The second week of 2022 began with a strengthening Japanese currency and declines in the SP500 index which, with US bond yields rising strongly, is no surprise. The yield on the 10-year Treasury note rose to 1.82% in the second week of January, the highest level since January 2020, as investors assume that the Fed will have to tighten monetary policy faster than initially expected following the hawkish FOMC minutes released last week.

The second week of 2022 began with a strengthening Japanese currency and declines in the SP500 index which, with US bond yields rising strongly, is no surprise. The yield on the 10-year Treasury note rose to 1.82% in the second week of January, the highest level since January 2020, as investors assume that the Fed will have to tighten monetary policy faster than initially expected following the hawkish FOMC minutes released last week.

- US10Y bond yields highest in 2 years

- yen strengthens against other currencies

- Tuesday and Wednesday live trading

Meanwhile, fresh US CPI data on Wednesday and speeches by several Fed officials should provide further clues on the timing of a rate hike by the central bank. The US Treasury will hold several auctions this week, including $52bn of 3-year notes, $36bn of 10-year notes and $22bn of 30-year notes.

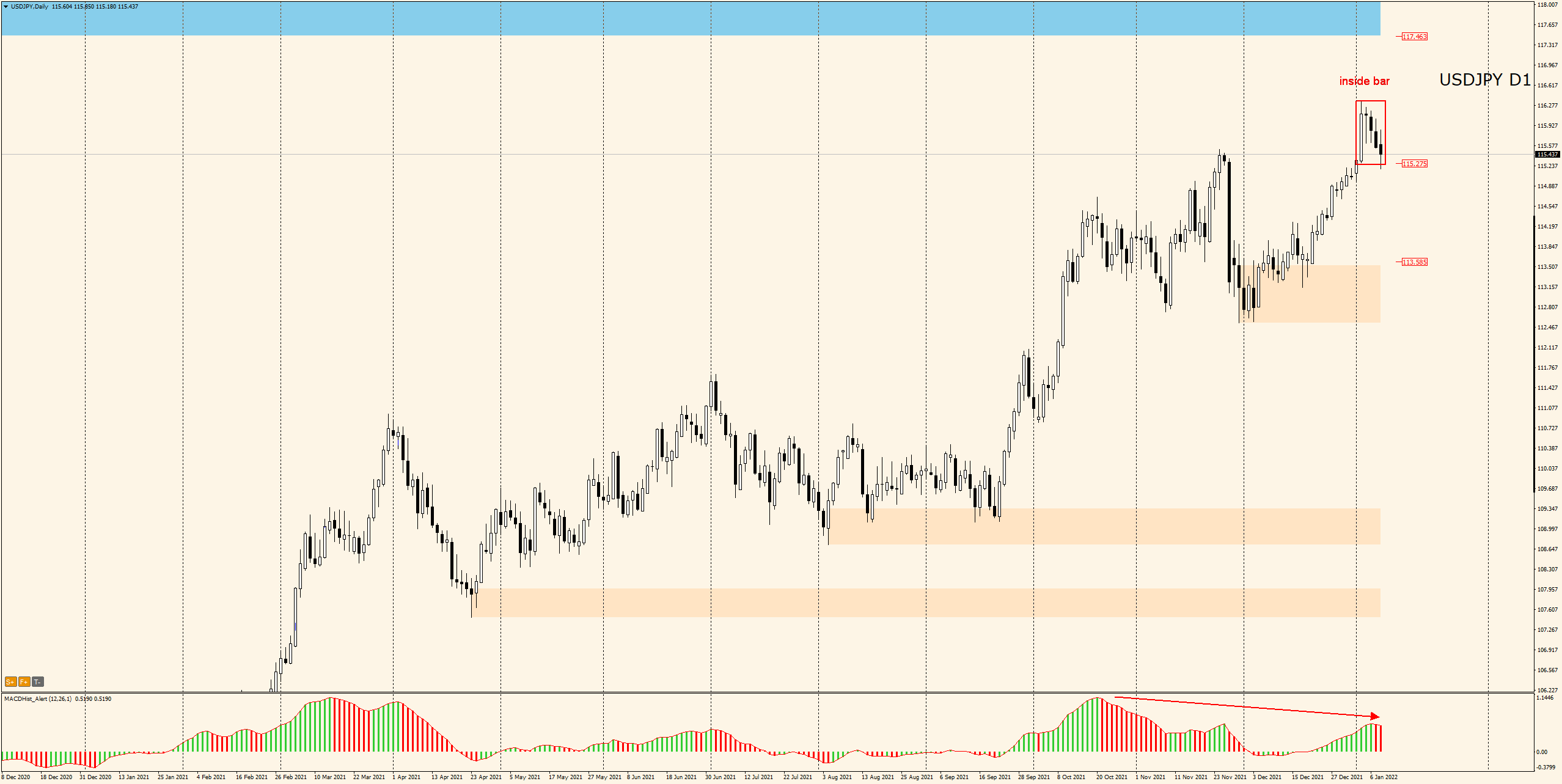

USD/JPY

Looking at the charts of several instruments from a purely technical perspective, we can see quite clear trends. On the USDJPY pair the price is approaching the minimum of the inside bar formation, the bottom breakout is very likely. Already on Friday, a downward divergence appeared on the daily chart, today is the continuation of the downward trend

