World stocks were mostly mixed on Tuesday as markets braced for an intense trading session dominated by the financial heavyweights ECB Mario Draghi, BoE Mark Carney and Fed head Janet Yellen all in focus. Asian shares turned in a mixed performance amidst an air of caution while the absence of appetite for risk punished European equities. With jitters over depressed oil prices still weighing on risk sentiment and investors adopting a defensive stance, Wall Street could come under selling pressure this afternoon.

Draghi optimism boosts Euro

Euro Bulls sprinted into action on Tuesday after European Central Bank President Mario Draghi displayed fresh optimism over the health of the European Economy. With “all signs now pointing to a strengthening and broadening recovery in the euro area,” expectations are likely to mount over the central bank tapering in the future. Although Draghi still highlighted that despite the impressive growth in the euro area, the inflation dynamics remained muted, this was overshadowed by comments of “deflationary forces being replaced by reflationary ones”. While monetary policy may remain accommodative in the short to medium term as the European economy stabilizes, the growing signs that the factors currently hindering inflation are transitory could support speculations of the ECB tapering QE in the longer term.

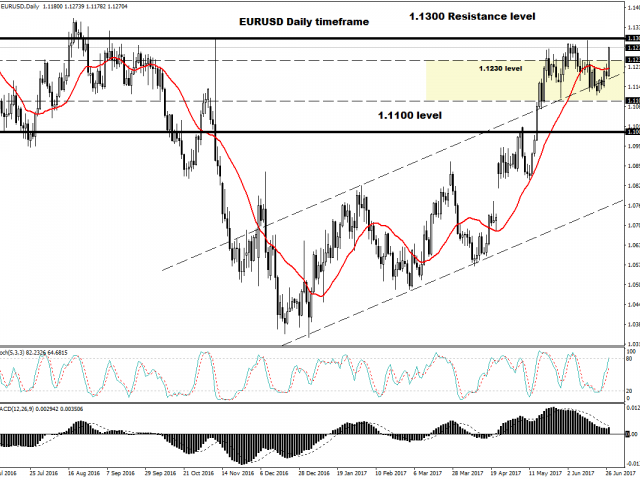

From a technical standpoint, the EURUSD lurched to its highest level in over a week at 1.1265 following Draghi’s upbeat comments with bulls securing control above the 1.1230 resistance. This dynamic resistance could transform into a solid support that supports a further incline towards 1.3000.

BoE Financial Stability Report in focus

Sterling turned erratic on Tuesday with prices violently swinging between losses and gains after the Bank of England stated that there were some areas of risk which required attention in its Financial Stability report. As insurance, capital requirements for UK lenders were increased by £11.4 billion in the event of an economic downturn, while the counter-cycle capital buffer rate was raised to 0.5% from zero. The central bank expects to increase the rate further to 1% in November to cover potential losses if the economy decelerates.

The GBPUSD was searching for direction after the FSR report showed prices still slightly pressured below 1.2775. Technical traders could make use of the 1.2775 resistance level on the GBPUSD to drive the pair lower towards 1.2600.

Will Yellen inspire Bulls again?

The Greenback has found itself under intense selling pressure ahead of an address by Federal Reserve Chair Janet Yellen this evening where she is expected to reiterate her hawkish rhetoric and optimism over the US economy. With Dollar bullish investors lacking the inspiration to support the Greenback amid soft economic data, today may be critical in ensuring that the Dollar Index remains above 96.50.

Investors will be waiting to see if Yellen repeats herself in saying that low inflation remains “transitory” while offering further clues on rate hike timings this year. A firmly hawkish Yellen could provide Dollar bulls a lifeline to keep above 96.50 in the short term. On the other hand, if markets still remain unconvinced over the Federal Reserve’s ability to raise US rates after Yellen’s speech then the Dollar Index is at risk of breaking below 96.50.