us.

On the Ichimoku chart, we see that the pair remains locked between the Kijun and Tenkan lines. The Chikou line perfectly reflected from Kijun and moved up. If we deal with the variant with the c wave irregular correction, then rejecting the currently tested Tenkan will be an opportunity to look for a short. Such a scenario is favored by the sentiment, where we have been seeing the increasing advantage of the short side for some time.

On the Ichimoku chart, we see that the pair remains locked between the Kijun and Tenkan lines. The Chikou line perfectly reflected from Kijun and moved up. If we deal with the variant with the c wave irregular correction, then rejecting the currently tested Tenkan will be an opportunity to look for a short. Such a scenario is favored by the sentiment, where we have been seeing the increasing advantage of the short side for some time.

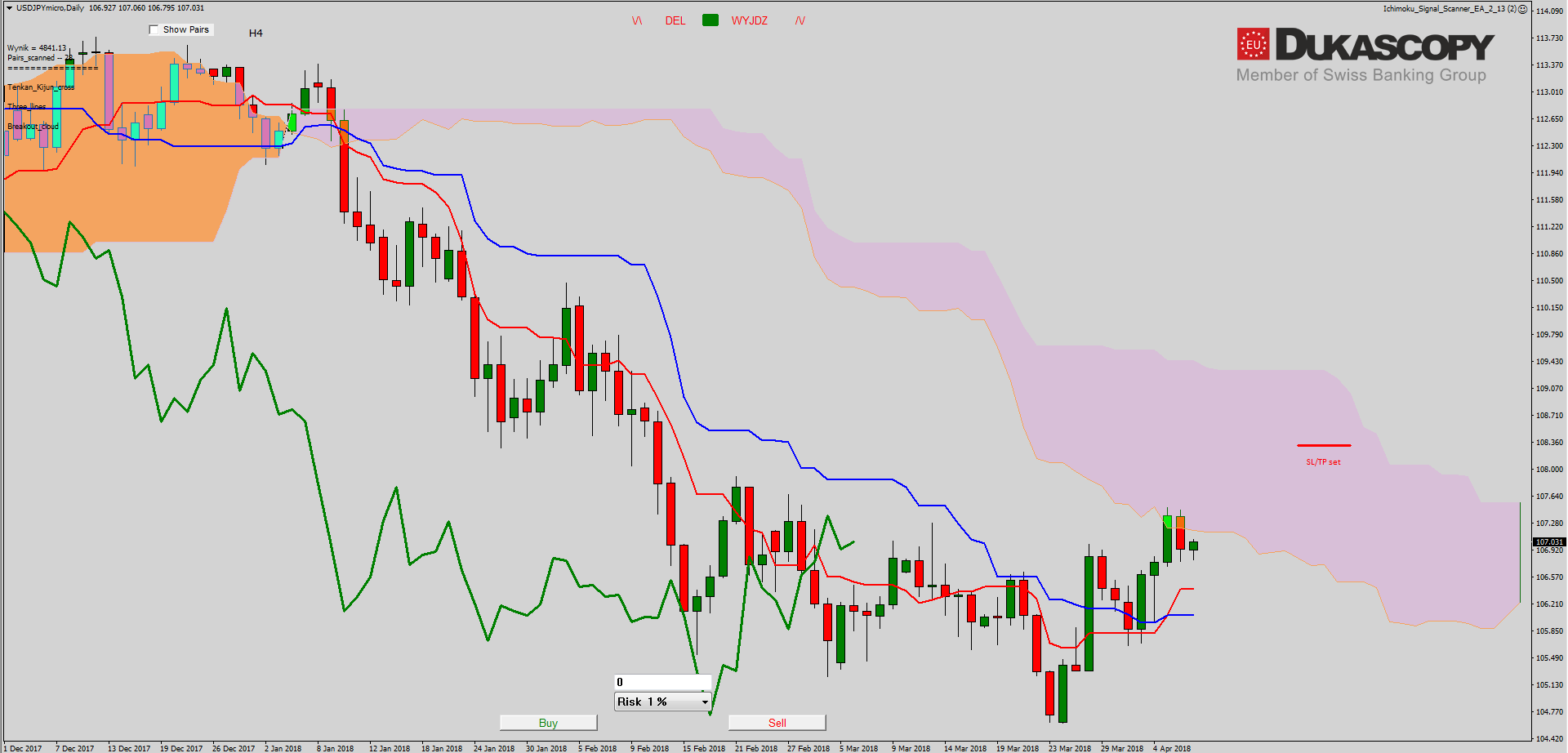

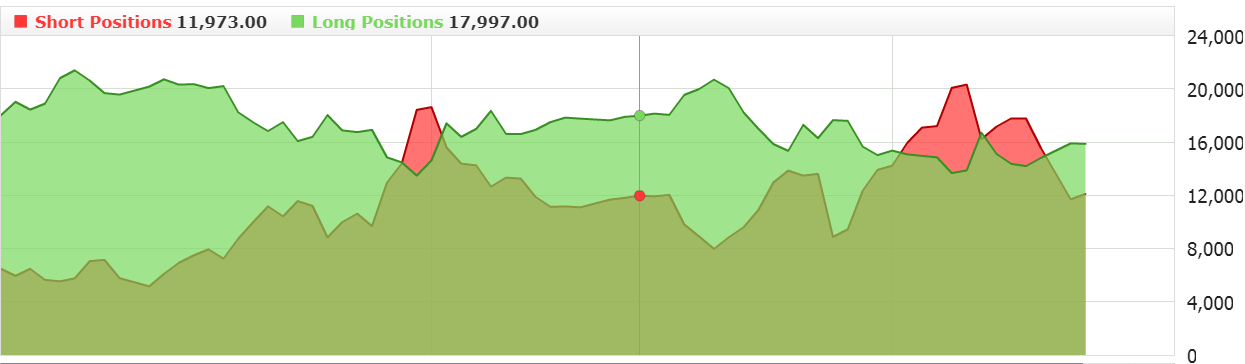

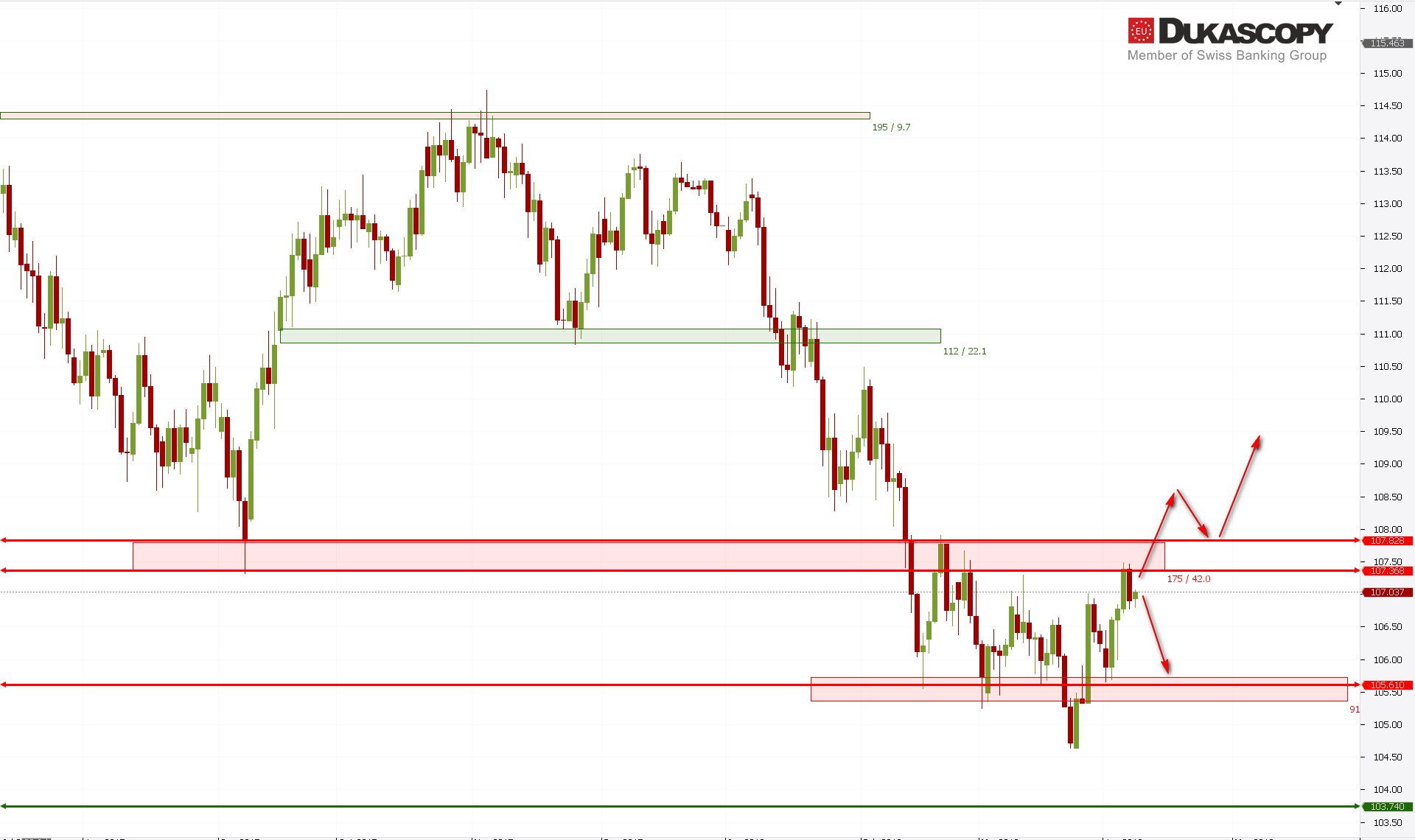

The USD/JPY reached the key resistance zone and the first attack attempt met with the reaction of supply. The previously presented scenarios are still possible. A successful attempt to attack the zone will allow completing formation of the inverted head with shoulders and a greater rebound, or even the ending of a large ABC correction and return to increases. Rejection of the level will mean the continuation of the lateral movement as part of the bearish wave four.

The USD/JPY reached the key resistance zone and the first attack attempt met with the reaction of supply. The previously presented scenarios are still possible. A successful attempt to attack the zone will allow completing formation of the inverted head with shoulders and a greater rebound, or even the ending of a large ABC correction and return to increases. Rejection of the level will mean the continuation of the lateral movement as part of the bearish wave four.

On the Ichimoku chart, we see that the pair reached the Senkou Span A line and rebounded from it. Tenakan and Kijun lines begin to move flat after creating a cross under the cloud. It remains to wait for a larger reaction on Senkou Span A and, depending on her defeat or rejection, look for a consistent position.