This seems like a distant past, and it is so recent, just at the beginning of 2021 most developed economies were struggling with too low inflation. After a period of trials and mistakes, most central banks adopted a strategy to deal with this problem, which was to dampen the upward pressure on bond yields exerted by improving GDP growth. The assumption was that this would encourage a positive feedback loop between falling real incomes and rising spending.

Typically, an improvement in economic growth causes bond yields to rise. This is because the market expects the central bank to tighten monetary policy in response. In addition, an improved economic outlook causes investors to move from safe government bonds to riskier assets.

Is a weakening yen good or bad for growth?

To begin with, a little explanation of what YCC is. Yield Curve Control – stands for keeping government bond yields at a constant, usually low, level through appropriate monetary policy by the central bank.

The depreciation of the yen plays a key role in thinking about how long the Bank of Japan will be able to maintain the YCC. In theory, a weaker yen is an important monetary policy element through which the YCC can stimulate higher Japanese economic growth. As the Bank of Japan holds the Japanese bond yield curve steady, rising yields outside Japan cause the yen to depreciate, which stimulates Japan’s net exports and puts direct upward pressure on Japanese inflation through higher import prices.

Every stick has two ends

Weakening the yen too far could unexpectedly be counterproductive. On the positive side, it could help to perpetuate upward cost pressures, to the point where companies would have no choice but to raise the prices of their products. This would mean an increase in inflation expectations, which is probably exactly what the YCC is aiming for.

On the other hand, consumer confidence in the face of falling real incomes could fall, further reducing their willingness to spend. Moreover, businesses forced to cut production from lack of demand and faced with reduced profits and greater exchange rate uncertainty could react by reducing investment spending which is a straightforward path leading to recession.

All this means that the Bank of Japan increasingly appears to be put between a hammer and an anvil. Continuing to hold the YCC at 0.2-0.25% in the face of rising bond yields around the world could hurt the economy by rapidly depreciating the yen. However, an upward revision of the YCC also risks a sharp appreciation of the Japanese currency and a significant deterioration in export competitiveness.

Not whether, just… when?

At its April meeting, the Bank of Japan signalled its continued support for a continuation of the YCC, but this should not necessarily reassure investors. Experience and history with artificially maintaining fixed exchange rates shows that even despite assurances, the central bank can unexpectedly change its mind.

Probably most of us remember the black swan on currency pairs with the Swiss franc when the Swiss central bank on 15.01.2015 suddenly abandoned its defence of the EURCHF = 1.20 rate. The franc then strengthened by 2,300 pips in a few seconds.

There is a high probability that officially the BoJ will defend the YCC until the last minute, after which it may unexpectedly adjust to the current market situation by raising the previous rigid limits on bond yields.

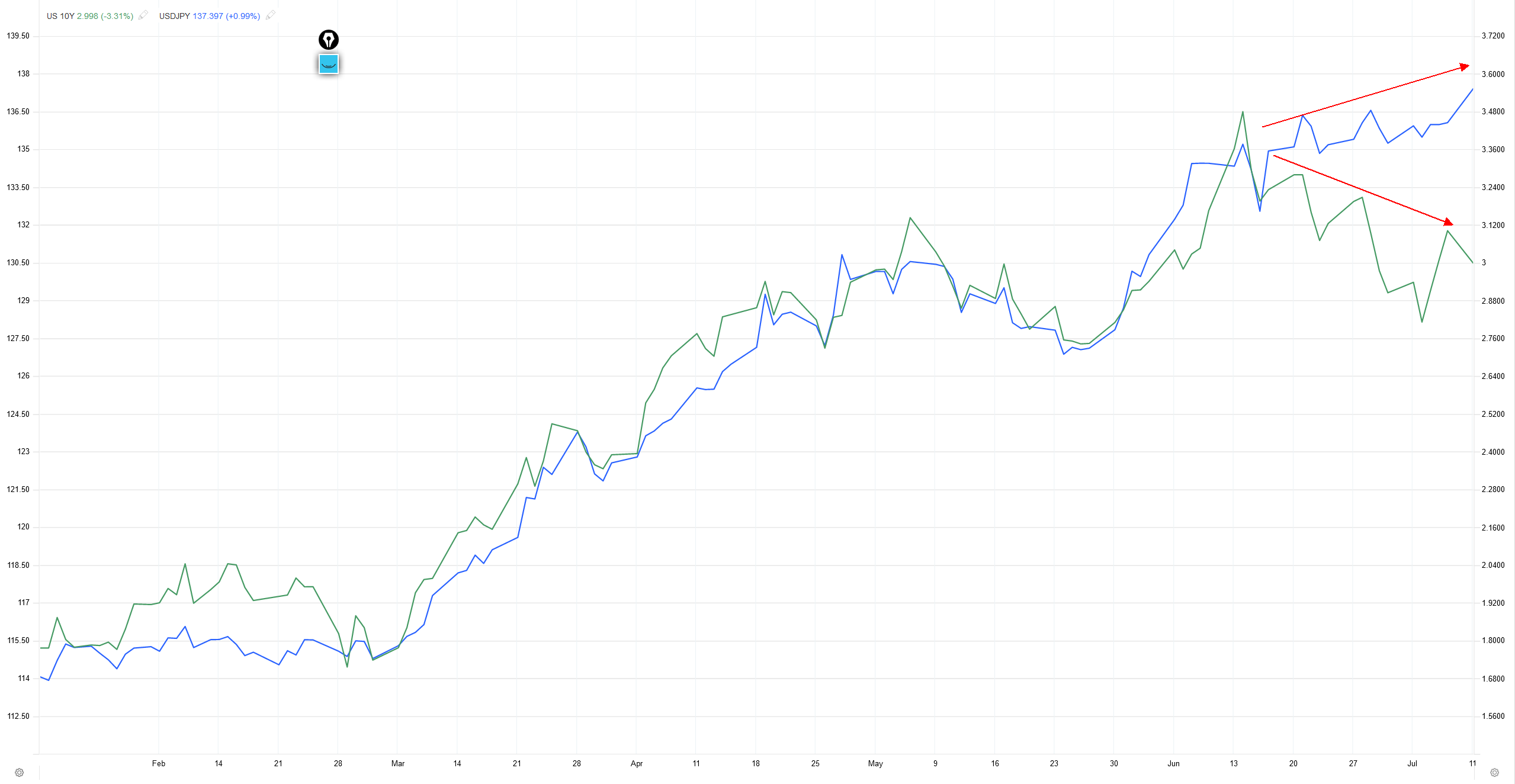

There is a known correlation between the US10Y yield ( US 10-year notes) and the USDJPY exchange rate. As can be seen in the attached chart, this long-standing correlation has changed in recent weeks. The USDJPY pair rate is making successive higher peaks while the US10Y chart is making lower and lower peaks. This should increase vigilance and may signal an increased risk of a sudden strengthening of the Japanese currency.

Technical outlook on USDJPY

Leaving aside the fundamental factors affecting the USDJPY pair outlined above, let’s take a look at the pair’s chart and assess the situation from a technical perspective only.

The price has reached the upper edge of the upward channel, forming another higher peak. The MACD on the H4 chart is still in an upward phase (green). A possible correction of the recent uptrend may occur if the price falls below 137 and the sentiment on the MACD changes (red).

As long as this does not happen, the uptrend continues and there are no reasons to open SELL positions. It will be worth considering opening BUY positions only when the price permanently overcomes the upper edge of the channel, currently it has retreated and is inside the formation.

I will have the opportunity to talk about this and several other instruments during my Tuesday live trading sessions.

LIVE TRADING SESSIONS- FREE ENTRY

I invite you to my – Tuesday’s, 12 th of July at 08:00-09:00 GMT +1 (London time) live trading session here: https://www.xm.com/live-player/basic

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions which you can attend from Monday to Friday.

More current analysis on the group : Trade with Dargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo