This week can be called the week of central bank decisions. The Fed will be the first to reveal what plans it has for the coming weeks. After that, we’ll learn about the SNB and BOE’s decisions, and on Friday the BOJ will wrap up an eventful week.

The SNB (currently 1.75%) and BOE (currently 5.25%) are expected to raise interest rates by 25 basis points, respectively, while the Fed will stay at its current 5.50%. The BOJ is not expected to change anything, but since the BOJ is known for its tendency to surprise markets the most, caution should be taken when making decisions on yen pairs at this time.

The SNB (currently 1.75%) and BOE (currently 5.25%) are expected to raise interest rates by 25 basis points, respectively, while the Fed will stay at its current 5.50%. The BOJ is not expected to change anything, but since the BOJ is known for its tendency to surprise markets the most, caution should be taken when making decisions on yen pairs at this time.

Following Ueda’s remarks about a “quiet exit” from ultra-loose monetary policy, the yen is bound to fluctuate depending on the BOJ’s decision, and be sensitive to possible verbal interventions by Min Fin representatives this week.

And to top it all off, on Friday we will also learn PMI data from the Eurozone, which at this point may have a greater impact on the EUR than last week’s ECB decision.

Given that we won’t know the Fed until Wednesday, the start of the week will be quiet before things pick up.

As I mentioned, trading on the yen and its pairs this week could be risky, but since the BOJ’s decisions won’t be made until Friday it might be worth looking at the charts from the technical side after all, and maybe by then there will be an opportunity to play out some setup before Friday’s decisions..

USDJPY – bearish outsidebar

The quotes of the USDJPY pair are moving in an ascending wedge formation. A bearish engulfing formation appeared on the H4 chart last Friday. A breakout to the bottom may direct the quotes to the support of the wedge. MACD is currently forming a downward divergence with the pair’s chart. This may suggest a correction of the recent increases.

We can talk about this week’s events and their possible impact on the quotations of currencies and other financial instruments during the live session:

LIVE EDUCATION SESSIONS

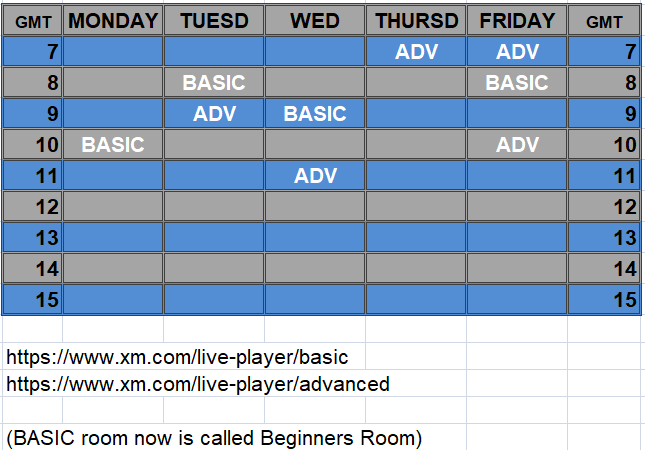

This WEEK (18-23 September 2023 ) I am pleased to invite you to several online sessions. Below is the schedule of meetings:

Links: BASIC (beginners room) ADVANCED ROOM

Links: BASIC (beginners room) ADVANCED ROOM

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions which you can attend from Monday to Friday.

More current analysis on the group : Trade with Dargo