By far the favorite social network for journalists and second favorite for financial buffs is Twitter. At least for now.

The hallmark of this unique platform has been the amount of information that you can gather in the least amount of time and screen space. Each tweet is limited to 140 characters, so you can literally scan hundreds of headlines in the span of a few minutes.

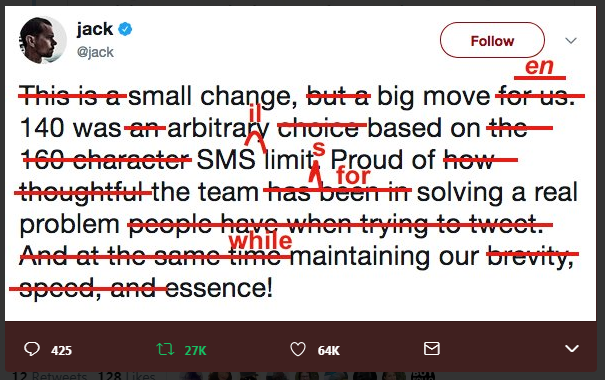

Yesterday night, Twitter started a war with their own community by announcing that some users will now be allowed to create 280 character tweets. The backlash was instant with many calling out the CEO Jack Dorsey. One even decided to fix his tweet in a very appropriate way showing that if you’re creative enough, anything worth saying can be said in 140 letters or less.

@MatiGreenspan

eToro, Senior Market Analyst

Today’s Highlights

- We Don’t Have a Clue

- USD Making a Comeback

- Jay is the Man!

Please note: All data, figures & graphs are valid as of September 27th. All trading carries risk. Only risk capital you’re prepared to lose.

Market Overview

Janet Yellen’s speech last night was groundbreaking, to say the least. Not only did she elaborate on her previous statement that the Fed doesn’t understand inflation but she also explained how they plan to proceed despite this apparent lack of knowledge.

This is not Yellen’s first rodeo and she did handle the markets with extreme caution, like a five year old holding an egg on a spoon. She alternated between telling Wall Street what it wanted to hear and delivering hard truths in a very digestible way. This display proves that though they may not have a clue when it comes to the current factors driving the economy they certainly know how to manipulate the markets.

Rather than taking this as a big red warning sign, many traders remained hyperfocused on what this will mean in the short term. More specifically, will the Fed raise the US interest rate in December?

The answer that many analysts arrived at is yes. The odds of a rate hike by the end of the year moved from 63% yesterday to 70% this morning. The immediate impact on the markets was a much needed boost to the US Dollar.

With Donald Trump’s new weak USD policy the Dollar has been having an extremely bad year so far losing 12.5% of it’s value from the highs in January (green circle) to the lows at the beginning of September (purple circle).

Now, every technical analyst draws their lines slightly differently. So on this chart, I’ve drawn two paths of resistance. The yellow line is the most conservative possibility and the blue line is the most aggressive possible.

Thanks to Yellen’s clever manipulation the blue resistance is now broken and due to the quick nature of the Trump induced decline, there isn’t much in the way of technical levels to point to until the yellow line.

The strength of the Buck has large ramifications for other markets as well. The most noticeable in this case is Gold which is now struggling to maintain its gains. As of this writing, the shiny metal is below $1300 per ounce and fighting to hold what little support it has left.

Well Deserved

Big Kudos to our top cryptotrader @Jaynemesis who appeared in an extensive article on Bloomberg about cryptos, copytrading, and the recent market moves.

The full article can be found at: https://www.bloomberg.com/news/articles/2017-09-27/cryptocurrency-derivatives-you-bet-this-trader-has-295-return

As we showed yesterday, the cryptomarket has been able to break the downwards trend already. However, it has yet to decide on the next direction. To reiterate, here’s a chart of the breakout in Bitcoin. A strong tear through $4000 could be quite significant.

Also, though many on Wall Street are calling cryptocurrencies a bubble. One trader has stated that the bubble is just getting started and that he thinks this will turn out to be the biggest bubble we’ve ever seen. In true Wall Street fashion, Mike Novogratz wants to ride it all the way.

Here’s the link to that story: New $500 Million Crypto Hedge Fund

Let’s have an amazing day ahead!!

![Reltex Group Reviews: Explore business opportunities by Trading [reltexg.com]](https://comparic.com/wp-content/uploads/2023/12/image001-218x150.jpg)

![Mayrsson TG Reviews: Why Choose Crypto-Trading with Them? [mayrssontg.com]](https://comparic.com/wp-content/uploads/2023/12/image1-218x150.jpg)