Russia’s invasion of Ukraine continues. This is already the fifth day of the war provoked by the Kremlin and condemned by the international community. Economic sanctions are being imposed on Russia.

- Russia’s invasion of Ukraine condemned by the international community

- Russian banks excluded from SWIFT system

- S&P500 index in upward correction

The British government, as part of further sanctions imposed on Russia for its invasion of Ukraine, announced on Monday that it will ban Russian banks from settling payments in pounds, freeze the assets of three more banks and ban Russian ships from entering British ports.

Airspace over Europe was closed to Russian airlines. On Sunday, Russian banks were excluded from the SWIFT system. Today, shares in Russia’s largest bank fell from $15 to $1. The dollar cost nearly 130 rubles and the Bank of Russia raised interest rates from 9.5 to 20%. The Moscow stock exchange has cancelled trading until 5 March.

The civilised world seeks to isolate everything that is Russian. Even Monaco has joined the sanctions. Sports organisations are excluding Russian athletes from international competitions.

It would seem that such a situation should lead to a crash in world stock markets and yet this has not happened. The beneficiary of sanctions imposed on Russia may turn out to be American companies, which are now perceived as a safe haven. Capital does not like vacuum and will start moving overseas.

S&P500 will benefit from Russia sanctions

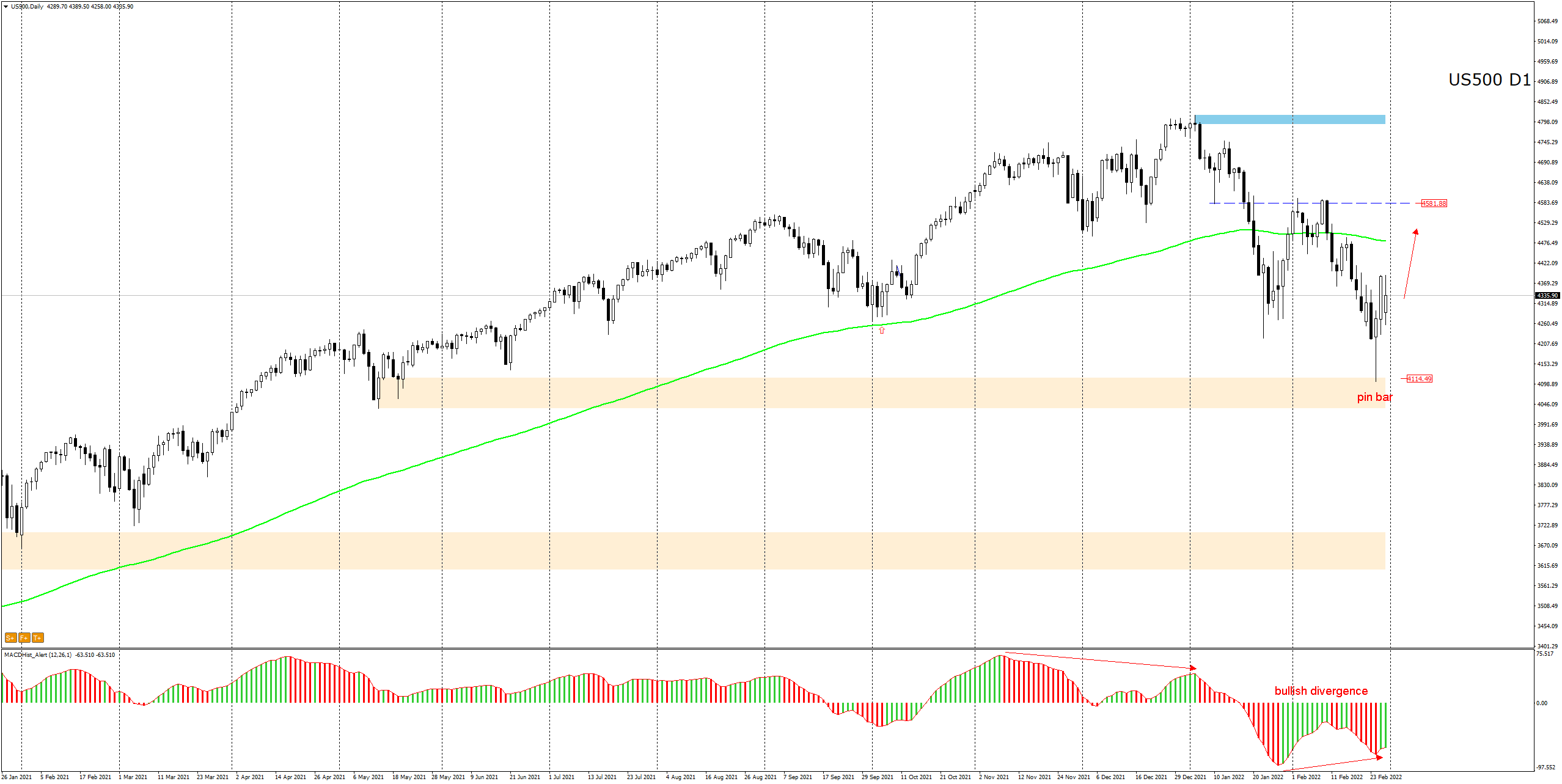

Let’s look at the S&P500 index from a purely technical perspective, leaving aside any fundamentals.

The index took a dive on Thursday to the demand zone at 4100, but quickly recovered the morning losses and closed the day on a positive note with an bullish pin bar. The following days also ended on plus.

Additionally, last Friday an bullish divergence appeared on the MACD. Technically, the SP500 index is in an upward phase and the target could be the 4580-4600 level.

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions which you can attend from Monday to Friday.

More current analysis on the group : Trade with Dargo

I invite you to my – Tuesday’s, 1st of March at 08:00-09:00 GMT and 10:00-11:00 GMT– live trading sessions here: https://www.xm.com/live-player/basic

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo