For the second consecutive Monday we had a short period of volatility on the charts, the reason: another pharmaceutical company – Moderna – reported the production of an effective vaccine against covid-19. This time the volatility was not as high as last Monday, but there were also longer candles on gold, yen and indexes SP500 and Dax30.

- Moderna vaccine effective in 94.5%.

- Will the Australian dollar gain to the New Zealand dollar?

AUDNZD – a chance to rebound?

Today’s analysis is a bit later than usual – the comparic.pl and comparic.com website did not work from the midnight, which was caused by a server failure of the hosting company.

The pharmaceutical company – Moderna – reported the production of an effective vaccine against covid-19. The tests showed that 94.5% of the vaccinated people gained resistance to covid-19.

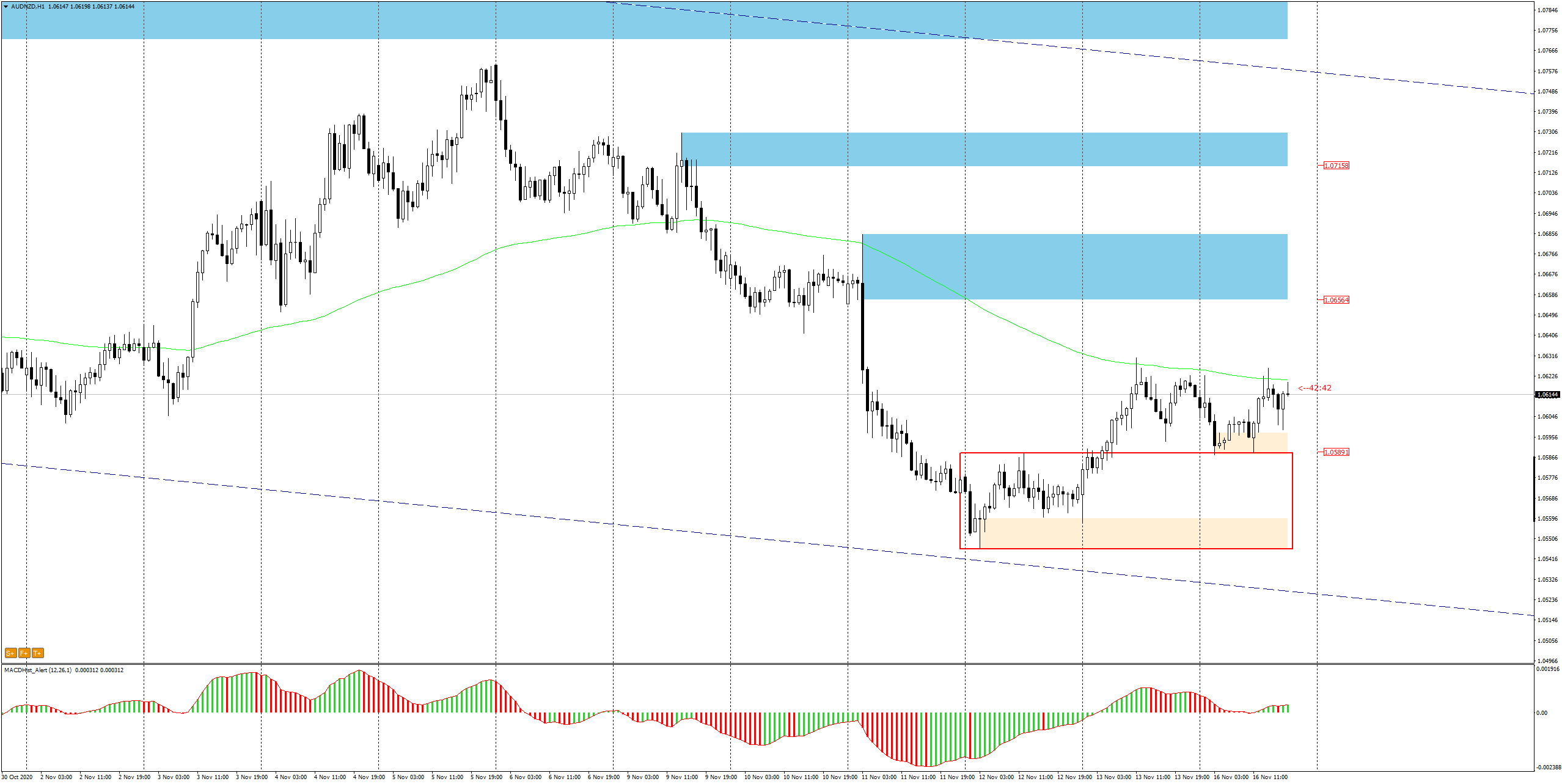

Looking at the charts of the various instruments by noon, it was very difficult to find any structure that would give a strong signal to take a position. After the opening of the markets in the USA, I noticed some on AUDNZD.