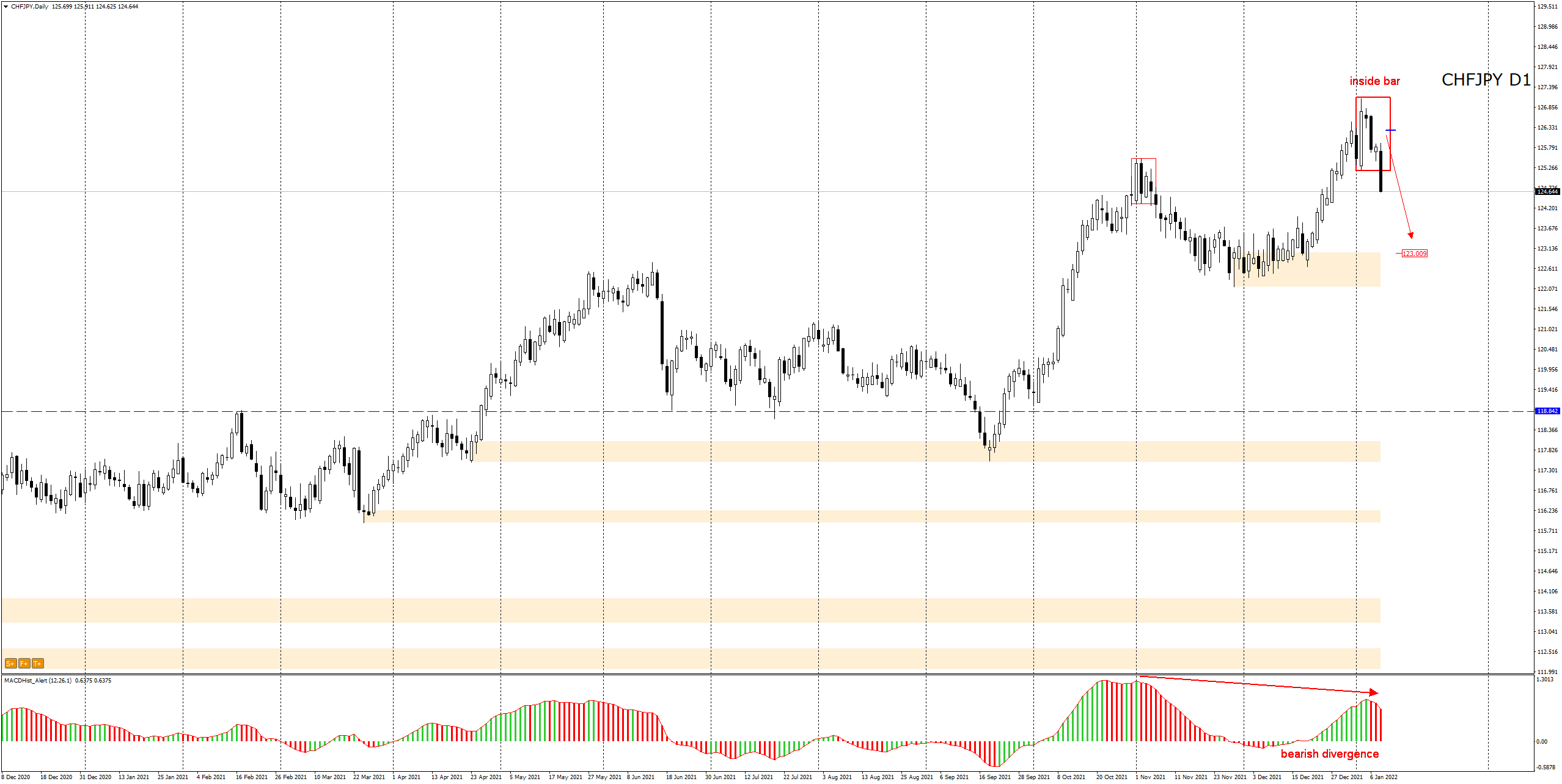

CHF/JPY

Here we have a downward divergence already since last Thursday. Today the price broke down from the inside bar with great momentum and the dynamics of the decline indicates that it will continue for a while. A good place to take a position would be the re-test of the lower level of the inside bar. The question is if this will happen. Alternatively, sell orders can be opened with a stop loss above today’s maximum.

GBP/JPY

The pair of the pound with the yen also looks to be falling. Today’s daily candle forms a bearish engulfing pattern and has led to a change in sentiment on the MACD. Declines are very likely. Range is about 150p to the nearest support.

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions which you can attend on Tuesdays and Wednesdays.

More current analysis on the group : Trade with Dargo

Tuesday, 11th of January 8:00-9:00 GMT

Wednesday, 12th of January at 10:00-11:00 GMT– my live trading session here: https://www.xm.com/live-player/basic

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo