More bickering in Washington among the Republican party with Trump taking to Twitter to rail against one senator and another announcing his retirement only to dig into the President. The fun continues in politics but doesn’t seem to have any effect on the stocks. Tax reform is still widely expected to happen and that’s all that investors care about right now. That and earnings season, which is well underway.

More bickering in Washington among the Republican party with Trump taking to Twitter to rail against one senator and another announcing his retirement only to dig into the President. The fun continues in politics but doesn’t seem to have any effect on the stocks. Tax reform is still widely expected to happen and that’s all that investors care about right now. That and earnings season, which is well underway.

Market Overview

Sometimes all you need is a little push in order to really fly. After taking some minor losses on Monday, the Dow Jones leaped 161 points yesterday.

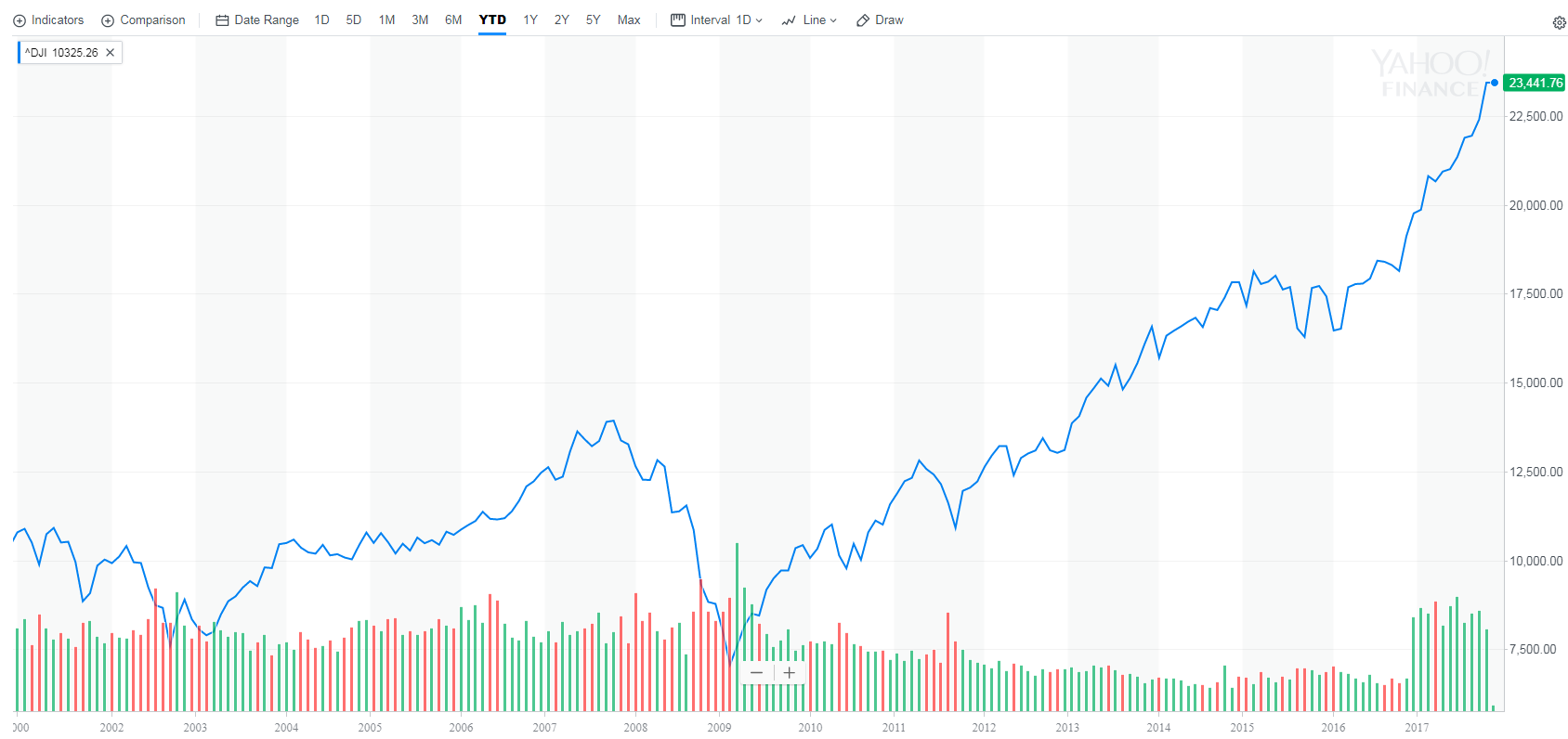

For dramatic effect, here is a chart of the benchmark index since the turn of the century…

Some great results from CAT and MMM have propelled the markets. AMD put out some good numbers after the closing bell but investors were disappointed about their source of revenues going forward and it is expected to open about 10% lower when the market opens this afternoon.

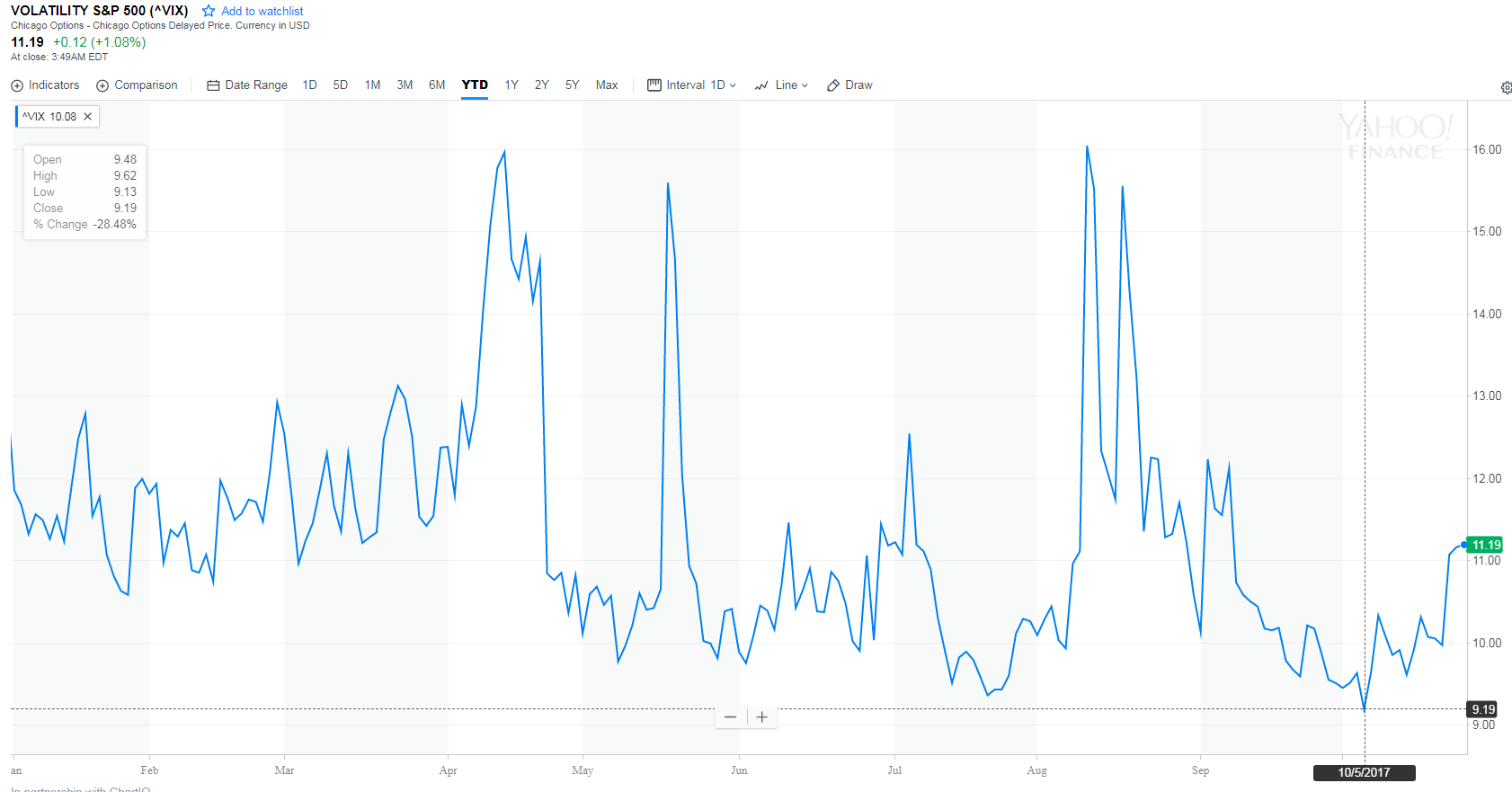

The VIX volatility index has also woken up and is well above the record low levels seen earlier this month.