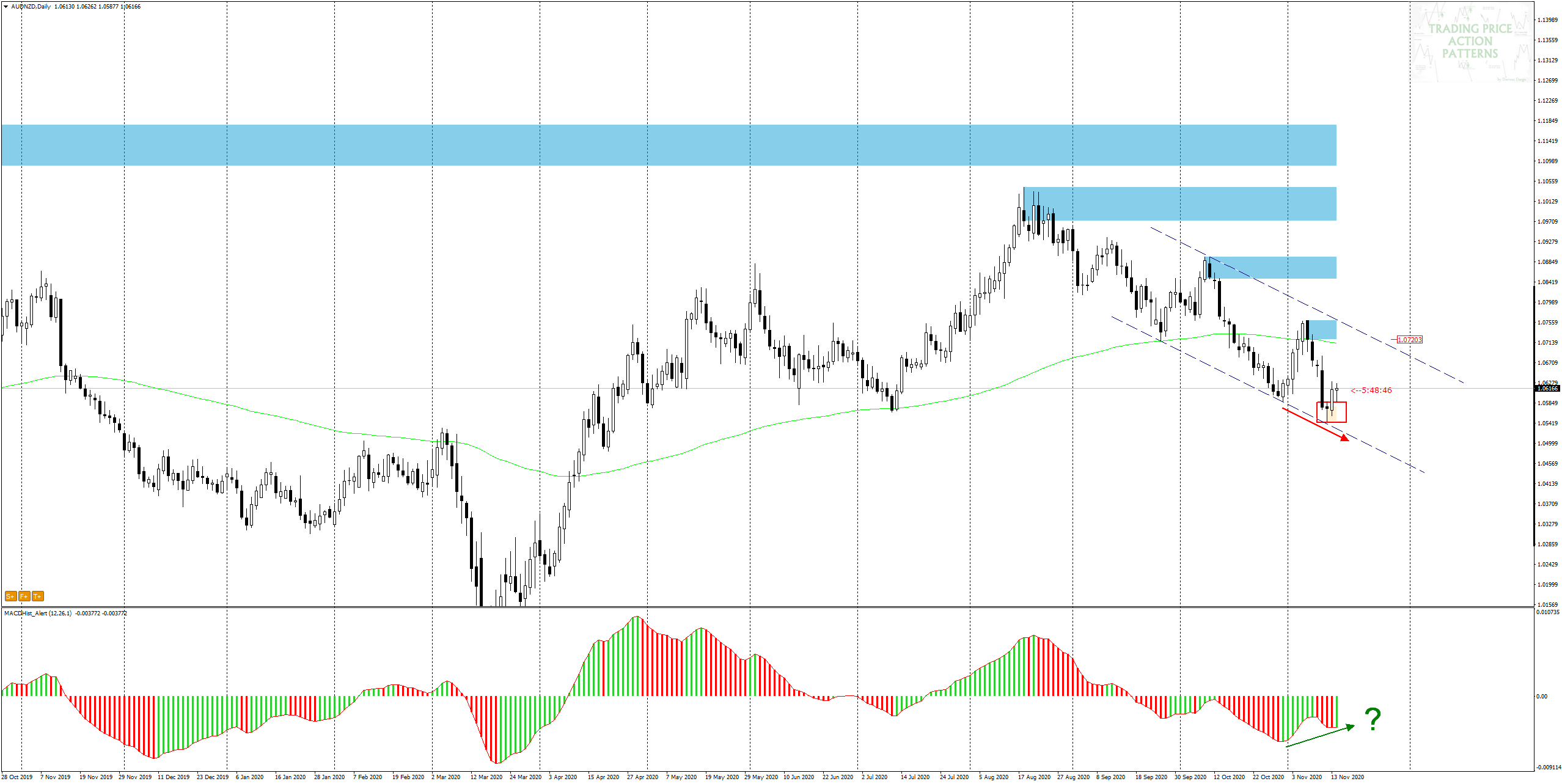

Thursday’s (12.11) daily candle has shape of a pinbar, the minimum of which is on the support of the downward channel, in which the quotations of this pair have been moving since September this year. The next , Friday`s candle, has overcome the maximum of the pin bar and has closed above its range.

Today, we are witnessing attempts to continue to grow. While writing the analysis on the MACD, a growth divergence appeared on the daily chart, but until the day is not over, it is not a foregone conclusion.

It is therefore worth waiting until the end of the NY session to see if the MACD has set a minimum, changed direction and entered the upward phase. If not, there will be no bullish divergence and growth scenario is less probable.

If the bullish scenario were to work – the target of demand could be the nearest supply zone of 1.0650. It is difficult to judge what will happen next, as recent days have shown that the market is ruled by news about the vaccine and the pandemic caused by covid-19. It is therefore necessary to be cautious and not to risk too much volume and to secure orders with stop-losses.

I also recommend:

Trading with PA+MACD, or how to increase the probability of winning

ongoing analysis https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo