22-Jan-2014, GMT 14:37 a.m.

Right before upcoming Bank of Canada statement (15:00 GMT) lot of attention focuses on USD/CAD.

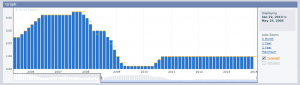

USD/CAD pair is moving up since September 2012, when it marked last longterm low just above 0.96, and made 1200 pips gain so far beating the parity and knocking to the ceiling on 1.1000 level. Uptrend have recently accelerated after passing 1.05 resistance. Now pair stopped under 1.10 waiting for BoC decision. Many sources state that on this round level sits cumulated take profit for all these long positions built during last 16 months, while others say that USD/CAD will be this year’s black horse that is worth betting for.

Click to enlarge!

Technically we see pretty big rally on a daily chart after breaking up December’s range. Daily Moving Average 21 has clearly sharpened what can be also noticed on RSI14 – for higher high we have lower RSI value. Basically this means that there is still some upward potential on daily timeframe. But does it mean that we have signal to buy? Absolutely not. Buying after such rally would be unreasonable.

Click to enlarge!

Here it’s good to consider upcoming BoC statement. There are speculations that BoC may cut interest rates or loose monetary conditions in other way. Data shows that Canada is sliding into stagnation connected with disinflation. If BoC would cut official rates then Canadian Dollar should lose on value significantly. On the other hand, after such strong depreciation of CAD, cutting overnight rate by 25 points seems to be already in price. Therefore extensive liquidity provided by additional USD/CAD buyers may be used to book profits being built by last 1200 pips. However Bank of Canada was very stable and predictable in his monetary decisions, so base scenario still assumes no major move in monetary policy. In such case some corrective move, i.e. towards 1.07 should be anticipated. Societe Generale thinks, that BoC statement will be dovish and holds its strategy of buying dips on USD/CAD targeting 1.15/1.20 area foreseeing possible correction on the overbought pair.

Big banks, like Goldman Sachs, Morgan Stanley, etc. are already in long positions and first level of taking profit is set on 1.12: