Trading Price Action Formations –under this heading you will find analysis made on basis of most known Price Action formations – Inside Bar, Outside Bar, Head & Shoulders, Triangle, Wedge, Statistics show that best results give breakout from such formation on Daily chart, so mainly this time frame charts will be analysed.

Trading Price Action Formations –under this heading you will find analysis made on basis of most known Price Action formations – Inside Bar, Outside Bar, Head & Shoulders, Triangle, Wedge, Statistics show that best results give breakout from such formation on Daily chart, so mainly this time frame charts will be analysed.

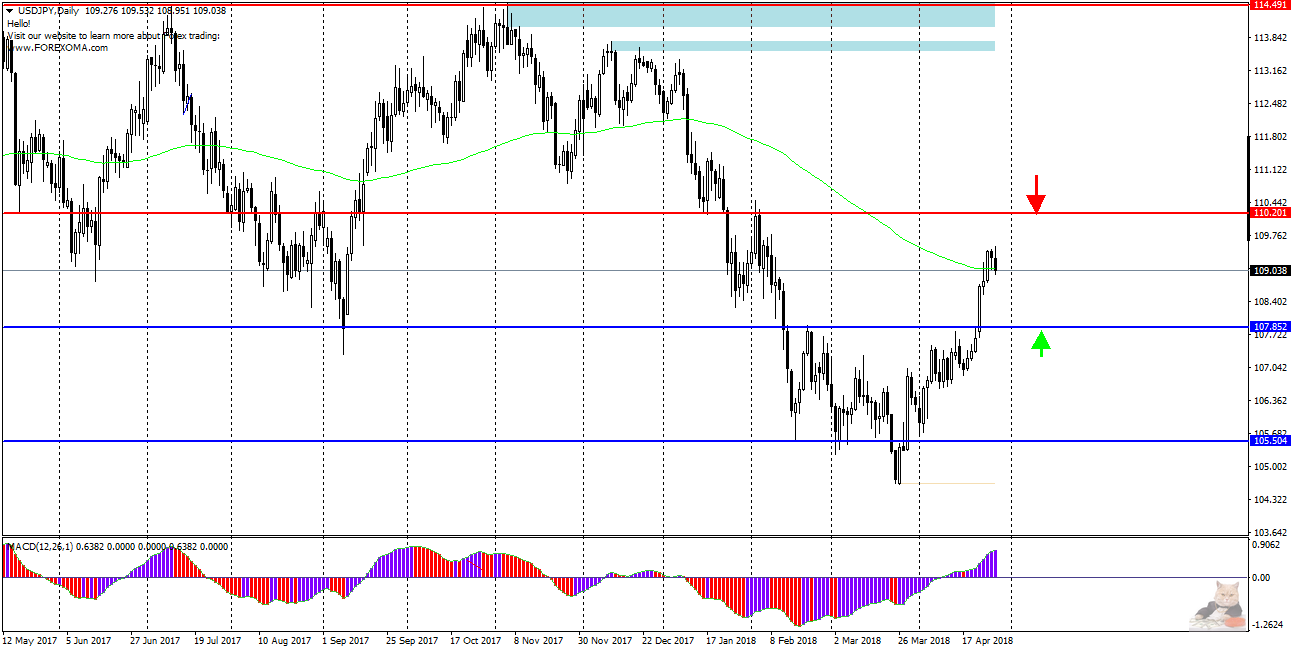

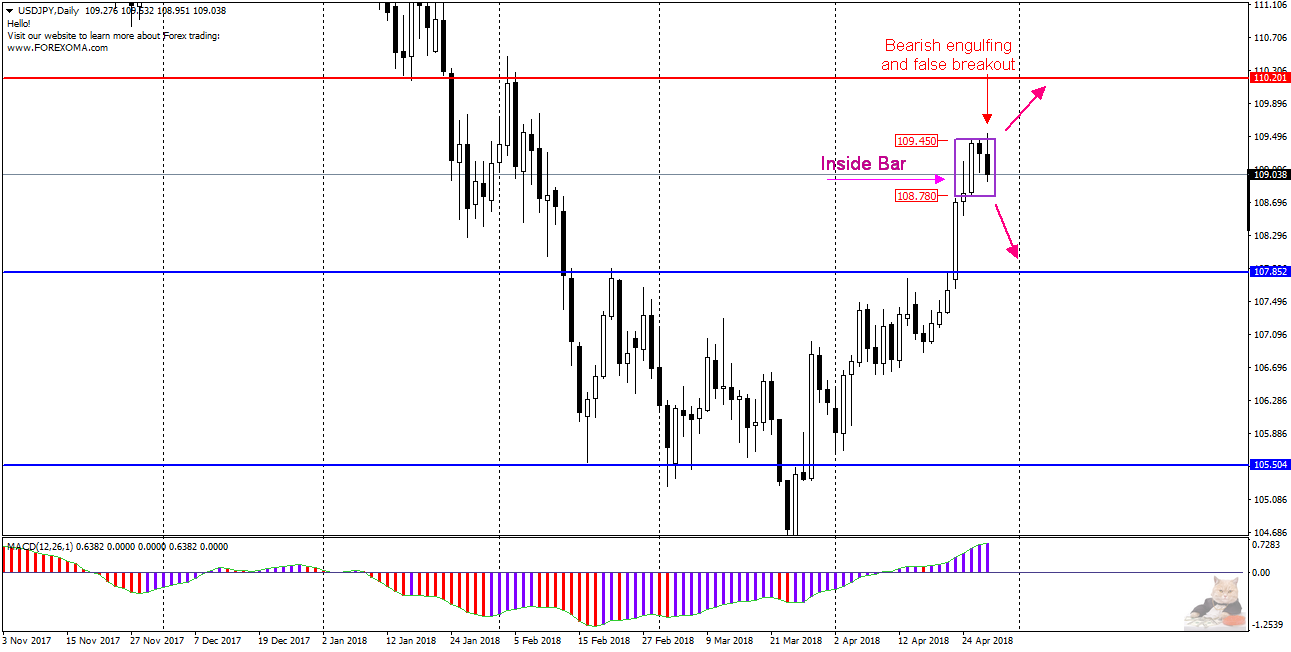

USDJPY – Inside Bar and Bearish Engulfing

USDJPY – on this pair there are actually some interesting Price Action candle formations.

The first one is an Inside Bar created by a large bullish candle from 25.04, whose range 108.78-109.45 was not exceeded by the next daily (26.04). The Friday quotes of this pair did, to a small extent, break above the upper limit of the IB, but the closing of the week was already within its range, which means that we are dealing with a “false” breakout. What else is worth noting is the fact that the Friday candle completely covered range of previous candle , which additionally formed in this case bearish formation of Outside Bar, (bearish engulfing).

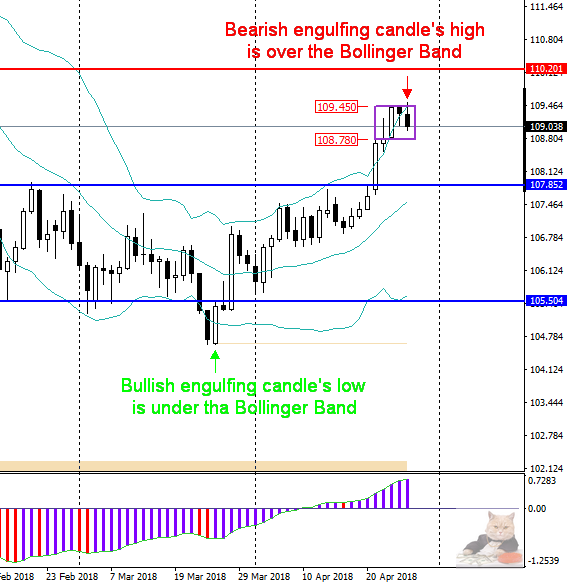

As I described the formation earlier – not every appearance of it results in decreases . The importance of the formation depends on where it appears. If the covering candle has its maximum above the upper bollinger band ( frankly saying high in relation to a dozen or so previous candles) then the probability of drops is high. On the chart next, I marked two formations from the Outside Bar family – the current one – the bearish engulfing and the previous from 26/03 bullish engulfing, which heralded increases.

As I described the formation earlier – not every appearance of it results in decreases . The importance of the formation depends on where it appears. If the covering candle has its maximum above the upper bollinger band ( frankly saying high in relation to a dozen or so previous candles) then the probability of drops is high. On the chart next, I marked two formations from the Outside Bar family – the current one – the bearish engulfing and the previous from 26/03 bullish engulfing, which heralded increases.

Summing up, in the case of breaking out from IB thru the bottom, I expect a continuation of declines towards 108.00. If, however, a new attack on the level 109.45 (upper limit IB) occurs and is effectively defeated, the target may be 110.20