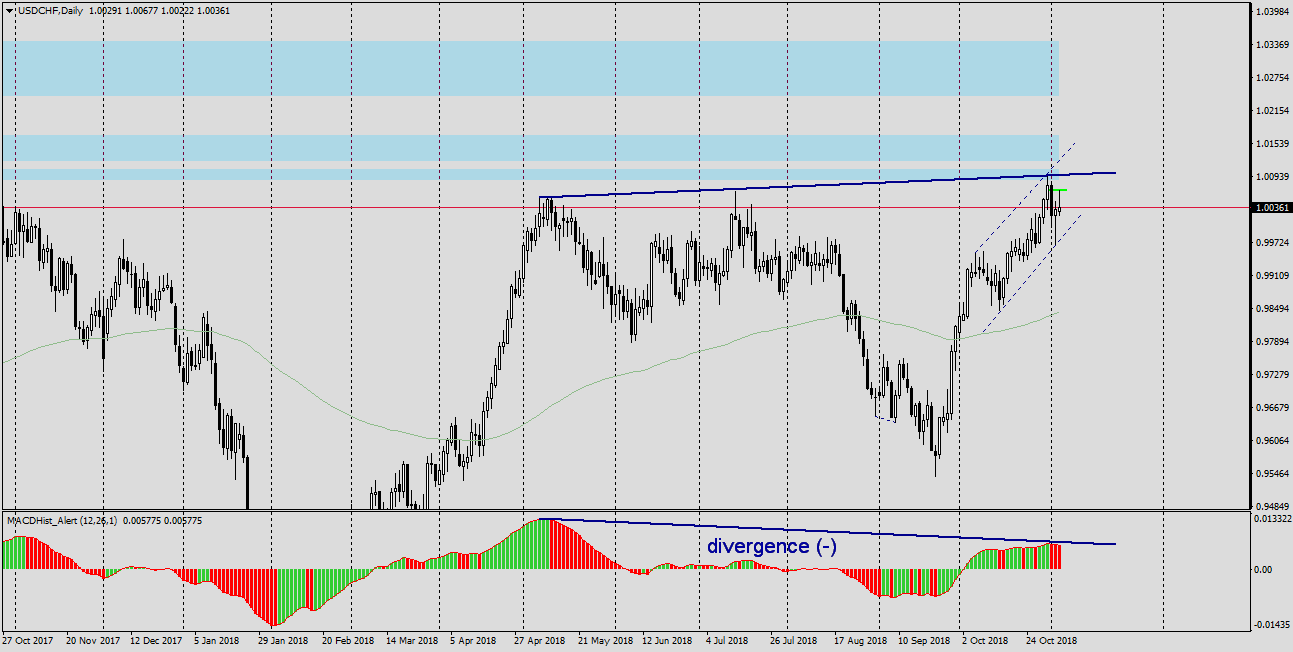

USDCHF – I described the technical situation of this pair last week. Today, the price has reached the level of 1.0070 (green zone), which in that analysis I have designated as the level of supply and above it was supposed a level of SL for Sell orders.

The price behaviour in this zone indicates the weakness of “bulls” and the fact that the bears have entered the game. Additionally, the downward divergence (-) on MACD continues.

On the H4 chart, MACD also created the maximum today and starts to decrease, which suggests further declines.

Looking at the H1 chart, we can see with what accuracy the supply zone has been tested, and quite dynamic declines indicate that the sellers have already joined the game. The price still moves in the growth channel.

From the layout of the levels on the chart, we can pre-determine a setup for the Sell order:

- Stop Loss above 1.0085,

- TP in the support area (lower limit) of the growth channel, currently 0.9980

- the level of entry on the market at your discretion, the closer to the green zone, the better for the Risk / Reward ratio.