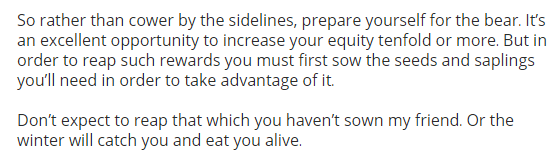

Though most analysts agree the market is overpriced, it still doesn’t make sense to go in short. One of my clients on eToro put an excellent rant on the network this morning explaining that this is where patience comes in and predicting that for those who prepare correctly, there could be an opportunity to 10X shortly.

Here’s my favorite part…

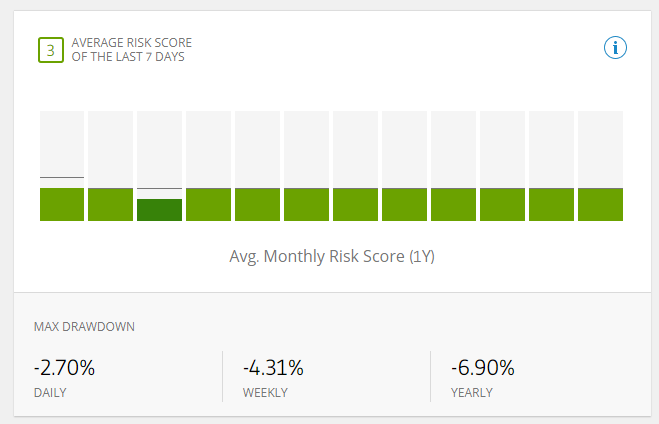

The author @NestorArmstrong from Mexico has delivered himself and about 80 copiers a return of 30% since the beginning of the year with an incredibly low stable risk score and virtually no drawdown…

Of course, predicting a market crash can be even tougher than predicting an earthquake so while most investors are still wildly bullish on the markets, now is the time to prepare for the eventuality that the markets will turn and for the abundant opportunities such a turn can bring.

Bitcoin Technical

As we’ve been discussing in these updates, bitcoin has been trading counter to the rest of the digital currencies lately. Here we can see that the original blockchain asset is up about 30% since the beginning of the month even though most of the others are still in negative…

If we do see the digital king start to trek further above $6000 and mark new highs that could certainly kick in the FOMO factor and we could see further surges in price. However, as Nestor says, we need to be prepared and sow the seeds.

Bitcoin has broken just about all the rules of technical and fundamental analysis but for now, it’s the only thing we have to go by. By fundamental analysis, we’ve got some calling for $0 and some for $100,000 and just about everything in between.

If we’re looking for a perfect entry and if the price does indeed come down further, we need to look at the graph from the beginning of the year. A mighty graph indeed.

The white line does indeed represent a solid form of resistance. Even though it’s quite a sharp incline the line has yet to be broken.

Try out cryptocurrencies trading with eToro

On the bottom, however, it’s difficult to find the exact support. Many are of the mind that the dotted blue line can indeed hold and we have only to go up from here. The yellow line in my mind is a bit more practical. Meeting that yellow line at about $4500 a coin would represent a total pullback of 25% from the peak.

As always, all questions, comments, and feedback are extremely welcome. Tag me on eToro or any other social network. I’m always glad to hear from you.

![Reltex Group Reviews: Explore business opportunities by Trading [reltexg.com]](https://comparic.com/wp-content/uploads/2023/12/image001-218x150.jpg)

![Mayrsson TG Reviews: Why Choose Crypto-Trading with Them? [mayrssontg.com]](https://comparic.com/wp-content/uploads/2023/12/image1-218x150.jpg)