“Search, Analyse, Trade” is a series of analyses for Price Action and Elliott Waves. Its detailed step-by-step description can be found over here. I invite you to today’s review of selected currency pairs and potential trading opportunities.

The analyses are based on the Dukascopy sentiment that can be seen here.

EUR/USD reached the support zone yesterday. Demand response and upward movement have occurred in the direction of the recently broken supply zone. Because head and shoulders is still intact, this movement should be treated as a return to the broken neckline. Looking at the last wave of declines, we see that one more drop in wave 5 is needed to finish it. This wave should once again test the lower limit of the support zone, which is around 1.1680 level.

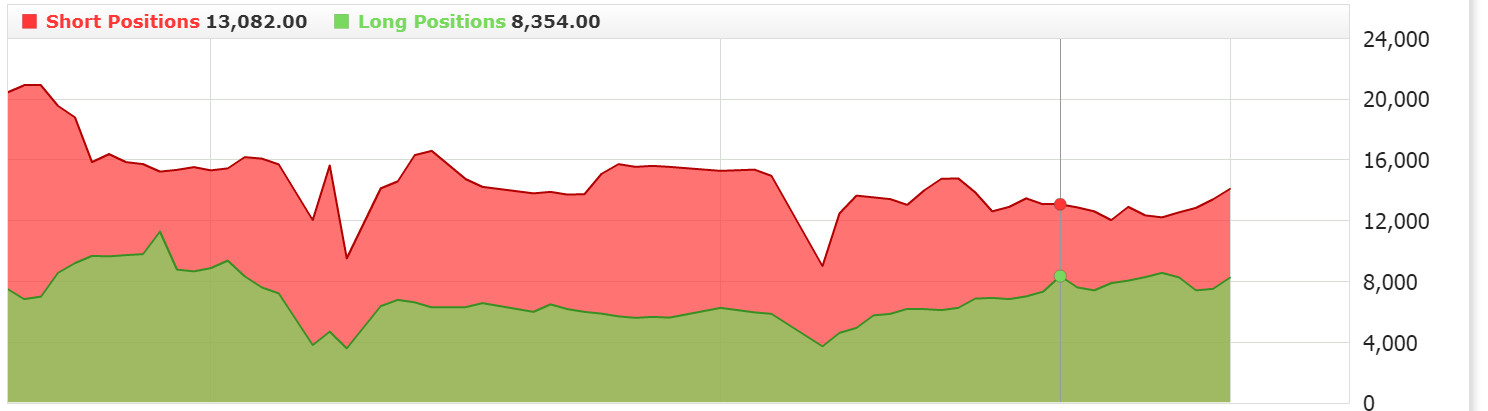

On the sentiment chart we see reduction of long positions and a slight increase in short. This layout allows us to search for shorts. The re-test of the neck line of the H&S formation and its rejection will be an opportunity to seek position for the fifth wave.

On the sentiment chart we see reduction of long positions and a slight increase in short. This layout allows us to search for shorts. The re-test of the neck line of the H&S formation and its rejection will be an opportunity to seek position for the fifth wave.

GBP/USD yesterday tested support at 1.3340 level. The demand response was determined, but the resulting gowth has led to a re-test of the recently defeated support zone. Its rejection may cause a downward move towards 1.3270 where there is an important support zone. Overcoming resistance will be the signal to complete the downward correction, which should be the fourth wave of recent upswing and lead to the test of the last high. This movement can also be a wave B of a larger correction structure and after that we will see another drop in wave C.

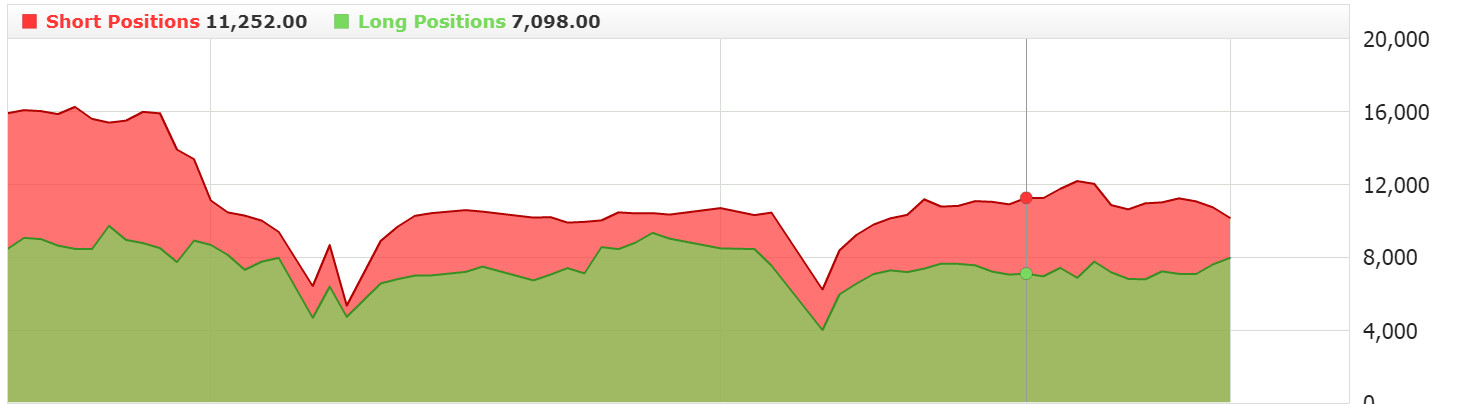

The sentiment remains neutral. If the number of long positions at the time of rejection of the currently tested resistance level is reduced, then a chance for going short will appear.

USD/JPY is still unable to cope with the lines drawn over the last highs. Their defeat opens the way towards 114,300. On the H4 was created an Inside Bar. At night we were trying to break down the bottom and bottom of the resistance zone. However, the level was defended and Fakey formed. The pair returned to Iniside Bar and now is testing one of the lines. Its rejection may result in a decrease to 111,700.

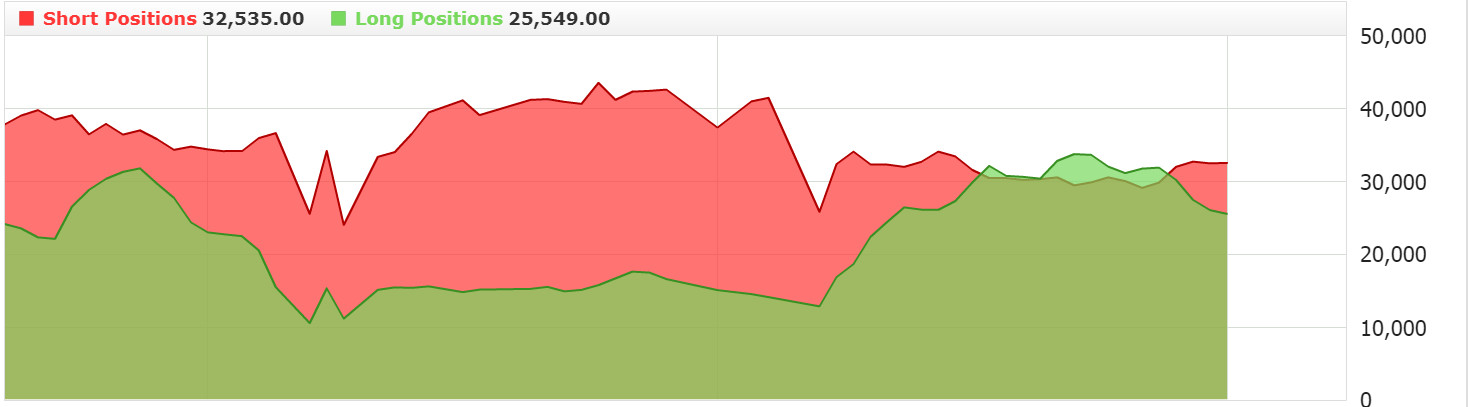

The sentiment chart, where we see a continuous increase in long positions and a reduction of shorts , allowed to play the Falsey and entering long trade (though the place itself is not that good). Since I already have a position on the pair that I opened a few days ago,I remain on the side.