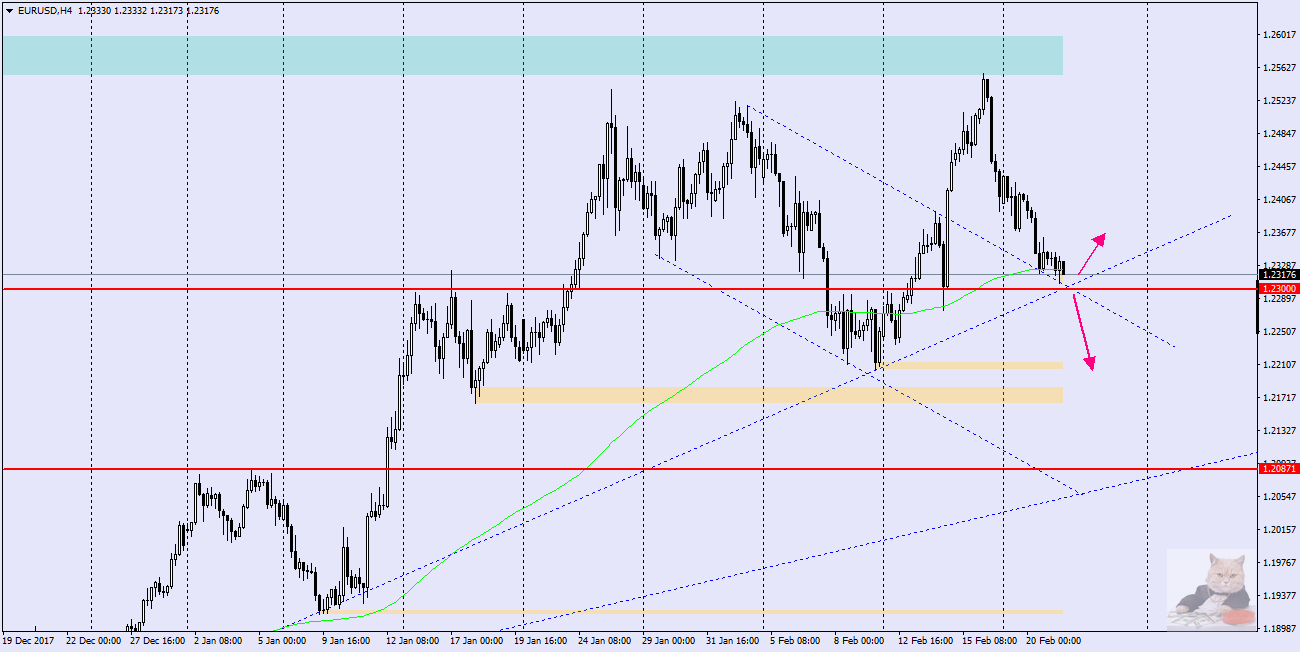

EURUSD – in the last analysis (Monday) I pointed to probable decreases due to the appearance of the “bear market” formation on this pair. So far, the downward trend is in progress.

Today we are watching a fierce battle with confluence of supports:

- at 1.2300 we have horizontal support determined by the January maxima

- upper limit of the bearish channel from which on February 14 a break-out took place, and today we have a re-test of this channel

- an upward trend line from the minimum of 12/12/2017

Defeating or defending this level may decide about the future of EURUSD for the next few sessions. Perhaps today’s FOMC protocols( Wednesday 20:00) will be the information that will give the impulse and choice of direction for this pair.

Defeating or defending this level may decide about the future of EURUSD for the next few sessions. Perhaps today’s FOMC protocols( Wednesday 20:00) will be the information that will give the impulse and choice of direction for this pair.

Looking at this layout on the chart from the EMA144 strategy point of view, as in the already mentioned analysis – defeating EMA144 resulted in drops and until the price is below average, the bears can feel safe.