Markets this week slowly passed in holiday mood, and the last two weeks of 2016 will be characterized as always in this period by decline in investors activity, and thus also lower liquidity. But before we forget about trading and focus on the Christmas holidays, we still await decision on interest rates of Bank of Japan, which will be announced on December 20th, at night our time.

Markets this week slowly passed in holiday mood, and the last two weeks of 2016 will be characterized as always in this period by decline in investors activity, and thus also lower liquidity. But before we forget about trading and focus on the Christmas holidays, we still await decision on interest rates of Bank of Japan, which will be announced on December 20th, at night our time.

Surprisingly good data from the Polish economy – key Monday events

In relatively empty macroeconomic calendar during Monday’s session, a positive surprise were Polish data of industrial production and retail sales.

Below a summary of the headlines of the day:

- The morning market overview – pre-Christmas peace enter markets

- AUDCAD – the lowest since July 2016.

- German IFO surveys up. What about EUR?

- Wages in the euro area up. How markets react?

- After 13 years of Easy Forex officially changes name to easyMarkets

- FCA warns: Scam mail and unregulated brokers

- Strong industrial production and retail sales strengthened PLN

- Markit: The slowdown in the US service sector.

During today’s session, Janet Yellen will have a speech at the University of Baltimore (19:30 our time). The theme of the seminar of chairman of the Fed will be “state of the labor market.” We will hear few relevant comments that are able to translate directly to quotation of USD.

Will BoJ surprise markets at the last meeting?

The most important for financial markets central banks at the end of the year very often show increased activity. It was so in the case of the Federal Reserve, which raised interest rates and the European Central Bank, which again extended the duration of the program QE. Will BoJ join the Fed and the ECB ?

Persons closely associated with the Bank of Japan say that Haruhiko Kuroda can raise forecasts evaluating the state of the local economy, which would be the first such move since May 2015. Hawkish change would certainly weaken market expectations of continuation of loosening monetary policy and further interest rate cuts in the coming months.

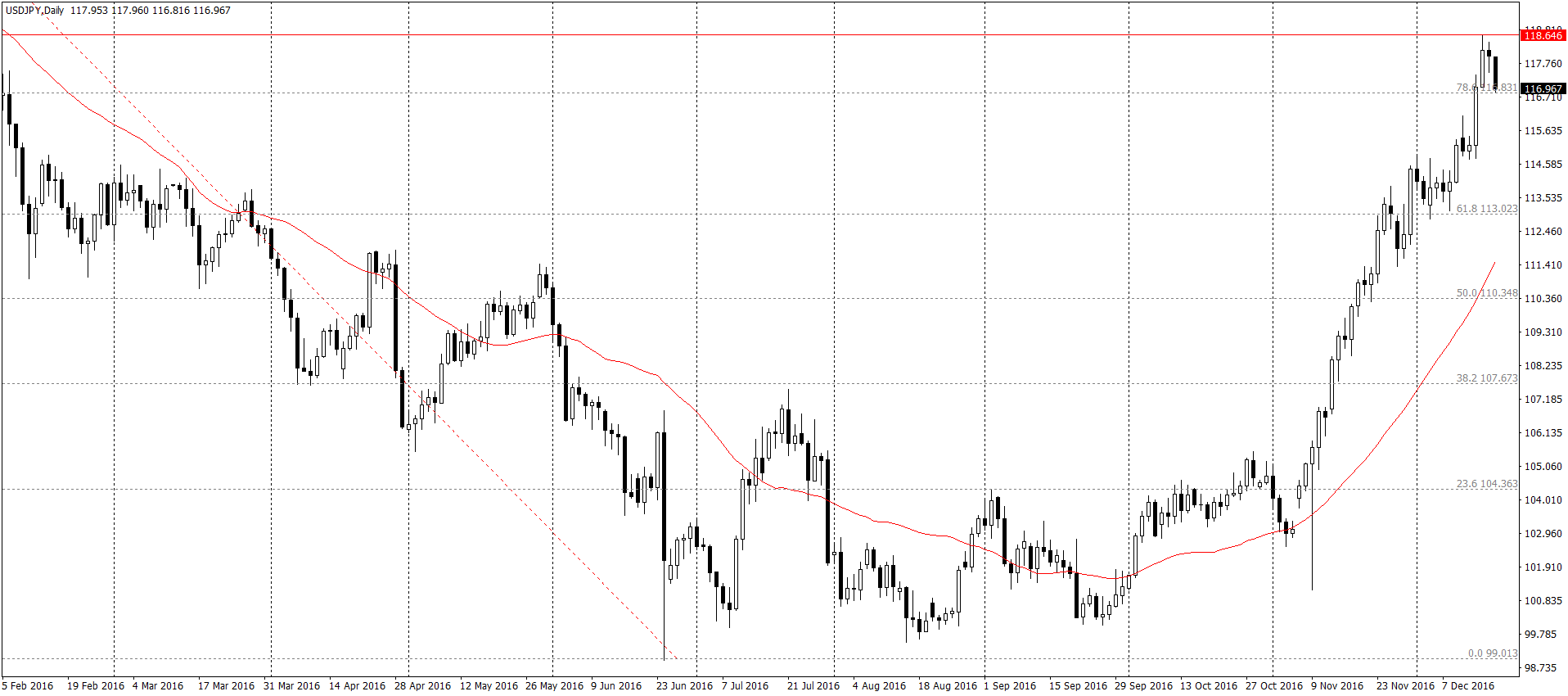

Since the presidential election in the US – USD/JPY rose by 11%. The main problem of the Bank of Japan is usually too strong Yen – at least in his opinion – and actively tries to weaken it. Current movements should, however, temporarily please politicians of BoJ, what in turn will bring calm summary of the two-day meeting and no change in the current monetary policy.

The following look at the quotation USD/JPY intraday basis. From Friday’s top pair lost almost 200 pips:

What awaits us on Tuesday?

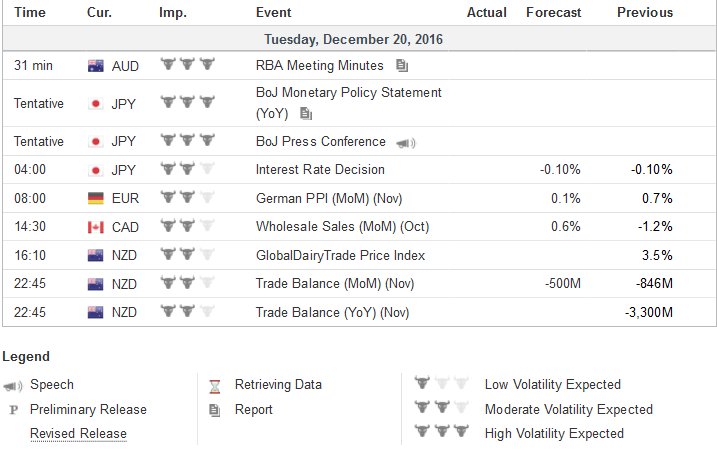

European traders during Tuesday’s session, will not be able to fid too many interesting events in macroeconomic calendar. Key events session – the minutes of the RBA meeting and a summary of the BoJ meeting – will take place in the night of our time. While open hours of European markets, only two medium importance information and the next valid data packet will not appear until 22:45 and will concern the trade balance of New Zealand for November: